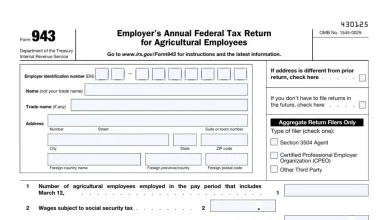

Federal Income Tax

Federal income tax is a tax levied by the U.S. government on individuals’ and businesses’ earnings, calculated based on income brackets and filing status. It funds various public services, including defense, healthcare, and infrastructure.