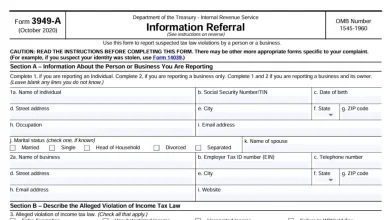

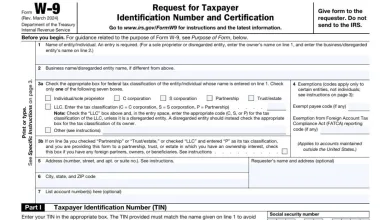

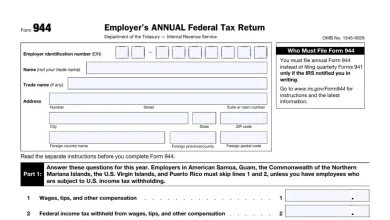

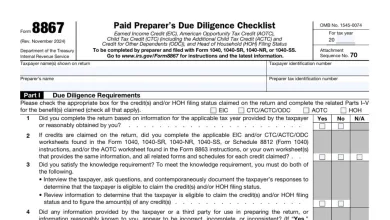

Federal Taxes

Federal taxes are a fundamental aspect of the U.S. tax system, impacting individuals and businesses at various levels. This category offers insights into income tax rates, deductions, credits, and the filing process to help you navigate your federal tax obligations.