Can civic associations be tax exempt in Ohio? That’s the burning question at the center of this article! If you’re part of a neighborhood group, HOA, or community league, understanding the rules around tax-exempt status for civic associations in Ohio is crucial for keeping your organization on the right side of the law (and the IRS). In this comprehensive guide, we’ll explain everything you need to know about applying for tax exemption as a civic association, clarify the difference between “not-for-profit” and “tax-exempt,” and highlight the specific keywords you need to master the topic. Whether you’re a board member, concerned neighbor, or just tax-status-curious, we’ll unravel this sometimes tricky subject with a friendly approach and practical advice for Ohio groups wanting—and needing—that tax break.

Can Civic Associations Be Tax Exempt in Ohio?

The short answer is: Yes, civic associations in Ohio can be tax-exempt, but there are important caveats. The most common route is seeking federal recognition as a 501(c)(4) “social welfare organization,” not as a 501(c)(3) charitable organization (which is a stricter standard and usually reserved for charities, not homeowners or civic groups). To qualify for 501(c)(4) status with the IRS, your association must:

- Be organized and operated exclusively for the promotion of social welfare (meaning the common good and general welfare of the community—not just the benefit of your members).

- Not operate for profit.

- Keep earnings from benefiting individuals or shareholders.

Once the IRS grants your group 501(c)(4) status, you can apply for certain state and local exemptions, though property and sales tax rules are separate hurdles.

Differences Between “Not-for-Profit” and “Tax-Exempt”

Don’t confuse being a not-for-profit organization with being tax-exempt. “Not-for-profit” simply means your group operates without aiming to make a profit for its members. “Tax-exempt” means the IRS and/or the State of Ohio agrees that your group meets certain requirements and therefore doesn’t owe income tax (and maybe gets breaks on sales or property taxes as well). You have to apply and be approved for exemptions—they aren’t automatic!

Ohio State and Local Tax Exemptions

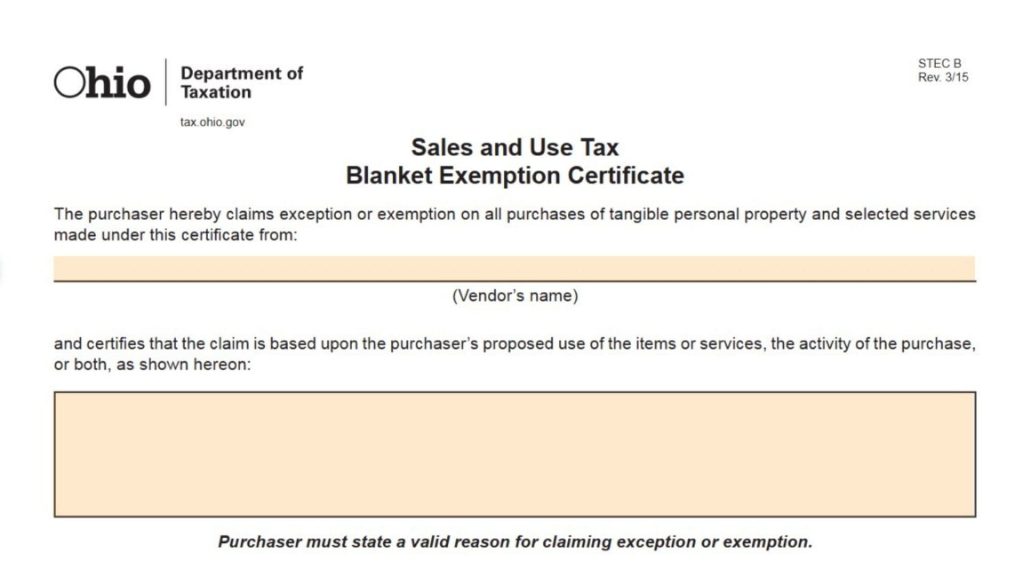

- Sales Tax Exemption: Civic associations recognized as 501(c)(4) groups may apply for Ohio sales tax exemption by filing the required forms. However, just organizing as a non-profit in Ohio does not automatically grant sales tax exemption—you must specifically file for it and meet Ohio’s standards.

- Property Tax Exemption: For exemption from local property taxes, real estate must be owned by a qualifying nonprofit and used exclusively for charitable or public purposes—merely being a nonprofit or civic association isn’t enough. The Ohio tax commissioner focuses on how the property is actually used.

- Income Tax Exemption: Federal 501(c)(4) status shields your association from federal income tax. For state income tax, as long as you’re recognized at the federal level and file the proper forms, Ohio generally follows suit.

How to Apply for Tax Exempt Status in Ohio

- Apply for federal tax exemption as a 501(c)(4) with the IRS (using Form 1024).

- Obtain an IRS determination letter granting your exemption.

- File for Ohio sales tax exemption using the state application and your IRS letter.

- For property tax exemption, apply to your county with evidence the property is used for exclusively eligible purposes.

- Stay compliant by filing annual IRS returns and maintaining proper documentation.

Fun Facts & Key Takeaways

- Civic associations rarely qualify for 501(c)(3) charitable status, which is stricter and reserved for groups advancing education, religion, or the arts—not those maintaining private amenities.

- Not all tax exemptions are automatic; you must apply and qualify!

- Civic associations can lose their exemption if they stray from their mission or primarily serve members rather than the community at large.

FAQs

Q: Can all civic associations in Ohio be tax-exempt?

A: Only if they qualify—most can as 501(c)(4) social welfare organizations, not 501(c)(3) charities, and must apply for each exemption they seek.

Q: Does being a non-profit mean my civic association is tax-exempt?

A: Not automatically! You must apply for tax-exempt status at both the federal and state level and meet all the requirements.