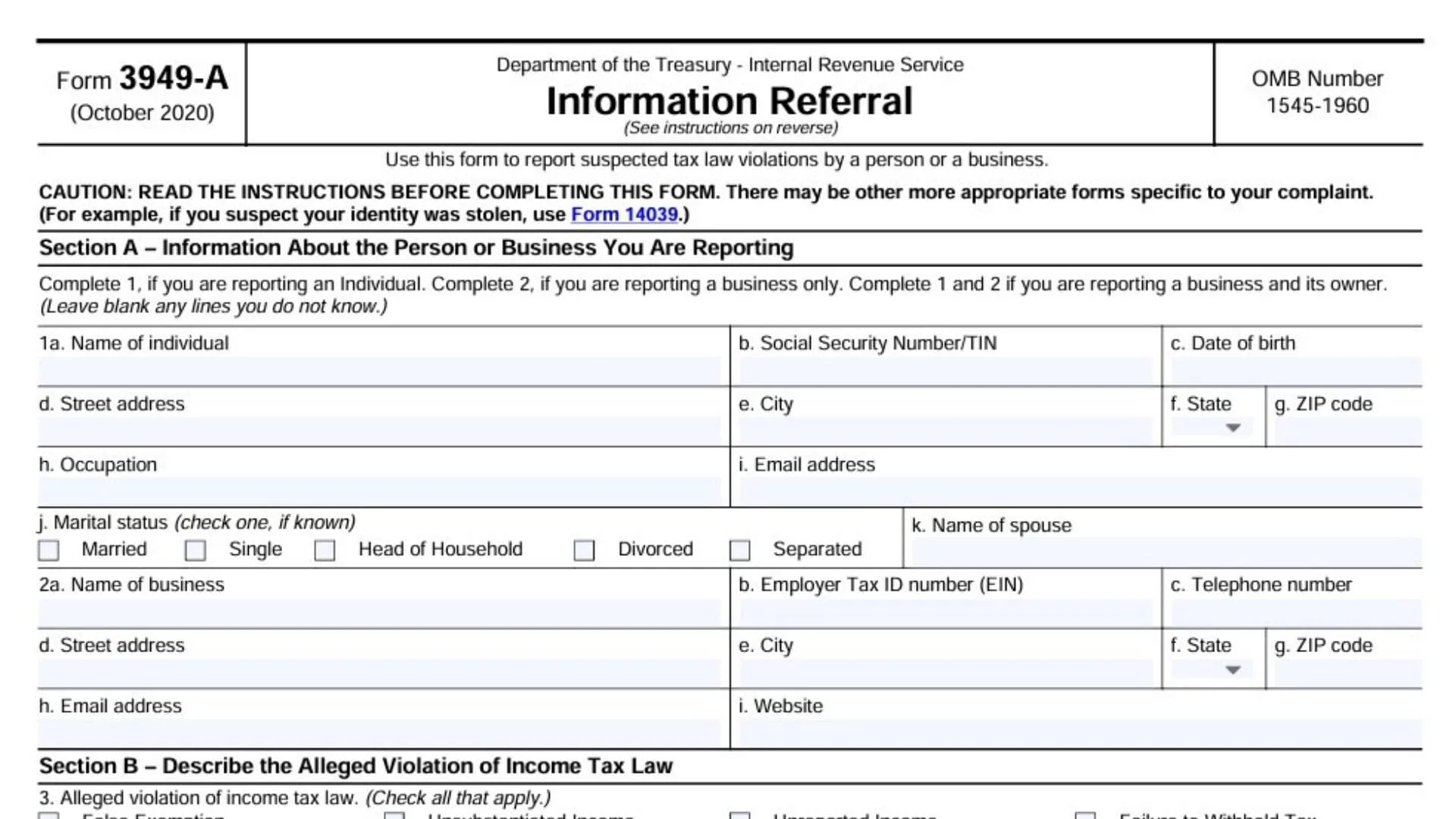

Form 3949-A, officially titled “Information Referral,” is the designated document used by the Department of the Treasury and the Internal Revenue Service for reporting suspected federal tax law violations committed by an individual, a business, or both. This form serves as the primary channel for concerned citizens to alert the IRS about potential misconduct such as unreported income, false exemptions, failure to pay taxes, or even organized crime activities that impact tax revenue. It is important to distinguish this form from others; specifically, you should not use it if you are reporting identity theft (use Form 14039), misconduct by a tax return preparer (use Form 14157), or abusive tax avoidance schemes (use Form 14242). The information you provide on Form 3949-A is voluntary, but it plays a critical role in helping the IRS ensure compliance with the law and collect the correct amount of tax revenue. While you are not required to identify yourself, providing your contact information can be helpful if investigators need further details, and rest assured, the IRS does not share your identity with the person or business you are reporting.

How To File Form 3949-A

Once you have completed the form with as much detail as possible, you must mail it to the centralized processing center. There is no online submission portal for this specific form; it must be printed and sent via traditional mail.

Mail your completed form to:

Internal Revenue Service

PO Box 3801

Ogden, UT 84409

How To Complete Form 3949-A

Section A – Information About The Person Or Business You Are Reporting

This section is where you identify the subject of your report. Fill out as many fields as you can, but leave blank any lines where you do not have the information.

- 1a. Name of individual: Enter the full legal name of the person you are reporting.

- 1b. Social Security Number/TIN: If you know it, provide their SSN or Taxpayer Identification Number.

- 1c. Date of birth: Enter their birth date if known.

- 1d. Street address: Provide their current home address.

- 1e. City: Enter the city of residence.

- 1f. State: Enter the state of residence.

- 1g. ZIP code: Enter the postal code.

- 1h. Occupation: State their job title or profession.

- 1i. Email address: Provide their personal email address if known.

- 1j. Marital status: Check the appropriate box for Married, Single, Head of Household, Divorced, or Separated, if you know it.

- 1k. Name of spouse: If they are married, enter the name of their husband or wife.

- 2a. Name of business: If you are reporting a company, enter its legal business name here.

- 2b. Employer Tax ID number (EIN): Provide the business’s federal tax ID number if available.

- 2c. Telephone number: Enter the main phone number for the business.

- 2d. Street address: Provide the physical location of the business.

- 2e. City: Enter the city where the business is located.

- 2f. State: Enter the state.

- 2g. ZIP code: Enter the business postal code.

- 2h. Email address: Provide the business contact email.

- 2i. Website: Enter the URL of the business’s website if they have one.

- Note: If you are reporting a business and its owner, complete both Part 1 and Part 2.

Section B – Describe The Alleged Violation Of Income Tax Law

This section allows you to categorize the type of misconduct you are reporting.

- 3. Alleged violation of income tax law: Check all the boxes that apply to the situation. Options include:

- False Exemption: Claiming dependents they are not entitled to.

- False Deductions: Inflating expenses to lower taxable income.

- Multiple Filings: Submitting more than one return to get fraudulent refunds.

- Organized Crime: Involvement in illegal enterprises like drugs or money laundering.

- Unsubstantiated Income: Reporting false income sources to get a refund.

- Earned Income Credit: Claiming credits or children they do not qualify for.

- Public/Political Corruption: Officials using their position for illegal personal gain.

- False/Altered Documents: Creating fake W-2s or 1099s.

- Unreported Income: Hiding cash payments or income from goods/services.

- Narcotics Income: Money derived from illegal drug sales.

- Kickback: Illegal payments exchanged for business referrals or influence.

- Wagering/Gambling: Hiding winnings from betting activities.

- Failure to Withhold Tax: Not withholding taxes from employees (e.g., paying under the table).

- Failure to File Return: Not submitting required tax returns.

- Failure to Pay Tax: Owing taxes but refusing to pay.

- Other: If the violation doesn’t fit these categories, check this and describe it in box 5.

- 4. Unreported income and tax years: If your report involves hidden income, list the specific Tax Years (TY) and the estimated dollar amounts involved (e.g., TY 2023 – $50,000).

- 5. Comments: Briefly describe the facts. Explain who, what, where, when, and how you learned about the violation. You can attach an extra sheet of paper if you need more space.

- 6. Additional information: Answer the following three questions if possible:

- 6a. Are book/records available? Check Yes or No. If they are available, do not send them yet; the IRS will ask for them later if needed.

- 6b. Do you consider the taxpayer dangerous? Check Yes or No.

- 6c. Banks, Financial Institutions used by the taxpayer: List the Name, Address, City, State, and ZIP code for any banks the subject uses.

Section C – Information About Yourself

Providing your information is optional but recommended if the IRS needs to follow up.

- 7a. Your name: Enter your full name.

- 7b. Telephone number: Provide a number where you can be reached.

- 7c. Best time to call: Indicate when you are available to speak.

- 7d. Street address: Enter your mailing address.

- 7e. City: Enter your city.

- 7f. State: Enter your state.

- 7g. ZIP code: Enter your postal code.