If you’re a foreigner who has financial dealings with the U.S., you might have heard of the W-8 form. The W-8 form is used to certify that you are not a U.S. citizen or resident alien for tax purposes, which can help you avoid or reduce U.S. tax withholding on certain types of income. In this article, we’ll answer the crucial question: Do foreigners need to file the W-8 form every year? This form is required for various reasons, such as claiming tax treaty benefits and establishing the correct tax withholding rate for U.S.-source income. But the good news is that the W-8 form doesn’t always need to be filed annually, although there are certain circumstances where you might need to update it. Whether you’re a freelancer, investor, or business owner receiving U.S.-source income, understanding the W-8 filing requirements will save you from unnecessary headaches when dealing with U.S. taxes. We’ll break down exactly when and why the W-8 form is necessary, and how to handle it in your specific situation.

What Is the W-8 Form?

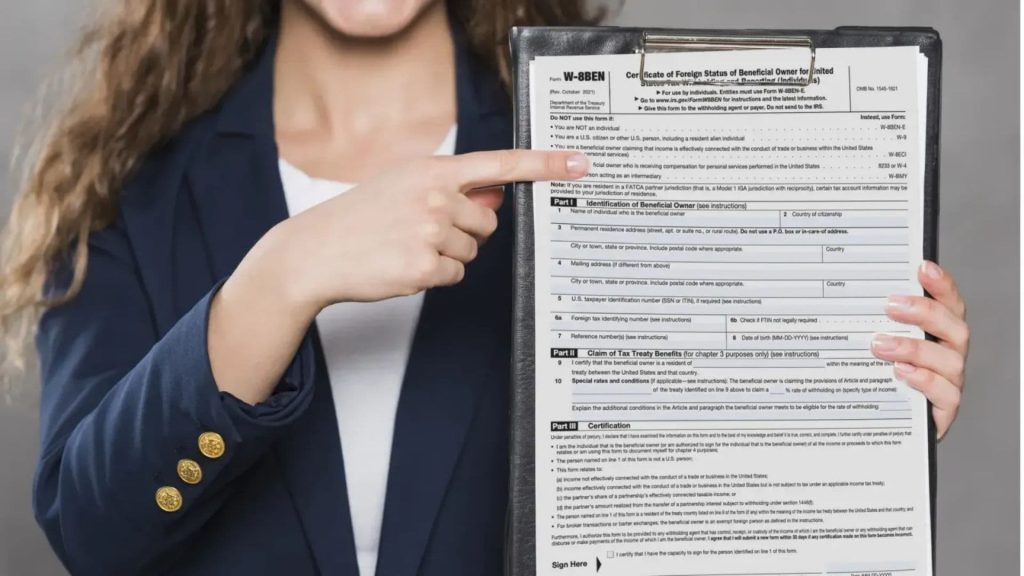

Before diving into the filing requirements, it’s important to know what the W-8 form is and why it exists. The W-8 form is a tax form used by foreign individuals and entities to certify their foreign status for the U.S. Internal Revenue Service (IRS). This form helps prevent U.S. tax withholding at the standard rate on income like dividends, interest, or royalties that foreign individuals might earn from U.S. sources. There are different types of W-8 forms, such as the W-8BEN (for individuals) and W-8BEN-E (for entities), each with slightly different requirements depending on your situation.

Do You Need to File the W8 Form Every Year?

Generally, the W-8 form doesn’t need to be filed annually. Once you submit it to the payer (such as a U.S. financial institution or a U.S.-based company) or withholding agent, it remains in effect for the year you file it and for the next three calendar years. After that, you’ll typically need to submit a new form if there have been changes to your tax status or if the IRS requests an updated version. So, unless your situation changes or your form expires after three years, you generally do not need to file the W-8 form every year.

When Should You File an Updated W8 Form?

There are specific situations where you will need to file an updated W-8 form. These include:

- Changes in Your Tax Status: If you move to the U.S. or change your tax status (such as becoming a U.S. citizen or resident alien), you’ll need to file a new W-8 form.

- Expiration of the Form: As mentioned earlier, the W-8 form is valid for three years, after which you’ll need to submit a new one.

- Changes in Tax Treaty Status: If your country’s tax treaty status with the U.S. changes, it’s necessary to update your W-8 form to reflect those new terms.

How to File the W8 Form

To file the W-8 form, you’ll need to download the appropriate form from the IRS website or receive it from your payer. Fill out the form accurately, ensuring you provide the necessary information such as your name, address, country of citizenship, and taxpayer identification number. Once completed, submit it directly to the person or institution requesting it, not to the IRS. Keep a copy for your own records in case you need it for future reference.

Consequences of Not Filing the W8 Form

Failing to submit a W-8 form when required can have significant consequences. U.S. payers will often withhold taxes at a higher rate, typically 30%, on any U.S.-sourced income you receive if you fail to submit the W-8 form. This could mean a substantial amount of your earnings will be withheld for taxes, which might be difficult to recover later. Additionally, not filing the W-8 form might delay payments or prevent you from claiming any tax treaty benefits you might be entitled to.

Benefits of Filing the W8 Form Correctly

When you file the W-8 form correctly, you can reduce or eliminate U.S. tax withholding on various types of income. In some cases, your country may have a tax treaty with the U.S. that reduces or exempts tax withholding, so filing the W-8 form ensures you receive the correct amount of income without overpaying in taxes. Correct filing also ensures that the IRS recognizes you as a foreign person for tax purposes, thus avoiding potential penalties or issues down the line.

Common Questions About the W8 Form

How Long Is a W-8 Form Valid?

The W-8 form is generally valid for three years from the date of submission. After that, you will need to file a new one if your situation has changed or if the form has expired.

Do All Foreigners Need to File the W-8 Form?

No, only foreign individuals or entities that receive income from U.S. sources need to file the W-8 form to certify their foreign status. If you’re not earning income from U.S. sources, you don’t need to file the W-8.