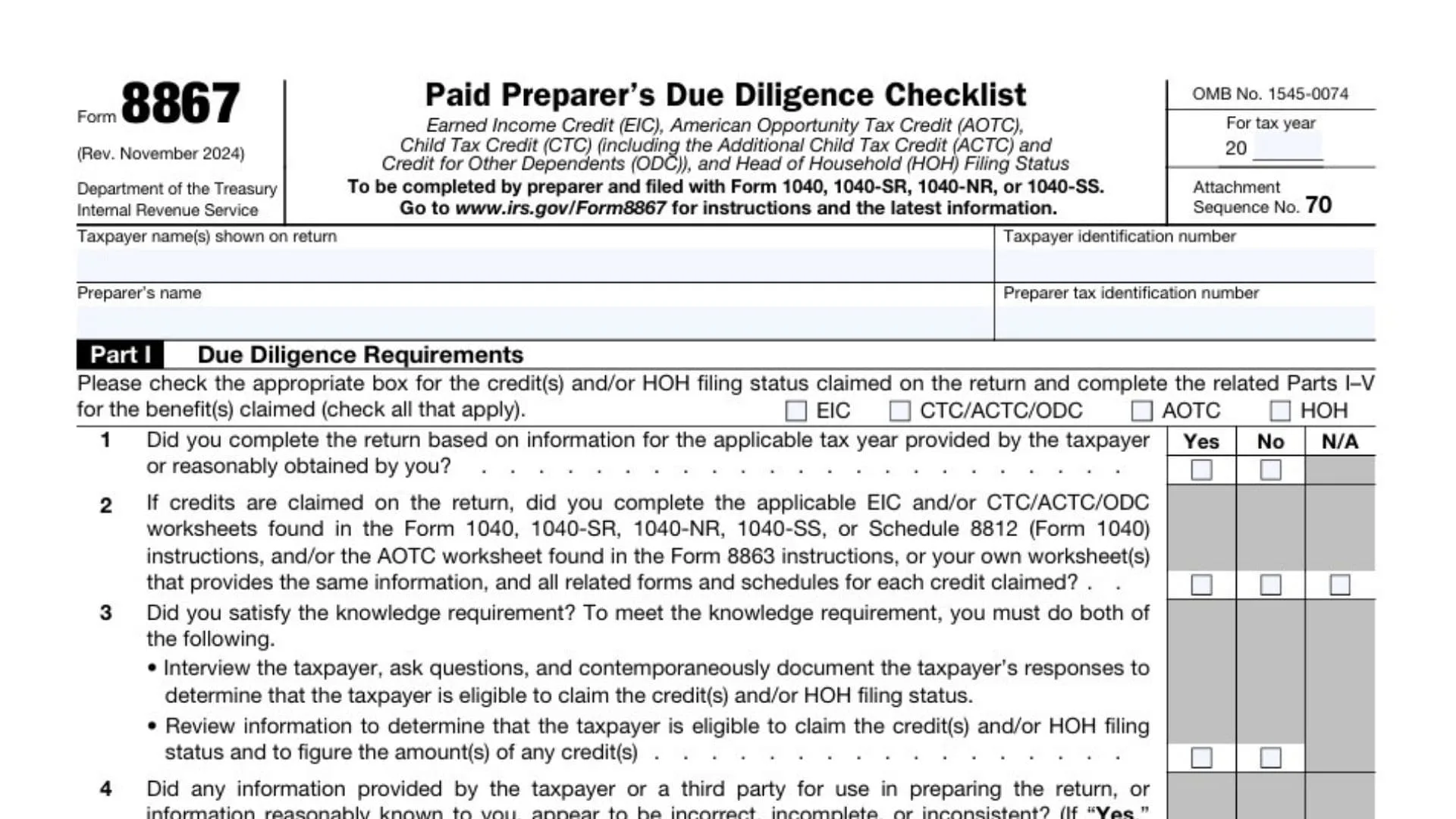

IRS Form 8867, officially titled “Paid Preparer’s Due Diligence Checklist,” is a mandatory document that professional tax preparers must complete and attach to every tax return that claims the Earned Income Credit, American Opportunity Tax Credit, Child Tax Credit (including Additional Child Tax Credit and Credit for Other Dependents), or Head of Household filing status. The November 2024 revision of this form serves as both a verification tool and a compliance safeguard to ensure that tax professionals conduct thorough research before claiming these benefits on behalf of clients. This form is not optional for paid preparers—it is a strict legal requirement enforced by the Internal Revenue Service to prevent fraudulent or erroneous claims that could result in substantial financial penalties for both the preparer and the taxpayer. When a paid preparer submits a return with Forms 1040, 1040-SR, 1040-NR, or 1040-SS that includes any of these credits or the Head of Household status, Form 8867 must accompany that submission as Attachment Sequence Number 70. The form’s primary purpose is to document that the preparer has met four core due diligence obligations: completing all required worksheets, fulfilling the knowledge requirement through interviews and documentation, making reasonable inquiries when information appears questionable, and maintaining proper records for at least three years. Failure to properly complete and file this form can expose tax preparers to penalties of hundreds of dollars per return, making it one of the most critical compliance documents in the tax preparation industry.

How To File IRS Form 8867

Filing Form 8867 requires attaching it directly to the client’s tax return before submission to the IRS. The form cannot be filed separately or after the fact—it must be included with the original return filing. If you are filing electronically, your tax software will prompt you to complete Form 8867 when it detects any of the applicable credits or Head of Household status on the return. The form will then be transmitted electronically alongside the main tax return. For paper filings, print the completed Form 8867 and physically attach it behind the tax return using the designated attachment sequence number. Retain a copy of the completed form in your records for a minimum of three years from the latest date specified in the retention requirements, which typically means three years from the return’s due date or filing date, whichever is later.

How to Complete Form 8867

Header Section

Tax Year Field: Enter the four-digit tax year for which you are preparing the return in the space provided at the top of the form.

Taxpayer Name(s) Shown On Return: Write the exact name or names that appear on the tax return you are preparing, matching the format used on Form 1040 or its variants.

Taxpayer Identification Number: Enter the primary taxpayer’s Social Security Number or Individual Taxpayer Identification Number exactly as it appears on the return.

Preparer’s Name: Provide your full legal name as the paid tax preparer completing this checklist.

Preparer Tax Identification Number: Enter your Preparer Tax Identification Number issued by the IRS, which is required for all paid tax return preparers.

Part I: Due Diligence Requirements

Checkbox Row (EIC, CTC/ACTC/ODC, AOTC, HOH): Mark all boxes that apply to the return you are filing. If the taxpayer is claiming the Earned Income Credit, check the EIC box. If claiming Child Tax Credit, Additional Child Tax Credit, or Credit for Other Dependents, check the CTC/ACTC/ODC box. Check AOTC if claiming the American Opportunity Tax Credit, and check HOH if the taxpayer is filing with Head of Household status. You must complete the corresponding parts of the form for each box you check.

Line 1: Answer whether you prepared the return using information that the taxpayer provided for the current tax year or information you reasonably obtained through your professional inquiry. Check “Yes” if all information came from legitimate sources for the applicable tax year, “No” if you used outdated or inappropriate information, or “N/A” if this question does not apply to your situation. This line verifies that you are not basing the return on assumptions or information from prior years without confirming its current accuracy.

Line 2: Indicate whether you completed the required worksheets for calculating the credits claimed on the return. If you are claiming EIC, you must complete the EIC worksheet found in Form 1040 instructions. For CTC/ACTC/ODC claims, complete the worksheet in Schedule 8812 instructions. For AOTC, use the worksheet in Form 8863 instructions. You may also use your own custom worksheets as long as they gather the same information and calculations as the official IRS worksheets. Check “Yes” if all applicable worksheets were completed.

Line 3: Confirm whether you met the knowledge requirement, which has two mandatory components. First, you must interview the taxpayer by asking specific questions about their eligibility for each credit or filing status, and you must document their responses at the time of the interview (contemporaneous documentation). Second, you must review supporting information to verify that the taxpayer qualifies for the credit or status and to accurately calculate the credit amounts. Both actions are required to check “Yes” on this line.

Line 4: Indicate whether any information provided by the taxpayer, a third party, or information you already knew appeared to be wrong, incomplete, or inconsistent. If you check “Yes,” you must answer Lines 4a and 4b. If you check “No,” skip directly to Line 5.

Line 4a: If you answered “Yes” to Line 4, confirm whether you made reasonable inquiries to clarify and correct the questionable information. This means you must actively investigate discrepancies rather than simply accepting problematic data.

Line 4b: Confirm whether you documented your inquiries at the time you made them. Your documentation should include the specific questions you asked, the person you questioned, the date and time of the inquiry, the information they provided in response, and how that information affected your preparation of the return. This contemporaneous record-keeping is legally required.

Line 5: Verify that you met the record retention requirement. You must keep five categories of records for three years from the latest applicable date: a copy of Form 8867, a copy of all applicable credit worksheets, copies of any documents the taxpayer provided that you used to determine eligibility or calculate credits, a record showing how, when, and from whom you obtained the information used on Form 8867 and worksheets, and copies of any supporting documents you relied upon to verify eligibility or credit amounts.

Line 5 (Continuation – List Documents): In the space provided, write a list of all documents the taxpayer gave you that you used to determine their eligibility or calculate credit amounts. Examples might include school tuition statements, birth certificates, rental agreements, pay stubs, or custody agreements.

Line 6: Confirm whether you asked the taxpayer if they could provide documentation to prove their eligibility and credit amounts if the IRS selects their return for an audit. This question ensures that taxpayers understand they may need to substantiate their claims later and should have records available.

Line 7: Indicate whether you asked the taxpayer if the IRS disallowed or reduced any of these credits in a previous tax year. If the answer is “Yes,” proceed to Line 7a. If the answer is “No,” skip to Line 8.

Line 7a: If credits were disallowed or reduced in a prior year, confirm whether you completed Form 8862, which is the required recertification form that taxpayers must file to reclaim these credits after a denial.

Line 8: If the taxpayer reports self-employment income on their return, confirm whether you asked sufficient questions to prepare a complete and accurate Schedule C. This is critical because self-employment income directly affects eligibility and calculation of earned income credits.

Part II: Due Diligence Questions For Returns Claiming EIC

Note: Only complete this section if the return claims the Earned Income Credit. If not claiming EIC, skip to Part III.

Line 9a: Confirm whether you determined that the taxpayer qualifies to claim the EIC for the specific number of qualifying children they are claiming, or that they qualify to claim the EIC without any qualifying children. If the taxpayer is claiming EIC without a qualifying child, you may skip to Line 10.

Line 9b: Indicate whether you asked the taxpayer if the child physically lived with them for more than half of the year. This residency requirement is separate from financial support—even if the taxpayer supported the child for the entire year, the child must have lived with the taxpayer for over half the year to qualify for EIC.

Line 9c: Confirm whether you explained the tiebreaker rules to the taxpayer. These rules apply when a child meets the qualifying child criteria for more than one person, and only one person can claim the EIC for that child. You must educate the taxpayer on how the IRS resolves these conflicts.

Part III: Due Diligence Questions For Returns Claiming CTC/ACTC/ODC

Note: Only complete this section if the return claims Child Tax Credit, Additional Child Tax Credit, or Credit for Other Dependents. If not claiming these credits, proceed to Part IV.

Line 10: Verify that each qualifying person for the CTC/ACTC/ODC is a dependent of the taxpayer and is a United States citizen, national, or resident. Non-resident aliens do not qualify for these credits.

Line 11: Confirm whether you explained to the taxpayer that they cannot claim CTC or ACTC if the child did not live with them for more than half the year, even if they provided financial support, unless the custodial parent has released the exemption claim for that child.

Line 12: Indicate whether you explained the special rules for divorced or separated parents (or parents living apart) regarding CTC/ACTC/ODC claims. This includes informing the taxpayer about the requirement to attach Form 8332 or a similar written declaration if the non-custodial parent is claiming the credit.

Part IV: Due Diligence Questions For Returns Claiming AOTC

Note: Only complete this section if the return claims the American Opportunity Tax Credit. If not, proceed to Part V.

Line 13: Confirm whether the taxpayer provided substantiation for the education credit, such as Form 1098-T from the educational institution or receipts documenting qualified tuition and related expenses. Without this documentation, you cannot verify eligibility for AOTC.

Part V: Due Diligence Questions For Claiming HOH

Note: Only complete this section if the return uses Head of Household filing status. If not, proceed to Part VI.

Line 14: Verify that the taxpayer was either unmarried or considered unmarried on the last day of the tax year and that they paid more than half the cost of maintaining a home for a qualifying person throughout the year. Both conditions must be met for Head of Household status.

Part VI: Eligibility Certification

This section summarizes your compliance obligations. You will meet all due diligence requirements if you complete four actions: interview the taxpayer with adequate questions and contemporaneous documentation while reviewing sufficient information to determine eligibility and credit amounts (Action A); complete Form 8867 truthfully and accurately for all applicable credits and filing status (Action B); submit Form 8867 in the required manner with the tax return (Action C); and retain all five categories of records for three years as specified in the Document Retention section of the form instructions (Action D).

The five record categories you must retain are: a copy of Form 8867, copies of all applicable worksheets, copies of documents the taxpayer provided that you relied upon, a record of how, when, and from whom you obtained the information, and a record of additional information including questions asked and responses received.

The form warns that failure to comply with all due diligence requirements may result in penalties for each instance of non-compliance related to a credit claim or Head of Household filing status.

Line 15: This is your final certification. Answer “Yes” only if you certify that all answers on Form 8867 are true, correct, and complete to the best of your knowledge. Answering “No” indicates you cannot certify the accuracy of the form, which would mean the return should not be filed until you can truthfully answer “Yes.”