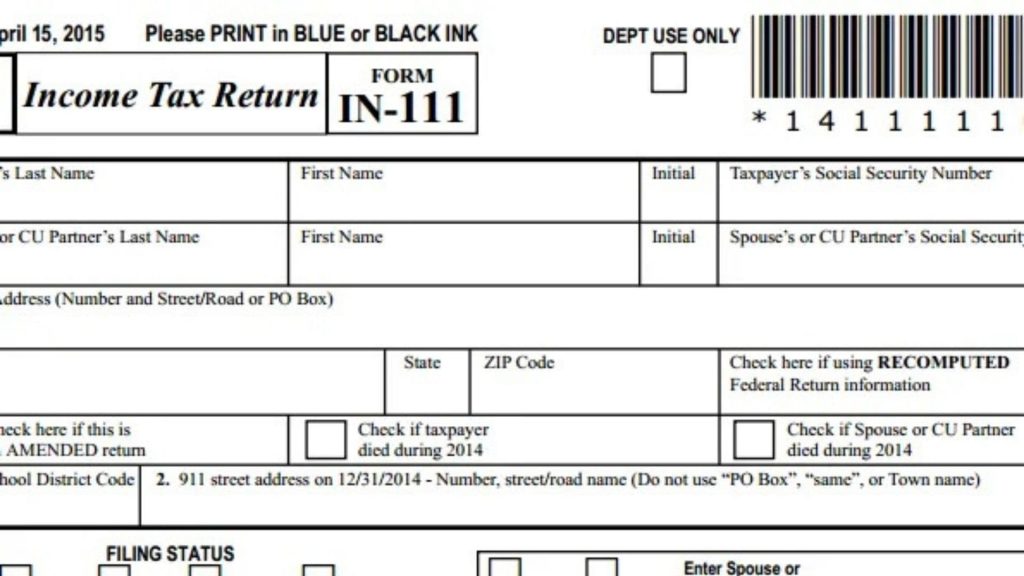

When it comes to Vermont taxes, figuring out how to report a one-time payment on taxes can be confusing — especially if you’re not used to dealing with irregular income. Whether it’s a freelance project, a lottery win, a side hustle payment, or a surprise check from an old employer, one-time payments still fall under Vermont’s income tax laws and often need to be reported to the Vermont Department of Taxes. The key is understanding whether your payment qualifies as taxable income and how to report it properly on your Vermont Form IN-111 (the state’s individual income tax return).

Understanding One-Time Payments And Vermont Tax Rules

A one-time payment is any non-recurring income you receive outside your regular salary or wages. Common examples include:

- Freelance or gig work payments

- Bonuses or commissions

- Inheritance or gifts

- Lottery or gambling winnings

- Insurance settlements or rebates

- One-time consulting fees

- Sale of assets or personal property

Not all one-time payments are treated the same. Vermont generally follows federal income tax rules when determining what’s taxable, so if the IRS requires you to report it, Vermont likely does too. However, some exceptions exist for gifts, inheritances, and certain rebates — more on that below.

How To Report One-Time Payments On Your Vermont Taxes

When filing your Vermont income tax return, you’ll need to include all taxable income — even if you only received it once. Here’s how to do it step by step:

1. Determine If The Payment Is Taxable

Ask yourself whether the payment was income you earned or money you simply received.

- Taxable Examples: Freelance work, prize winnings, consulting payments.

- Non-Taxable Examples: Gifts, inheritances, certain life insurance proceeds.

2. Check The Form You Received

You may get a Form 1099-MISC, 1099-NEC, or 1099-K, depending on the source. These forms report payments made to you that the IRS also tracks.

3. Report It On Your Federal Return First

Vermont’s tax system starts with your federal adjusted gross income (AGI). That means you first report your one-time payment on your IRS Form 1040, and Vermont uses that figure as the base for your state taxes.

4. File With The Vermont Department Of Taxes

When completing Form IN-111, your AGI from your federal return automatically includes any taxable one-time income. Make sure to include documentation like your 1099 forms or other proof of payment in case of verification.

5. Pay Any Additional Tax Owed

If your one-time payment pushes you into a higher income bracket, you may owe additional state tax. Vermont’s income tax rates range progressively from 3.35% to 8.75%, depending on total earnings.

Special Cases For One-Time Payments

Gifts And Inheritances

Generally, gifts and inheritances are not taxable in Vermont. However, if the inherited asset produces income later (like rent, dividends, or capital gains), that income is taxable.

Lottery And Gambling Winnings

All gambling or lottery winnings are fully taxable in Vermont and must be reported as part of your AGI.

Freelance And Side Gig Payments

Any income from freelance work, even if it’s a one-off job, must be reported. You may also deduct related business expenses using Schedule C.

Property Sales And Capital Gains

Selling property or assets may result in capital gains. Vermont follows federal capital gains rules, but certain exclusions apply, like the sale of a primary residence.

Tips To Stay Compliant And Organized

- Keep Documentation: Always save records of one-time payments, receipts, and tax forms.

- Check Federal Guidelines: Vermont’s taxable income is closely tied to federal definitions.

- Use E-File Tools: Vermont’s myVTax portal makes filing simpler and faster.

- Consult A Tax Professional: For complex cases (like inheritance or business sales), expert advice can prevent costly mistakes.

Common Mistakes To Avoid

- Ignoring a 1099 Form: The IRS and Vermont both receive copies — skipping it can trigger a notice.

- Forgetting Withholding: Many one-time payments don’t have taxes withheld, leading to a surprise bill later.

- Mixing Personal And Business Income: Keep business income separate for deductions and clarity.

Final Thoughts: Reporting One-Time Payments Doesn’t Have To Be Painful

Learning how to report a one-time payment on Vermont taxes may sound intimidating, but once you understand the process, it’s totally manageable. The trick is to determine if it’s taxable, report it on your federal return, and carry it through to your Vermont state filing. Whether it’s a lucky win or a hard-earned side gig, being proactive and organized ensures you stay compliant — and keep your financial stress to a minimum.

❓ FAQs

Q: Do I need to report a one-time bonus or freelance payment in Vermont?

A: Yes, if it’s income you earned, it’s taxable and must be reported on your Vermont income tax return.

Q: Are gifts or inheritances taxable in Vermont?

A: No, they are generally not taxable — but income generated from inherited assets may be.

Q: What if I didn’t receive a 1099 for my one-time payment?

A: You still need to report the income. Keep documentation or bank records as proof.

Q: Can I deduct expenses from one-time freelance income?

A: Yes, if the payment relates to self-employment or contract work, you can deduct related business expenses.