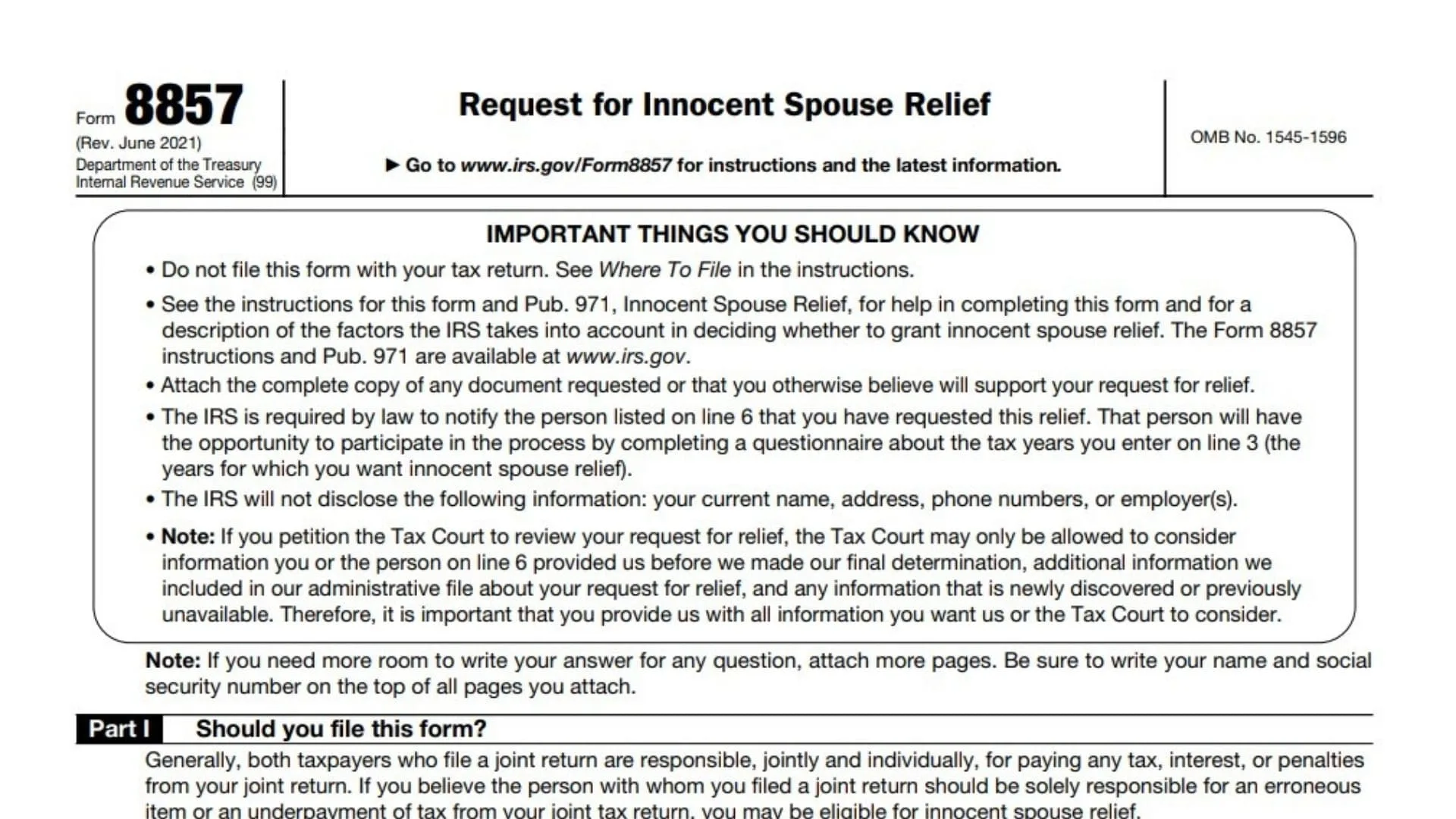

If you’re exploring innocent spouse relief, chances are you’ve come across the term “Form 8857 preliminary determination.” The Form 8857 preliminary determination is a crucial milestone in the IRS’s process for deciding whether you qualify for relief from joint tax liability due to your spouse’s or ex-spouse’s tax missteps. When you file IRS Form 8857—Request for Innocent Spouse Relief—the IRS reviews your submission, contacts your spouse or former spouse to get their side of the story, and then, once all the facts are in, issues a preliminary determination letter. This letter spells out the IRS’s initial decision about your request, outlining whether they intend to grant you full, partial, or no relief. The preliminary determination is not the end of the road; both you and your spouse (or ex) have the right to appeal if you disagree with the outcome, setting the stage for a final determination.

Understanding the Form 8857 preliminary determination process is essential for anyone seeking innocent spouse relief, as it can affect your financial future, your tax obligations, and your peace of mind. In this article, we’ll break down the process, explain what happens after you file, and offer tips for navigating this sometimes-stressful—but ultimately empowering—IRS procedure. Keywords like “innocent spouse relief,” “IRS Form 8857,” “preliminary determination letter,” “joint tax liability,” and “tax relief process” are all part of this journey, so let’s demystify them together and help you take control of your tax situation.

What Is a Form 8857 Preliminary Determination?

A Form 8857 preliminary determination is the IRS’s initial written decision about your request for innocent spouse relief. After you file Form 8857 and provide all necessary information, the IRS reviews your case and contacts your spouse or former spouse to allow them to participate in the process. Once the IRS has gathered enough information, it sends a preliminary determination letter to both you and your spouse or ex-spouse, stating whether it intends to grant or deny relief, and to what extent. This letter is your chance to review the IRS’s reasoning and, if you disagree, to appeal the decision before it becomes final.

How Does the Form 8857 Preliminary Determination Process Work?

- Filing Form 8857:

You start by completing and submitting IRS Form 8857, Request for Innocent Spouse Relief, as soon as you become aware of a tax liability you believe should be your spouse’s or ex-spouse’s responsibility. - IRS Review:

The IRS reviews your application for completeness and contacts your spouse or former spouse to get their input. This step is required—even in cases of domestic violence, though the IRS will not disclose your personal information. - Gathering Information:

Both parties may submit additional documentation or statements to support their positions. The IRS may also request more information from you if needed. - Preliminary Determination Letter:

Once all information is in, the IRS issues a preliminary determination letter to both you and your spouse or ex-spouse. This letter details the IRS’s proposed decision regarding your request for relief. - Appeal Opportunity:

If either party disagrees with the preliminary determination, they may appeal to the IRS Independent Office of Appeals. If no one appeals, the decision becomes final after a set period, and the IRS issues a final determination letter. - Final Determination:

The final determination is binding and can be appealed to the U.S. Tax Court if you disagree with the outcome, provided you file your petition within 90 days of the final determination letter.

What Happens After You File Form 8857?

- The IRS cannot collect from you for the tax year(s) in question while your request is pending, but interest and penalties may continue to accrue.

- Both you and your spouse or ex-spouse are notified of the preliminary determination and have the right to appeal.

- If neither party appeals, the IRS will issue a final determination letter, which is the agency’s closing word on your request.

- If you do not receive a final determination within six months, you may petition the Tax Court for review.

Tips for Navigating the Preliminary Determination Process

- Be thorough: Provide as much detail and supporting documentation as possible when you file Form 8857.

- Stay organized: Keep copies of all correspondence, including the preliminary determination letter and any appeals you submit.

- Act promptly: Pay attention to deadlines for appeals and Tax Court petitions—missing them can limit your options.

- Seek help if needed: Consider consulting a tax professional or attorney, especially if your case is complex or involves domestic violence.

FAQs

What is a Form 8857 preliminary determination letter?

It’s the IRS’s initial written decision about your request for innocent spouse relief, sent to both you and your spouse or ex-spouse before a final determination is made.

Can I appeal the IRS’s preliminary determination?

Yes, both you and your spouse or ex-spouse can appeal the preliminary determination to the IRS Independent Office of Appeals before the decision becomes final.

What happens if neither party appeals the preliminary determination?

If no appeals are filed, the IRS will issue a final determination letter, which is binding unless you petition the Tax Court within 90 days.