News

-

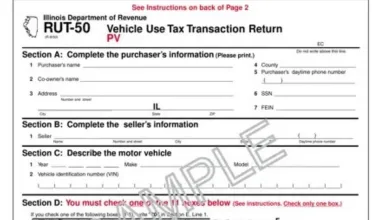

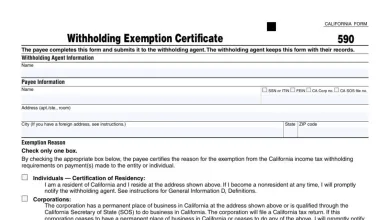

State and Local Taxes

-

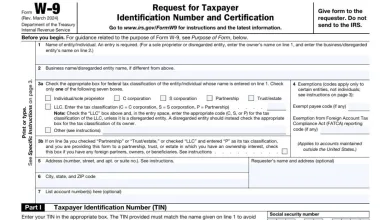

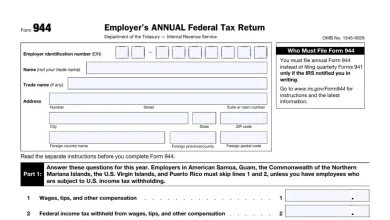

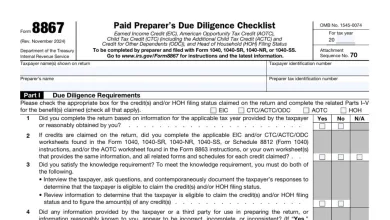

Federal Taxes

-

Federal Taxes

-

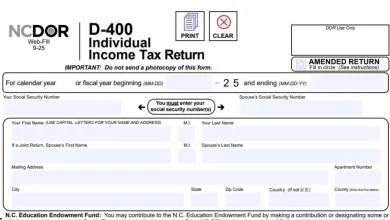

State and Local Taxes

-

State and Local Taxes

-

State and Local Taxes

-

State and Local Taxes

-

State and Local Taxes

-

State and Local Taxes

-

State and Local Taxes

-

State and Local Taxes

-

State and Local Taxes

-

Federal Taxes

-

State and Local Taxes

-

Federal Taxes

-

State and Local Taxes

-

Federal Taxes

-

State and Local Taxes

-

Federal Taxes

-

Federal Taxes

-

State and Local Taxes

-

Federal Taxes

-

Federal Taxes

-

Federal Taxes