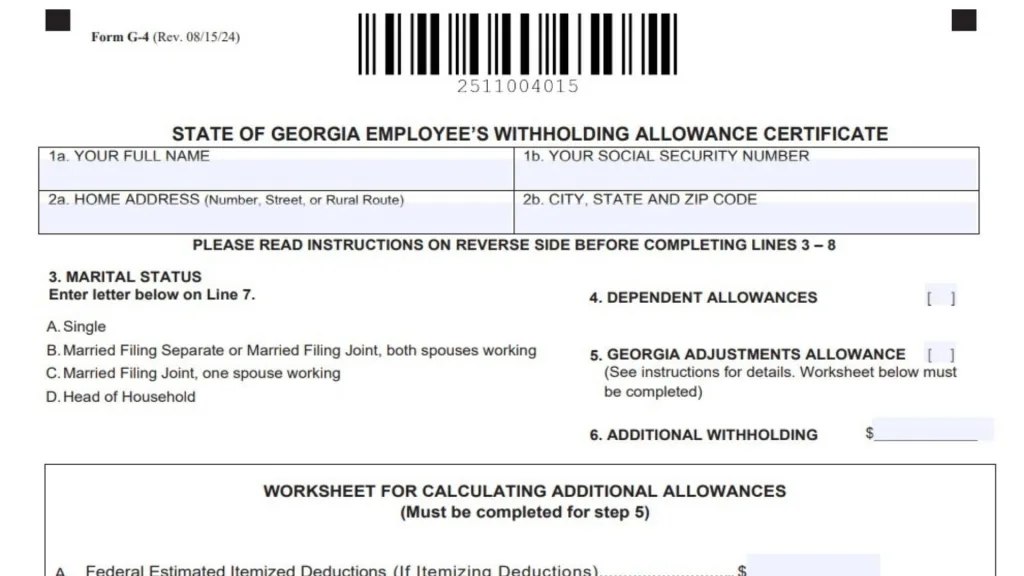

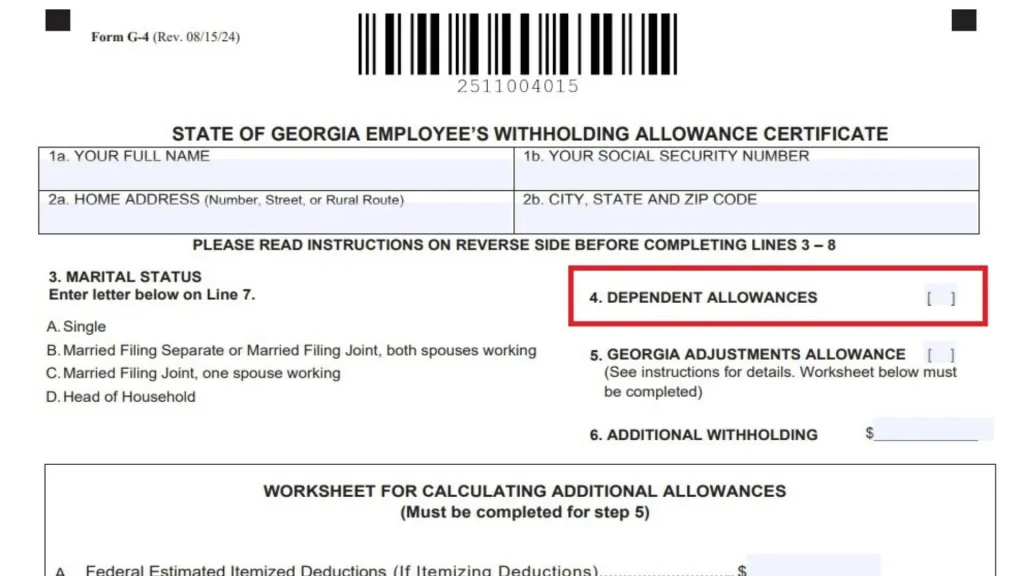

If you’re filling out Georgia Form G-4 for the first time or updating your withholding after a life change, understanding the dependent allowance in Georgia Form G-4 is essential to getting your state tax withholding correct—because each dependent you claim reduces the amount of Georgia income tax your employer withholds from your paycheck by approximately $4,000 worth of taxable income per year. The dependent allowance Georgia system follows federal definitions with one notable state-specific addition: Georgia recognizes unborn children with a detectable heartbeat as qualifying dependents, a rule that took effect in 2022 under the state’s Living Infants Fairness and Equality (LIFE) Act and remains in place for the 2026 tax year. On Line 4 of Form G-4, you’ll enter the total number of dependent allowances you’re entitled to claim—this number should match the dependents you plan to claim on your Georgia income tax return (Form 500 or 500EZ), including qualifying children, qualifying relatives, and eligible unborn children as defined by Georgia law. Each dependent allowance you claim tells your employer to withhold less tax from your wages, which increases your take-home pay but could result in owing tax at year-end if you overclaim, or getting a large refund if you underclaim. The math behind it is straightforward: Georgia’s withholding formula multiplies your number of dependent allowances by $4,000 (as of 2024 forward), then subtracts that total from your income before applying the state’s flat 5.39% tax rate to calculate how much to withhold each pay period. In this guide, we’ll walk through who qualifies as a dependent on Georgia Form G-4, how to count your dependents correctly (including the special unborn child provision), when to update your G-4 if your family situation changes, and how to avoid common mistakes that either inflate your paychecks now and create a tax bill later, or shrink your paychecks unnecessarily and hand the state an interest-free loan until you file your return and get your refund.

What Is A Dependent Allowance On Form G-4?

A dependent allowance is a number you enter on Line 4 of Georgia Form G-4 that represents each person you’ll claim as a dependent on your Georgia income tax return. Each allowance reduces your taxable income for withholding purposes by $4,000, which directly lowers the amount of Georgia tax withheld from your paycheck.

The more dependent allowances you claim, the less tax comes out of each paycheck—but you must have legitimate dependents to support your claim, or you’ll owe money when you file your return.

Who Counts As A Dependent For Georgia G-4 Purposes?

Georgia uses the same dependent definition as the federal Internal Revenue Code with one important state addition. Your dependents typically include qualifying children (your kids, stepchildren, foster children, siblings, or their descendants who meet age, residency, and support tests) and qualifying relatives (parents, grandparents, aunts, uncles, nieces, nephews, and certain other relatives you support who meet income and support requirements).

Georgia also allows you to claim any unborn child with a detectable human heartbeat as a dependent minor for income tax purposes. This means if you’re pregnant and a fetal heartbeat is detectable at any point during the tax year (which can occur as early as six weeks’ gestation), you can claim that unborn child as a dependent allowance on your G-4 and on your year-end Georgia tax return.

How The Unborn Child Dependent Rule Works

Georgia’s Living Infants Fairness and Equality Act (H.B. 481) expanded the definition of “dependent” to include unborn children with detectable heartbeats, effective July 20, 2022, and continuing into current tax years. If you have an unborn child with a detectable heartbeat at any time during the calendar year (including through December 31), you may claim a dependent exemption for that child.

You don’t need to provide medical documentation when you submit your G-4 to your employer, but you should be prepared to substantiate the claim if questioned—keep records like prenatal appointment summaries or ultrasound reports showing the detection of a heartbeat and approximate dates.

How Much Is Each Dependent Allowance Worth?

Each dependent allowance on your G-4 reduces your annual taxable income for withholding purposes by $4,000. Georgia’s current flat income tax rate is 5.39%, so each dependent allowance reduces your annual withholding by approximately $216 ($4,000 × 5.39%), or roughly $18 per month if you’re paid monthly, $8.30 per biweekly paycheck, or $4.15 per weekly paycheck.

The dependent allowance amounts have increased over recent years—prior to 2024, each dependent was worth $3,000—so if you’re using old information or forms, make sure you’re applying current-year rules.

How To Calculate Your Dependent Allowances

Count the number of people you’ll claim as dependents on your Georgia tax return (Form 500 or 500EZ). Start with qualifying children living with you who meet the federal dependent tests, add any qualifying relatives you support, and include any unborn children with detectable heartbeats if applicable.

Enter that total number in the bracket on Line 4 of Form G-4. If you have three children and you’re pregnant with a fourth (heartbeat detected), you would enter 4 on Line 4. Don’t include yourself or your spouse on Line 4—those are accounted for through your filing status letter on Line 3 and the corresponding tax tables.

Common Mistakes When Claiming Dependent Allowances

The biggest mistake is confusing dependent allowances with total allowances. Line 4 is only for dependents—don’t add yourself or your spouse here. Your marital status and whether both spouses work are handled separately through the filing status selection on Line 3 (letters A, B, C, or D), which determines which withholding tax table your employer uses.

Another error is overclaiming dependents you’re not entitled to claim—for example, claiming an adult child who earns too much income to qualify, or claiming a relative who doesn’t meet the support test. If you claim allowances you’re not entitled to and you end up owing tax, you may face underpayment penalties and interest.

When To Update Your G-4 Dependent Allowances

Update your Form G-4 whenever your number of dependents changes. Common triggering events include having a baby (or detecting a fetal heartbeat if claiming an unborn child), adopting a child, gaining custody of a child or relative, a dependent aging out or becoming financially independent, a dependent moving out or no longer meeting the support test, or a divorce that changes who claims the children.

Submit a new G-4 to your employer’s payroll or HR department within a few weeks of the change so your withholding adjusts for the rest of the year. Forms remain in effect until you submit a new one or until February 15 of the following year, at which point you should verify your withholding is still correct.

Line 4 Step-By-Step Instructions

Here’s how to complete Line 4 of Georgia Form G-4 in plain steps.

- Count your qualifying dependents using the federal definition (qualifying children and qualifying relatives).

- Add any unborn children with detectable heartbeats if applicable.

- Write the total number in the brackets on Line 4.

- Do not include yourself, your spouse, or anyone you can’t legally claim as a dependent on your tax return.

If you have no dependents, enter 0 (zero) on Line 4. If you’re unsure whether someone qualifies, use the IRS dependent tests as a starting point or consult a tax professional before claiming them on your G-4.

How Dependent Allowances Interact With Filing Status (Line 3)

Your filing status on Line 3 determines which Georgia tax table your employer uses, and each table has different built-in standard deductions. Single and Head of Household filers get a $12,000 standard deduction, Married Filing Separate and Married Filing Joint (both spouses working) get $12,000, and Married Filing Joint (one spouse working) gets $24,000.

Dependent allowances on Line 4 work in addition to these standard deductions. Your employer’s payroll system subtracts the standard deduction for your filing status, then subtracts $4,000 for each dependent allowance, then applies the 5.39% tax rate to what’s left.

The Worksheet For Additional Allowances (Line 5) Is Different

Don’t confuse dependent allowances on Line 4 with the Georgia Adjustments Allowance on Line 5. Line 5 is for claiming extra allowances based on itemized deductions, retirement income exclusions, or other adjustments that reduce your Georgia taxable income beyond the standard deduction and dependent allowances.

If you claim allowances on Line 5, you must complete the worksheet on the form showing your calculations. Line 4 (dependent allowances) does not require a worksheet—just count your actual dependents and enter the number.

What Happens If You Claim Too Many Dependent Allowances?

If you claim more dependent allowances than you’re entitled to, your employer will withhold too little Georgia income tax from your paychecks. When you file your Georgia tax return, you’ll owe the difference plus potential underpayment penalties and interest if the shortfall is significant.

Georgia employers are required to mail Form G-4s claiming more than 14 allowances to the Georgia Department of Revenue for review. If the Department determines your claim is excessive, they’ll notify your employer to adjust your withholding to Single with zero allowances until you submit a corrected form.

What Happens If You Claim Too Few Dependent Allowances?

If you claim fewer dependent allowances than you’re entitled to (or forget to update your G-4 after having a baby), your employer will withhold too much tax. You’ll get a larger refund when you file your Georgia return, but you’ve essentially given the state an interest-free loan throughout the year instead of having that money in your paycheck.

There’s no penalty for underestimating allowances—you just get your overpaid tax back as a refund. Some people prefer this as a forced savings method, but it’s generally smarter to claim the correct number of allowances and use the extra take-home pay to build emergency savings or pay down debt.

Special Considerations For Unborn Child Dependent Claims

If you’re claiming an unborn child as a dependent on your G-4 mid-year, submit an updated form as soon as the heartbeat is detected (usually around your 6-8 week prenatal appointment). This adjusts your withholding for the remainder of the year.

If the pregnancy ends before December 31 due to miscarriage or stillbirth, the dependent claim may no longer be valid for that tax year—consult the Georgia Department of Revenue guidance or a tax professional for your specific situation, as the law’s application in these circumstances is still evolving.

How To Submit Your Updated G-4

Complete a new Form G-4 with your updated dependent allowance number on Line 4, sign and date the form at the bottom, and submit it to your employer’s payroll or human resources department. Keep a copy for your records.

Your employer should implement the change within one or two pay periods. Check your next pay stub to confirm the withholding amount decreased if you increased your dependent allowances, or increased if you decreased your dependent allowances.

Comparing Dependent Allowances To Federal W-4

Georgia’s G-4 dependent allowance system is simpler than the current federal W-4. The federal form redesigned in 2020 eliminated allowances and uses a dollar-amount system for dependents and deductions, while Georgia still uses the traditional allowance-per-dependent approach.

When filling out both forms, your dependent count should generally match—if you claim three dependents on your federal W-4 (entering their dollar value), you should claim three dependent allowances on Line 4 of your Georgia G-4. However, the unborn child provision is unique to Georgia and doesn’t apply to federal withholding.

Employer Responsibilities For G-4 Dependent Allowances

Employers must honor properly completed G-4 forms as submitted unless they know the form is erroneous or unless the Georgia Department of Revenue notifies them otherwise. If an employee claims more than 14 total allowances or claims exempt status, employers must mail the form to the Georgia DOR for review.

Employers use the dependent allowance number from Line 4, combined with the filing status letter from Line 7, to calculate withholding using the Georgia Employer’s Tax Guide tables. Employers should not accept G-4 forms claiming exempt status (Line 8) if the employee also entered numbers on Lines 4-7, as these are mutually exclusive.

Tips For Getting Your Dependent Allowances Right

Use your most recent Georgia tax return as a guide—however many dependents you claimed on last year’s return is usually your starting point, adjusted for any changes (births, adoptions, dependents aging out, custody changes).

When in doubt, claim fewer dependent allowances rather than more—you’ll get a refund instead of owing tax. You can always submit an updated G-4 if you realize you’re having too much withheld.

If your situation is complex (split custody, dependents with income, supporting elderly relatives), consider using the Georgia Tax Calculator on the Department of Revenue website or consulting a tax professional to determine the correct number of allowances.

FAQs

How Many Dependent Allowances Should I Claim On Georgia G-4?

Claim the number of dependents you’ll report on your Georgia tax return—typically your qualifying children, qualifying relatives you support, and any unborn children with detectable heartbeats.

What Is Each Dependent Allowance Worth In Georgia?

Each dependent allowance reduces your taxable income for withholding by $4,000, which saves approximately $216 in annual withholding at Georgia’s 5.39% tax rate.

Can I Claim An Unborn Child On My Georgia G-4?

Yes, Georgia allows you to claim any unborn child with a detectable human heartbeat as a dependent allowance, effective from the date the heartbeat is detected through the end of the tax year.

Do I Include Myself Or My Spouse On Line 4?

No, Line 4 is only for dependents—yourself and your spouse are accounted for through your filing status selection on Line 3.

When Should I Update My G-4 Dependent Allowances?

Update your G-4 whenever your number of dependents changes due to births, adoptions, custody changes, dependents aging out, or other life events that affect who you can claim.

What Happens If I Claim Too Many Dependent Allowances?

You’ll have too little tax withheld and may owe money when you file your Georgia return, plus possible penalties and interest if the underpayment is substantial.

How Do I Change My Dependent Allowances On My G-4?

Complete a new Form G-4 with the updated number on Line 4, sign it, and submit it to your employer’s payroll or HR department.

Does Georgia Use The Same Dependent Definition As Federal Taxes?

Generally yes, but Georgia also recognizes unborn children with detectable heartbeats as dependents, which is not a federal rule.