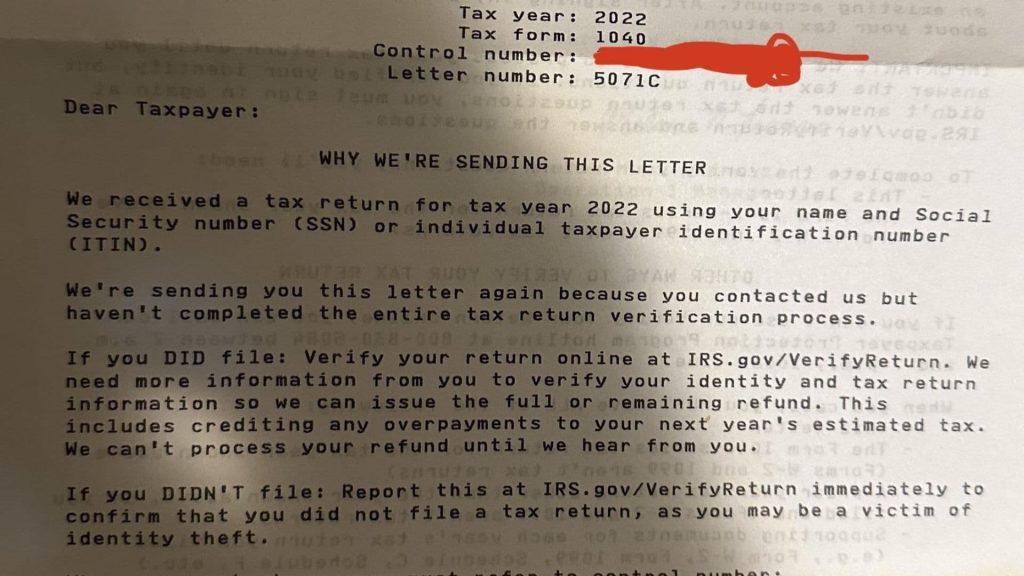

If you’ve received a letter asking you to verify your identity, you might be wondering, “Where do I enter control number for ID verification?” The control number-often a 14-digit code-is a key part of the identity verification process, especially for IRS tax return verification. When you receive a notice such as the IRS 5071C letter, you’ll be prompted to enter this control number either online at the IRS Identity Verification Service website or over the phone using the specific number provided in your letter. The control number is not found in your online IRS account or tax documents; it’s printed directly on the physical letter you received. To complete the process, you’ll need to enter the control number exactly as shown (no spaces needed) in the designated field on the IRS verification portal, or provide it when prompted during the phone call. This step is essential for confirming your identity, unlocking your tax return, and preventing fraud or delays in processing. If you can’t find the control number, double-check every section of your letter-typically, it’s found in the upper portion or near your name. Without this number, you won’t be able to proceed with verification, so keep your letter safe and never share the code with anyone unless you’re sure you’re dealing with an official source.

What Is a Control Number for ID Verification?

A control number is a unique code, often 14 digits, assigned to your specific identity verification case-most commonly used by the IRS for tax return verification. It acts as a security token, ensuring only the intended recipient can complete the verification process. You’ll find it on official letters like the IRS 5071C, not in your online account or tax transcript.

Where Do I Enter the Control Number?

- Online:

Go to the IRS Identity Verification Service website (the URL will be provided in your letter). After selecting that you received a verification notice, you’ll reach a screen asking for the 14-digit control number. Enter the code exactly as shown on your letter-no spaces are needed.

Example: On the “Verify Your Return” page, you’ll see a field labeled “Enter the 14-digit control number provided on your notice.” - By Phone:

Call the specific toll-free number listed on your IRS letter (not the general IRS line). When prompted, enter or provide the control number to the automated system or the agent. - In Person:

For some notice types (like IRS 5747C), you may need to visit a Taxpayer Assistance Center. Bring your letter and all required documents.

How Do I Find the Control Number?

- It’s only on the physical letter mailed to you, usually in the upper right corner or near your name, sometimes in a box labeled “control number” or “verification information”.

- If you received a different notice (like 4883C), you may not have a control number and will need to verify by phone or in person.

What If I Can’t Find or Lost My Control Number?

- Double-check both sides of your letter and all sections for the code.

- If you’ve lost your letter, you’ll need to request a new one via the IRS website or by calling the general IRS number. Be prepared for a wait, as new notices can take up to two weeks to arrive.

- The IRS will not email or text you the control number for security reasons.

Tips for Safe and Successful Verification

- Only enter your control number on the official IRS website or provide it over the phone using the number on your letter-never share it with anyone else.

- Watch out for scams: The IRS will never email or call you first about verification; all legitimate requests come by mail.

- Have your previous and current year’s tax returns, plus two forms of ID, ready for the process.

FAQs

Q: Where is the control number for ID verification found?

A: The control number is printed on the physical letter you receive from the IRS, typically in the upper portion or near your name-it is not available online or in your IRS account.

Q: Can I verify my identity without the control number?

A: No, the control number is required to complete the verification process. If you’ve lost your letter, you must request a new one from the IRS.

Q: What should I do if my control number doesn’t work?

A: Double-check you’ve entered all 14 digits with no spaces. If it still doesn’t work, contact the IRS using the number on your letter for assistance.

Q: Is it safe to enter my control number online?

A: Yes, as long as you are on the official IRS Identity Verification website and using the link or phone number provided in your letter.