A flat tax system is a method of taxation where a single tax rate is applied to all taxpayers, regardless of their income level. This means that everyone pays the same percentage of their income in taxes, contrasting with progressive tax systems where tax rates increase as income rises. The concept of a flat tax is often lauded for its simplicity, as it eliminates the need for complex tax brackets and deductions. However, it has also drawn criticism for potentially placing a disproportionate burden on lower-income earners.

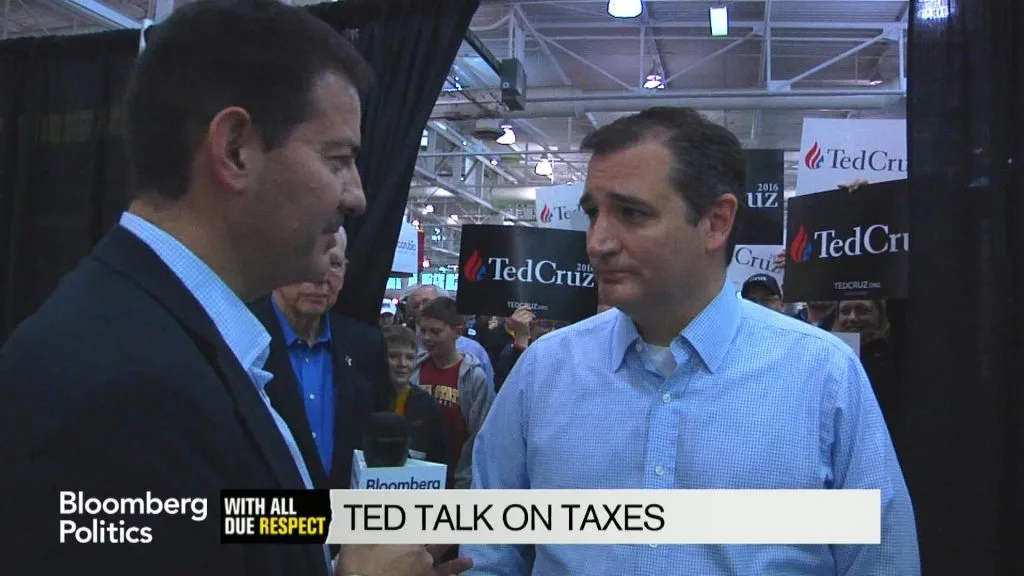

In a flat tax system, all taxable income is subject to the same tax rate. For example, if the flat tax rate is 15%, an individual earning $30,000 and another earning $300,000 would both pay 15% of their income in taxes. This straightforward approach simplifies tax calculations, reducing administrative burdens for both taxpayers and the government. However, even flat tax systems can include exemptions or deductions, potentially adding complexity to the structure. For instance, the flat tax proposal by US Senator Ted Cruz in 2016 included exemptions for families of four earning below $36,000, a 10% standard deduction, and a $4,000 personal exemption.

Advantages of a Flat Tax System

Simplicity: A flat tax’s primary appeal lies in its simplicity. With a single rate, taxpayers can easily calculate their tax liability without navigating complicated tax brackets and deductions, reducing compliance costs and administrative burdens.

Fairness: Proponents argue that a flat tax is fair because everyone pays the same percentage, regardless of income. This perceived fairness can foster a sense of shared responsibility for contributing to government revenue.

Economic Growth: Supporters believe that flat taxes can stimulate economic growth. Allowing individuals to retain more of their earnings incentivizes work, investment, and entrepreneurship, potentially leading to job creation and economic expansion.

Disadvantages of a Flat Tax System

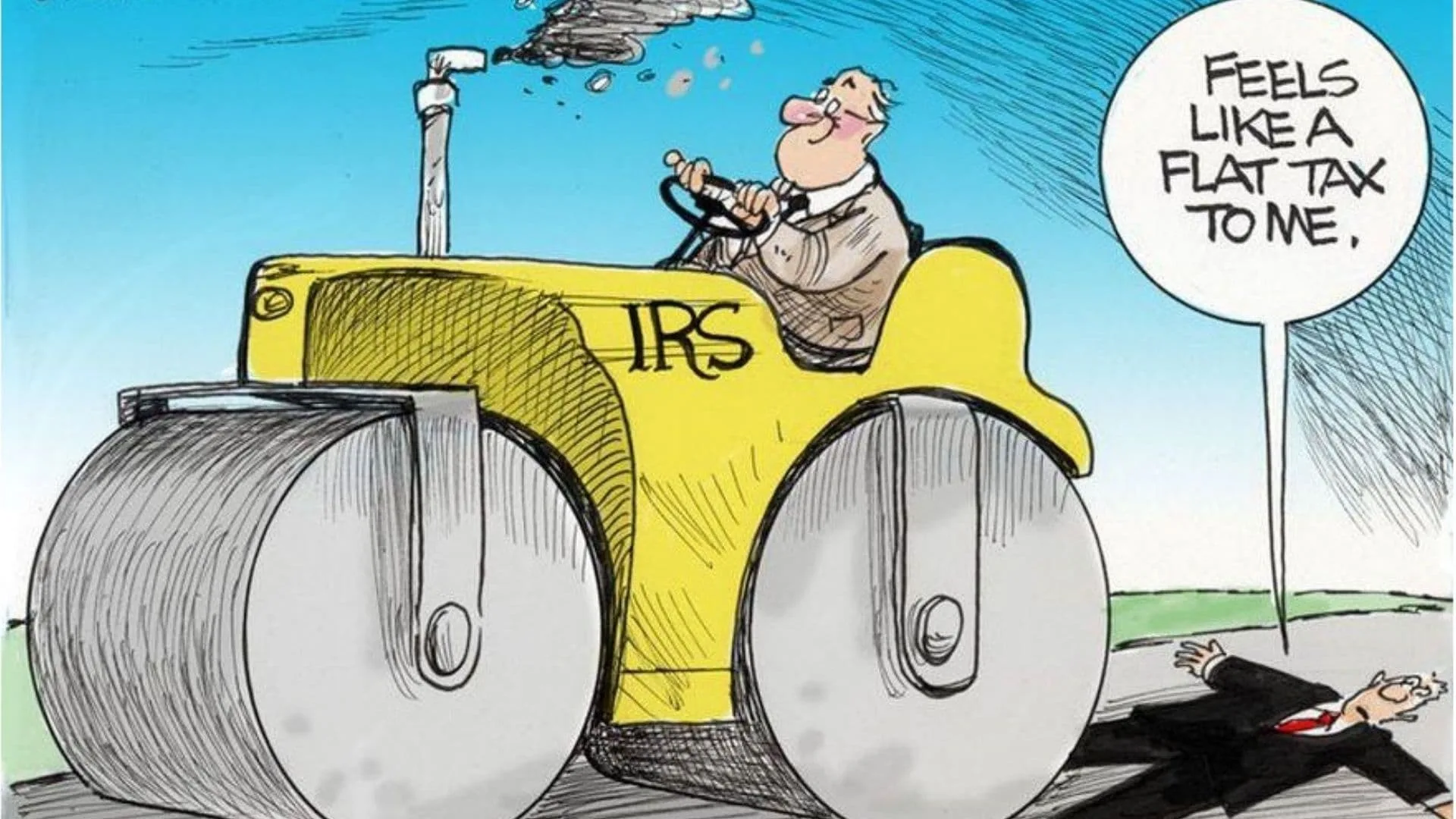

Burden on Low-Income Earners: The most significant criticism of the flat tax is its potential to disproportionately impact lower-income individuals. Paying the same percentage as wealthier taxpayers can create financial strain, potentially exacerbating income inequality. For instance, in a system with a 15% flat tax, someone earning $40,000 annually pays $6,000 in taxes, leaving them with $34,000. In contrast, someone earning $80,000 pays $12,000, retaining a significantly larger portion of their income at $68,000.

Impact on Social Programs: Implementing a flat tax could lead to cuts in essential social programs funded through progressive taxation. These programs, such as public services and social safety nets, are vital for supporting vulnerable populations and reducing inequality. Their potential reduction under a flat tax raises concerns about its broader societal impact.

Flat Tax vs. Other Tax Structures

Progressive Tax Systems: In a progressive tax system, higher-income earners pay a larger percentage of their income in taxes than lower-income earners. This structure aims to distribute the tax burden more equitably, ensuring that those with greater ability to pay contribute more to funding public services and social programs. Most countries, including the United States, use a progressive tax system for individual income tax. For example, in the US, someone earning under $9,275 annually pays 10% income tax, while someone earning above $500,000 pays 37%.

Regressive Tax Systems: In a regressive tax system, the average tax burden decreases as income increases. While a flat tax might appear neutral, it often functions as a regressive tax in practice. This is because lower-income earners spend a larger proportion of their income on essential goods and services subject to flat taxes like sales tax, effectively paying a higher percentage of their income in taxes compared to higher earners. For example, a sales tax of 7% on a $100 purchase impacts someone with a lower income more significantly than someone with a higher income, as it represents a larger portion of their overall funds.

Global Examples of Flat Tax Systems

Several countries have experimented with flat tax systems, showcasing both successes and challenges. For example, Russia adopted a 13% flat income tax in 2001, initially credited with increasing tax compliance and revenue. However, in 2021, Russia shifted to a progressive system to boost tax revenue. Other countries, like Estonia, Latvia, and Lithuania, have also transitioned from flat tax systems to progressive systems due to concerns about equity and revenue generation.

Within the United States, nine states currently have a flat tax on wage and salary income: Colorado, Illinois, Indiana, Kentucky, Massachusetts, Michigan, North Carolina, Pennsylvania, and Utah. These states offer insights into the practical implementation and long-term implications of flat taxes at a sub-national level.

The Debate Over Flat Taxes

The debate over flat taxes centers on the trade-offs between simplicity, fairness, and economic impact. Advocates highlight the straightforward nature of flat taxes and their potential to encourage economic growth. Critics, on the other hand, raise concerns about its regressive nature and potential to exacerbate income inequality. The effectiveness and desirability of a flat tax system depend on various factors, including the specific design of the system, the overall economic context, and societal values regarding equity and social welfare.