IRS Form 2441 is used to claim the Child and Dependent Care Credit, which helps taxpayers offset the costs of child and dependent care services. This form is required if you are filing your taxes with Form 1040, 1040-SR, or 1040-NR. The credit is available for individuals who incurred expenses for the care of a qualifying person to enable them to work or actively look for work.

Form 2441 serves as a means of reporting the care providers, the expenses paid, and other necessary details to determine the amount of credit you may qualify for. The form is divided into three main parts:

- Information on the care provider(s),

- Details of the care expenses and income,

- Dependent care benefits received.

How To File IRS Form 2441

To file IRS Form 2441, you will need to attach it to your primary tax return (Form 1040, 1040-SR, or 1040-NR). The form requires you to provide information about the care providers, the expenses you paid for dependent care, and any benefits you received through your employer or other means.

Before filing, ensure that you have the correct records of your care providers and any applicable benefits received. These can be found on your W-2 form or other tax-related documents.

How To Complete IRS Form 2441: Line-by-Line Instructions

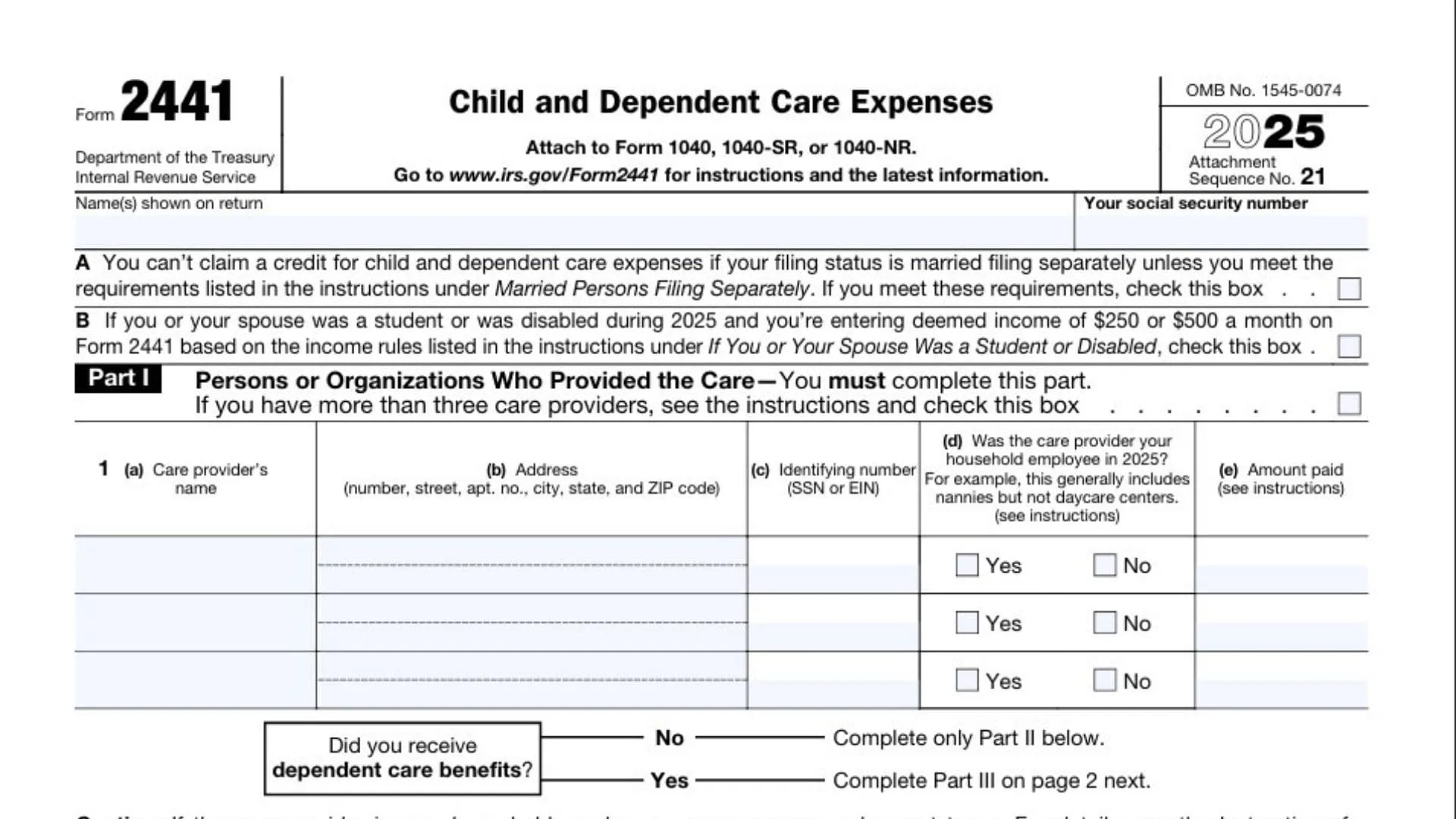

Part I: Persons or Organizations Who Provided the Care

- Line 1(a): Care Provider’s Name

Enter the name of each person or organization that provided care. If you have more than three care providers, check the box indicating this. - Line 1(b): Care Provider’s Address

List the address of each care provider (including street, city, state, and ZIP code). - Line 1(c): Identifying Number

Enter the care provider’s Social Security Number (SSN) or Employer Identification Number (EIN). - Line 1(d): Household Employee?

Indicate if the care provider was your household employee in 2025 (e.g., a nanny). For daycare centers, the answer is generally “No.” - Line 1(e): Amount Paid

List the total amount you paid to each provider for care during 2025.

Part II: Credit for Child and Dependent Care Expenses

- Line 2: Information About Your Qualifying Person(s)

List the name(s) and Social Security Number(s) of your qualifying person(s) (e.g., child, disabled dependent). Also, check the box if the person was over age 12 and disabled. - Line 3: Total Qualified Expenses

Add the amounts in column (d) from Line 2. Do not enter more than $3,000 for one qualifying person or $6,000 for two or more qualifying persons. - Line 4: Your Earned Income

Enter your earned income from employment, business, or other income sources. - Line 5: Spouse’s Earned Income (if Married Filing Jointly)

If married, enter your spouse’s earned income. If either you or your spouse is disabled or a student, follow the instructions for this line. - Line 6: Smallest Amount

Enter the smallest amount from Line 3, Line 4, or Line 5. If zero or less, enter “0.” - Line 7: Form 1040, Line 11a

Enter the amount from Form 1040, 1040-SR, or 1040-NR, Line 11a. - Line 8: Decimal Amount Based on Line 7

Based on the amount on Line 7, apply the appropriate decimal amount from the provided table to determine your credit percentage. - Line 9a: Multiply Line 6 by Line 8

Multiply the amount from Line 6 by the decimal from Line 8 to calculate the potential credit. - Line 9b: 2024 Expenses Paid in 2025

If applicable, complete Worksheet A in the instructions to enter any 2024 expenses paid in 2025. - Line 9c: Total of Lines 9a and 9b

Add the amounts from Lines 9a and 9b. This is the total credit amount for child and dependent care. - Line 10: Credit Limit

Enter the amount from the Credit Limit Worksheet in the instructions. - Line 11: Final Credit Amount

Enter the smaller amount from Line 9c or Line 10. This is the final amount of credit to claim.

Part III: Dependent Care Benefits

- Line 12: Total Dependent Care Benefits Received

Enter the total dependent care benefits you received in 2025, as shown on your W-2 or from your self-employed business. - Line 13: Amount Carried Over From 2024

If you carried over any dependent care benefits from 2024, enter the amount here. - Line 14: Amount Forfeited or Carried Forward to 2026

If any dependent care benefits were forfeited or carried forward, enter the amount here. - Line 15: Total Dependent Care Benefits

Add the amounts from Lines 12 through 14. - Line 16: Total Qualified Expenses

Enter the total expenses you incurred in 2025 for the care of your qualifying person(s). - Line 17: Smaller of Lines 15 or 16

Enter the smaller amount from Line 15 or Line 16. This amount is used to calculate your credit. - Line 18: Your Earned Income (Again)

Enter your earned income again for reference. - Line 19: Spouse’s Earned Income (for Married Filing Jointly)

If married filing jointly, enter your spouse’s earned income. For others, use the amount from Line 18. - Line 20: Smallest of Lines 17, 18, or 19

Enter the smallest of these three amounts. If zero or less, enter “0.” - Line 21: Maximum Amount for Dependent Care Plan

Enter $5,000 ($2,500 if married filing separately) unless limited by your dependent care plan. - Line 22: Sole Proprietorship/Partnership Benefits

If you received dependent care benefits from your own business, enter the amount here. - Line 23: Subtract Line 22 from Line 15

Subtract any benefits from your business (Line 22) from the total benefits on Line 15. - Line 24: Deductible Benefits

Enter the smallest of Lines 20, 21, or 22. Include this amount on the appropriate line(s) of your return. - Line 25: Excluded Benefits

If no benefits were received from your business, enter the smaller of Line 20 or Line 21. Otherwise, subtract Line 24 from the smaller of these two. - Line 26: Taxable Benefits

Subtract Line 25 from Line 23 to determine your taxable benefits. - Line 27: Credit for Child and Dependent Care Expenses

Enter $3,000 ($6,000 if two or more qualifying persons) to calculate the maximum possible credit amount. - Line 28: Add Lines 24 and 25

Add the deductible and excluded benefits from Lines 24 and 25. - Line 29: Subtract Line 28 from Line 27

If zero or less, stop; you cannot claim the credit. Otherwise, this is the amount you qualify for. - Line 30: Total Expenses

Complete the total expenses from Part I. - Line 31: Final Credit Amount

Enter the smaller amount from Line 29 or 30. This is the amount to claim on your tax return.