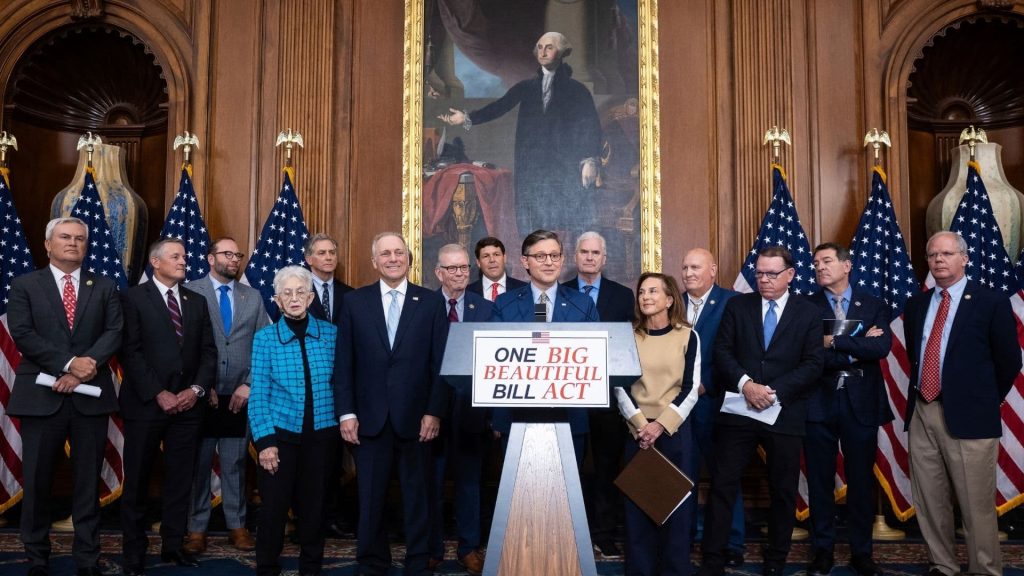

The Salt Cap in Big Beautiful Bill plays a starring role in the newly passed One Big Beautiful Bill Act, a sweeping tax reform law that introduces significant changes to the state and local tax (SALT) deduction cap. This article unpacks how the SALT cap rose from its long-standing $10,000 limit to a much more generous $40,000, effective starting in 2025, and explores the impact on taxpayers, especially those in states with high income and property taxes. The article also explains the phase-down rules for high earners, the cap’s yearly inflation adjustment through 2029, and the scheduled snapback to $10,000 in 2030. All these points outline a temporary yet powerful relief for many Americans looking to optimize their tax planning.

What The Salt Cap Is And Why It Matters

The SALT deduction allows taxpayers to deduct state and local taxes — including income, property, and sales taxes — from their federal taxable income. Since 2018, a cap of $10,000 limited this deduction, mainly impacting taxpayers living in high-tax states like California, New York, and New Jersey. The newly enacted Big Beautiful Bill raises this cap significantly to $40,000, offering broader relief for certain taxpayers from 2025 through 2029.

How The Salt Cap Changes Under The One Big Beautiful Bill Work

The Big Beautiful Bill not only raises the SALT deduction limit to $40,000 for most taxpayers but also phases out this increased cap for those earning above $500,000. The phaseout reduces the cap by 30% of income beyond this threshold, ensuring the highest income earners eventually return to the original $10,000 limit by 2030. Additionally, the cap will increase annually by 1% until it sunsets at the end of 2029, returning to $10,000 without income limits thereafter.

Who Benefits Most From The Increased Salt Cap?

- Taxpayers In High-Tax States: Residents in states with high property and income taxes gain the most from the increased cap, as many were previously limited by the $10,000 ceiling.

- Upper-Middle-Income Households: Families earning under $500,000 stand to reclaim more deductible taxes and see lower federal tax bills.

- Itemizers: Taxpayers who itemize deductions instead of taking the standard deduction will notice a bigger tax benefit.

- Homeowners: Property taxes often constitute a large portion of SALT deductions, making the higher cap a relief for those with expensive homes.

Potential Impact On Tax Planning And Filing

With the SALT cap increase under OBBB, many taxpayers may reconsider whether to itemize deductions or take the standard deduction. The higher cap encourages itemizing by increasing the deductible amount for state and local taxes paid, potentially lowering taxable federal income. However, taxpayers need to watch the income thresholds closely due to the phasedown provision for higher earners.

What Happens After 2029?

Unless extended by future legislation, the Big Beautiful Bill’s SALT cap increase expires after 2029, reverting to the previous $10,000 limit starting in 2030. This scheduled “snapback” means that taxpayers currently enjoying relief should prepare for a potential tax increase unless new reforms extend or replace the current provisions.

Simplified Overview Table: Salt Cap Timeline

| Year | SALT Deduction Cap | Income Phaseout Begins | Annual Increase | Notes |

|---|---|---|---|---|

| 2025 | $40,000 | $500,000+ | None (starting year) | New cap effective |

| 2026-2029 | $40,000+ (1% each year) | $500,000+ | 1% raise per year | Gradual increase & phaseout |

| 2030 | $10,000 | None | N/A | Cap reverts to previous law |

FAQs

Q: What is the SALT cap in the Big Beautiful Bill?

A: It’s a temporary increase of the SALT deduction limit from $10,000 to $40,000 between 2025 and 2029.

Q: Who benefits from the higher SALT cap?

A: Taxpayers in high-tax states and those earning under $500,000 annually see the biggest benefits.

Q: Does the SALT cap go away after 2029?

A: Yes, it is scheduled to revert to $10,000 in 2030 unless new legislation changes it.

Q: How does income affect my SALT deduction?

A: If your income exceeds $500,000, your increased cap phases out, reducing your maximum deduction.