If you’re searching for the Form 944 Mailing Address, you’re in the right place—because “where to file” is one of the easiest ways to accidentally turn a straightforward payroll task into a frustrating IRS delay. The tricky part is that the IRS Form 944 mailing address is not one universal location: the correct address to mail Form 944 depends on factors like your state, whether you’re including a payment, and sometimes whether you’re using the U.S. Postal Service versus a private delivery service. In this guide, you’ll learn how the IRS organizes the mailing addresses, how to select the right one quickly, what to include in your envelope, and what to do if you already mailed Form 944 to the wrong place—without repeating confusing jargon or sending you on a scavenger hunt.

What Is Form 944 (And Why It Has Special Mailing Rules)?

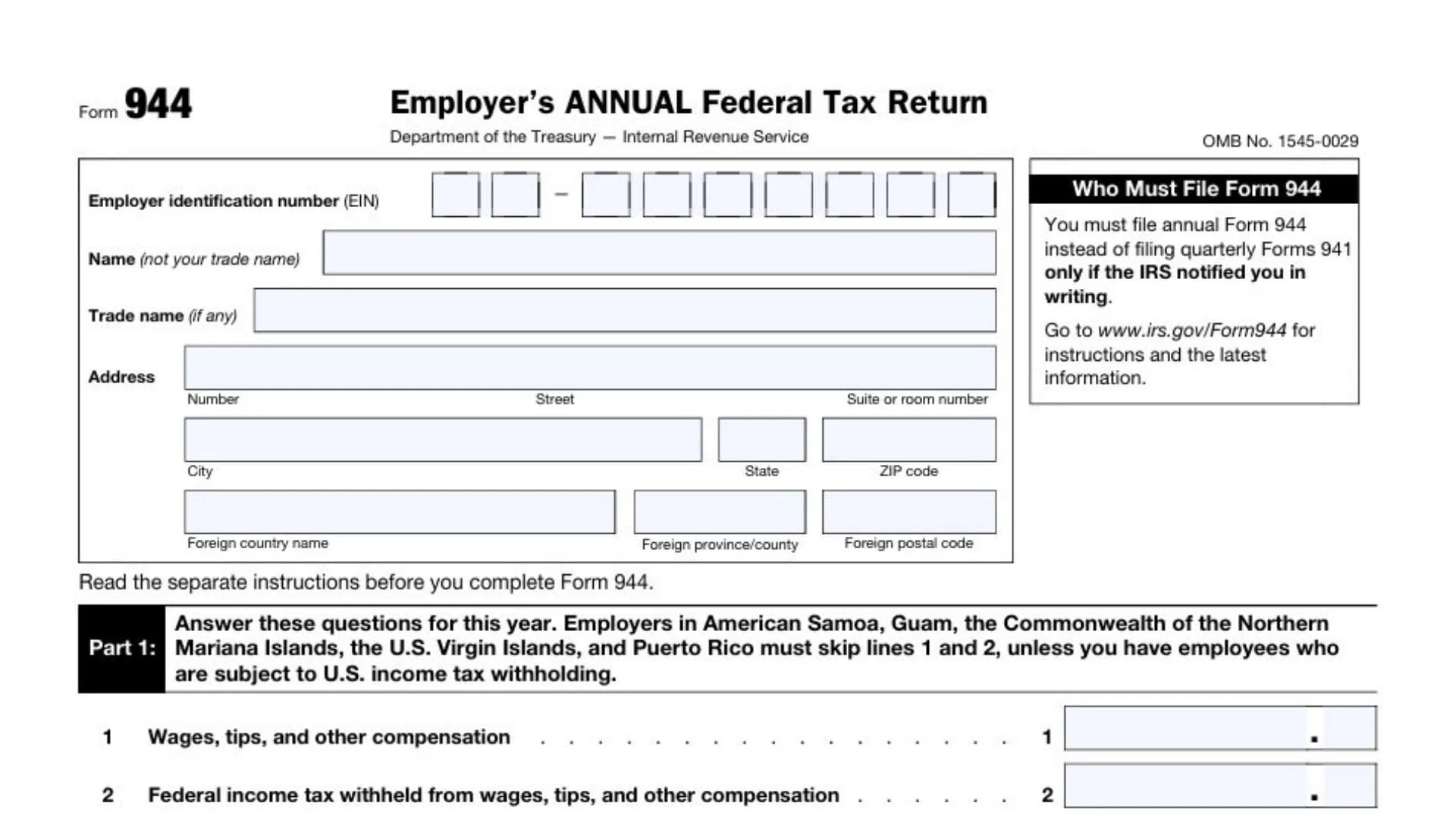

Form 944, Employer’s Annual Federal Tax Return, is an IRS payroll tax form designed for smaller employers who qualify to file once per year instead of filing Form 941 quarterly. Employers use it to report federal income tax withheld from employees’ wages and both the employer and employee shares of Social Security and Medicare taxes (plus any adjustments that apply). Because Form 944 is a payroll tax return (not an income tax return), it follows IRS processing workflows that often separate mail based on payment included and geographic location—which is why the “right” mailing address changes depending on your situation.

Why The Form 944 Mailing Address Matters

Mailing to the wrong IRS address can cause:

- Processing delays (your return lands in a different intake pipeline).

- Late notices if the IRS doesn’t treat it as timely received.

- Payment misapplication if your check and voucher don’t match the pipeline it entered.

- Extra administrative cleanup if you need to prove you mailed it on time.

In short: the correct address is not a technicality—it’s part of filing correctly.

How To Find The Correct Form 944 Mailing Address (Fast And Reliably)

Use this simple decision process:

- Confirm You’re Filing Form 944 (Not 941).

If the IRS told you to file 944, you generally must file 944 for that year—don’t assume. - Determine Whether You’re Mailing A Payment.

IRS mailing addresses are commonly split into:- “Without a payment” (return only)

- “With a payment” (return plus check/money order and the payment voucher, if applicable)

- Identify Your Business Location (State).

The IRS “Where To File” table lists addresses by the state where your principal business is located. - Use The “Where To File” Section For The Same Tax Year You’re Filing.

IRS mailing addresses can change. Always use the instructions for the exact filing year you’re sending. - If You’re Using FedEx/UPS/DHL, Check The Private Delivery Service Address.

The IRS often requires a different street address for private carriers than for USPS.

Best practice: treat the IRS instructions’ “Where To File” table as the single source of truth for addresses for that filing year.

Form 944 Mailing Address Rules By Scenario

Mailing Form 944 Without A Payment

Use the “without a payment” address listed for your state. This route is meant for returns only. If you put a check in an envelope going to a “no payment” address, your payment may not post as smoothly as you expect.

Pro Tip: If you already paid electronically (EFTPS), you typically still mail the return to the “without a payment” address because no physical payment is included.

Mailing Form 944 With A Payment

Use the “with a payment” address listed for your state. This route is designed to handle paper checks and apply them properly.

Payment Handling Tips:

- Make the check or money order payable to “United States Treasury.”

- Put your EIN, tax period, and “Form 944” on the payment memo line.

- Include the IRS payment voucher if your filing packet includes one and your instructions tell you to use it.

If You Are Using A Private Delivery Service (FedEx/UPS/DHL)

Private carriers generally cannot deliver to a standard IRS P.O. Box the same way USPS does. The IRS typically lists an alternate street address for private delivery services. If you want guaranteed tracking and delivery confirmation through a carrier, use the address specifically designated for private delivery.

Important: Using a private carrier does not automatically make your mailing “on time.” The IRS has specific “timely mailing treated as timely filing” rules—so keep shipping receipts and delivery confirmations.

What To Include In The Envelope (A Clean Mailing Checklist)

Before you seal the envelope, confirm:

- The return is signed and dated by an authorized person.

- You included any required schedules/attachments (if applicable).

- Your EIN and business name match IRS records.

- If paying by check:

- Check is filled out correctly

- Memo includes EIN and Form 944

- You included any required voucher

Also: keep a complete copy (PDF scan or photocopy) of everything you send.

Common Form 944 Mailing Mistakes (And How To Avoid Them)

Mixing Up Form 944 And Form 941

Employers sometimes file 941 by habit. If you were assigned to file 944, file 944 unless the IRS changes your filing requirement.

Mailing To Last Year’s Address

Addresses can change. Always verify the correct “Where To File” address for the filing year.

Sending A Payment To A “No Payment” Address

This can delay posting and create mismatched notices. If you’re paying electronically, don’t include a paper check.

Forgetting The Signature

An unsigned payroll return can trigger processing issues and correspondence.

Using The Wrong Delivery Method

If you use a private carrier, use the private delivery address—not the USPS P.O. Box.

E-Filing Versus Mailing Form 944

If you want the fewest headaches:

- E-filing is usually faster, reduces address errors, and provides immediate confirmation.

- Mailing is still allowed, but it requires careful address selection, proof of mailing, and extra lead time.

If you’re close to the deadline, e-filing can reduce the risk of mail delays.

Proof Of Mailing: How To Protect Yourself

If you mail Form 944, use at least one of these:

- Certified Mail (USPS) with a receipt

- Return Receipt if you want the signed delivery card

- Private carrier tracking (FedEx/UPS/DHL) with delivery confirmation

Keep your receipt with your payroll tax records.

What If You Already Mailed Form 944 To The Wrong Address?

Don’t panic—but don’t ignore it either.

- Track Delivery (if you have tracking).

- Wait A Reasonable Processing Window before sending duplicates.

- If a payment was included and you’re worried it won’t post correctly, consider contacting the IRS or monitoring your account/payment history (or your EFTPS records if you paid electronically).

- If you later get a notice, respond with your proof of mailing and a copy of what you sent.

Frequently Asked Questions

Do I Mail Form 944 To The Same Address If I Include A Check?

No. The IRS commonly lists different addresses for “with payment” versus “without payment,” so choose the correct one for your situation.

Can I Use FedEx Or UPS To Mail Form 944?

Yes, but you typically must use the IRS private delivery service street address (not the USPS P.O. Box).

What’s The Safest Way To Prove I Filed Form 944 On Time?

Use certified mail or a private carrier with tracking, and keep the receipt with your tax records.