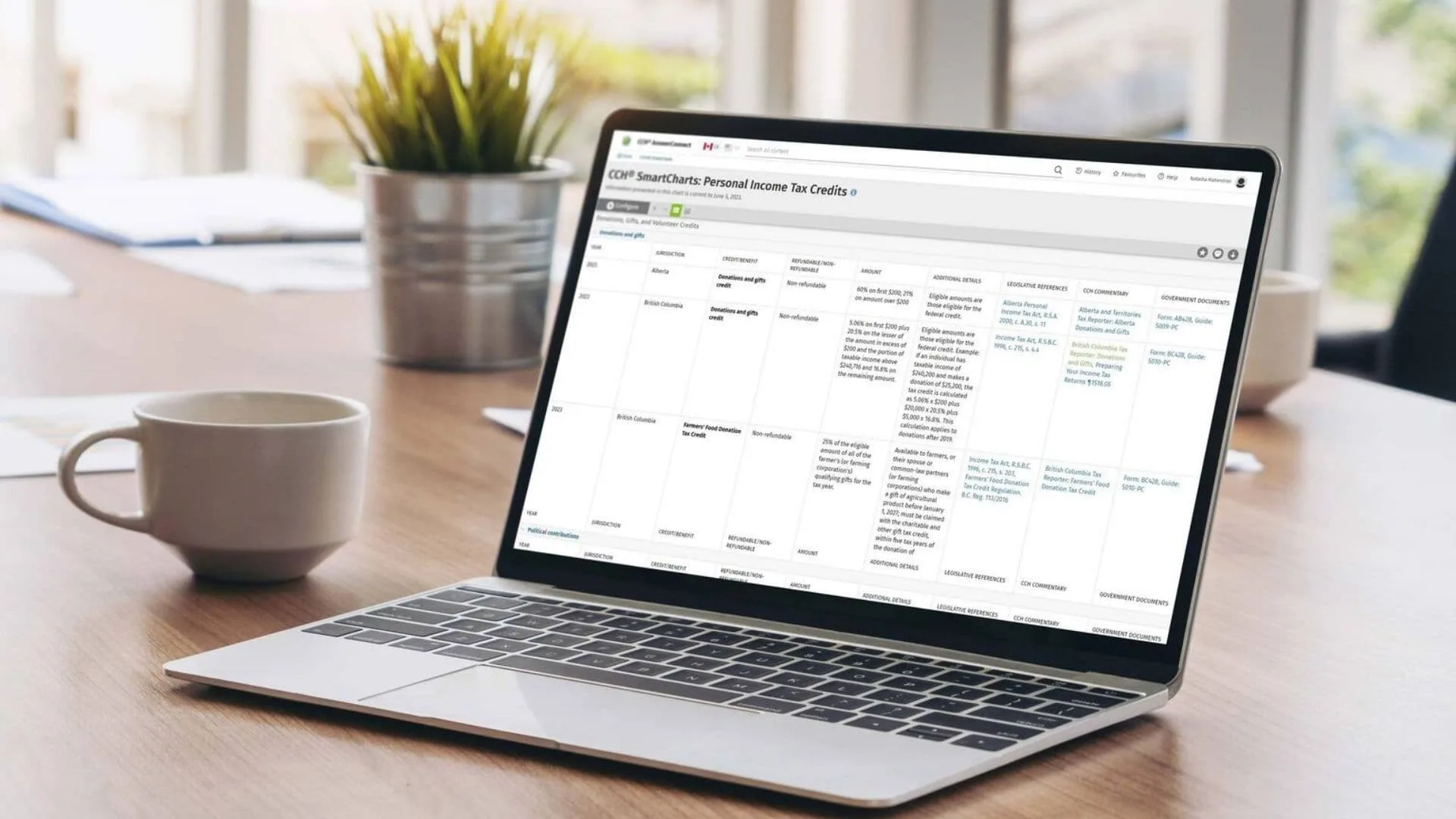

When tax season approaches, finding the best tax software for small businesses can make all the difference between a smooth filing process and a paperwork nightmare. The best tax software for small businesses is designed to handle everything from simple sole proprietorships to complex partnerships and corporations, offering features like intuitive interfaces, comprehensive tax form support, audit protection, and access to expert help. Whether you’re a freelancer, startup founder, or established business owner, choosing the right tax software ensures you maximize deductions, stay compliant, and avoid costly mistakes. With keywords like small business tax software, best tax tools for businesses, business tax filing, and tax software for freelancers, this guide will help you navigate the leading options for 2026, including TurboTax, H&R Block, TaxSlayer, TaxAct, and more.

Why Small Businesses Need Specialized Tax Software

Small businesses face unique tax challenges, from tracking multiple income streams and expenses to managing payroll, issuing 1099s, and claiming industry-specific deductions. The best tax software for small businesses simplifies these complexities by:

- Offering tailored guidance for different business structures (sole proprietors, LLCs, S-corps, C-corps, partnerships)

- Providing comprehensive support for federal and state returns

- Ensuring accuracy with built-in error checking and audit support

- Allowing easy imports from accounting tools like QuickBooks or Square

- Giving access to tax experts for tricky questions or reviews

Top Tax Software for Small Businesses

Let’s break down the top contenders and what makes each stand out:

TurboTax

- Best Overall for Small Businesses

- TurboTax is widely recognized for its intuitive design, robust help features, and seamless integration with popular accounting tools. The Premium and Live Assisted Business plans are ideal for sole proprietors, LLCs, and partnerships, offering unlimited W-2/1099 creation, direct access to tax pros, and year-round support.

- Prices range from $79 for federal returns (Premium) to $489 for more complex business filings.

- Standout features: Easy document uploads, comprehensive form support, audit guidance, and live expert help.

H&R Block

- Best for Affordability and In-Person Support

- H&R Block is praised for its user-friendly interface, comprehensive features, and the ability to file all major business entity returns. It’s a great pick for startups and small businesses looking for a balance of price and features.

- The Premium & Business software covers partnerships, corporations, trusts, and nonprofits, and includes five free federal e-files.

- Standout features: Step-by-step guidance, in-person or virtual support, easy data import, and error checking.

TaxSlayer

- Best for Freelancers and Self-Employed

- TaxSlayer is a budget-friendly option that offers all the necessary IRS forms and support for self-employed individuals, freelancers, and sole proprietors. Its Self-Employed tier includes unlimited access to tax professionals and audit assistance.

- Prices start as low as $42.95 for federal returns, with affordable state filing options.

- Standout features: Low cost, extensive form coverage, and personalized tax tips.

TaxAct

- Best Value for Partnerships and Corporations

- TaxAct is a strong alternative to TurboTax, offering similar features at a lower price point. It’s especially popular among partnerships and S-corps, with detailed deduction checks and customizable filing options.

- Prices start around $100 for sole proprietors and $150–$165 for partnerships and S-corps.

- Standout features: Maximum refund guarantee, audit defense add-ons, and TaxTutor guidance.

FreeTaxUSA

- Best Free or Low-Cost Option

- FreeTaxUSA is ideal for small businesses on a tight budget, offering free federal filing and low-cost state returns, with live chat support available for a small fee.

- Standout features: Maximum refund guarantee, unlimited amended returns, and strong customer ratings.

What to Look for in Small Business Tax Software

- Ease of Use: Look for software with an intuitive interface and clear instructions.

- Comprehensive Form Support: Ensure the software supports all forms relevant to your business structure.

- Expert Assistance: Access to tax pros can be invaluable for complex returns or audit support.

- Integration: Seamless imports from accounting tools like QuickBooks save time and reduce errors.

- Price: Compare tiers and features to find the best value for your needs.

Tips for a Smooth Tax Season

- Gather all your business income and expense records before starting.

- Take advantage of data import features to save time.

- Use audit protection or expert review options for peace of mind.

- File early to avoid last-minute stress and potential penalties.

FAQs

Q: What is the best tax software for small businesses in 2026?

A: TurboTax, H&R Block, TaxSlayer, and TaxAct are top picks, each excelling in areas like user experience, affordability, and expert support.

Q: Can I file business taxes online with these software options?

A: Yes, all major tax software for small businesses allow you to file federal and state returns online, with e-file and audit support available.