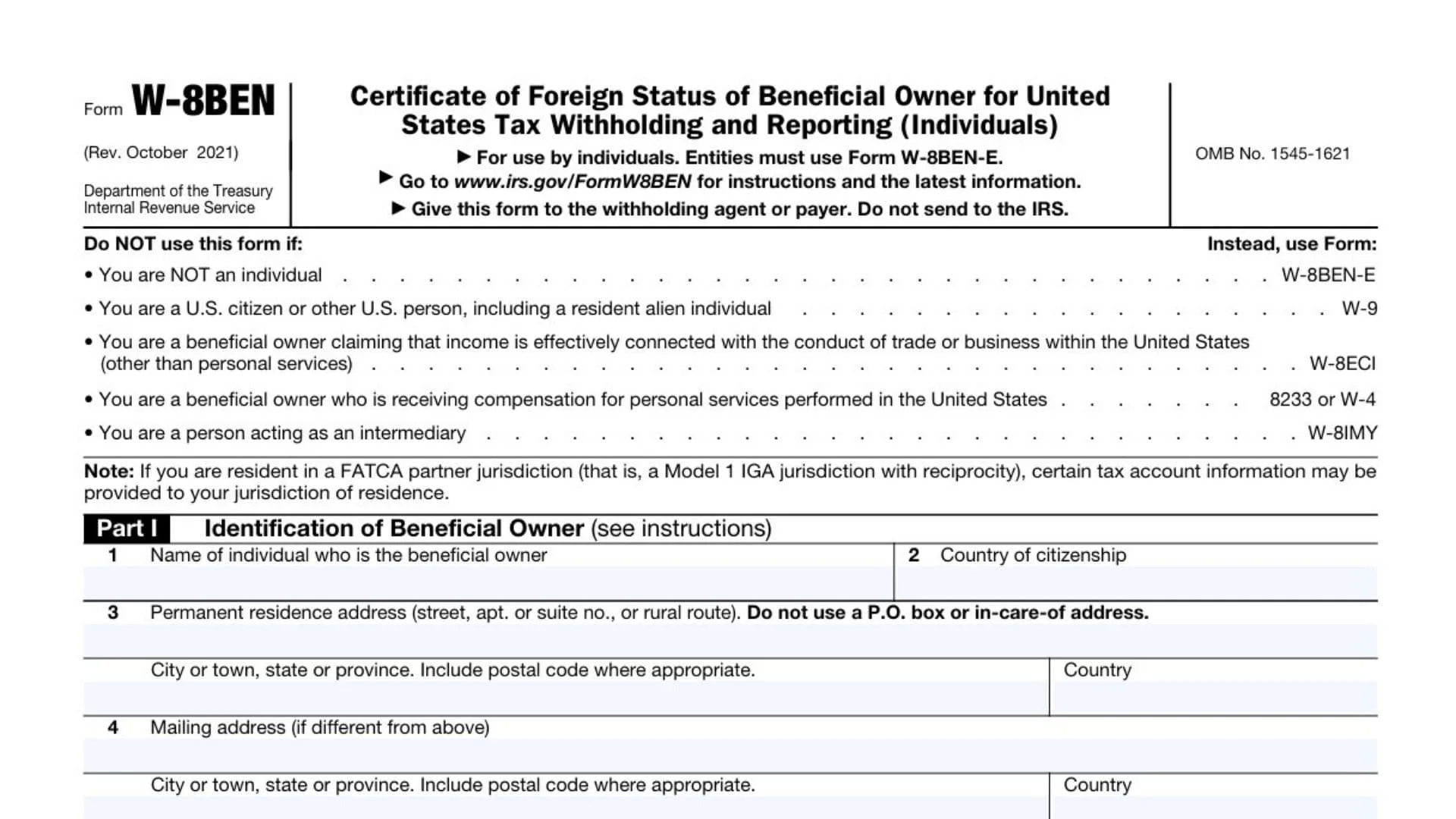

The Form W-8BEN, officially titled the “Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting,” is a critical tax document used by foreign individuals to verify their non-U.S. status. Its primary purpose is to establish that the individual is not a U.S. citizen or resident alien, which allows them to claim a reduced rate of, or exemption from, U.S. tax withholding on income earned from U.S. sources. This form is specifically for individuals; entities must use a different version known as Form W-8BEN-E. You should not use this form if you are a U.S. citizen, a resident alien, or if the income involved is effectively connected with a U.S. trade or business (which requires Form W-8ECI). Additionally, individuals receiving compensation for personal services performed within the United States or acting as intermediaries should use other specific forms like Form 8233, W-4, or W-8IMY. The form essentially serves as proof to withholding agents that you are the beneficial owner of the income and are subject to tax regulations of a foreign jurisdiction, potentially including those under a FATCA partner agreement.

How To File Form W-8BEN

Once you have completed and signed the document, you must provide it directly to the withholding agent or the payer who requested it. Do not send this form to the Internal Revenue Service (IRS). The agent or payer will keep it on file to justify the tax withholding rate applied to your income.

How to Complete Form W-8BEN

Part I: Identification Of Beneficial Owner

Line 1: Name Of Beneficial Owner

Enter the full legal name of the individual who is the beneficial owner of the income. This must be a person, not a business or entity.

Line 2: Country Of Citizenship

Indicate the country where you currently hold citizenship. If you are a citizen of multiple countries, enter the one where you are claiming tax residency.

Line 3: Permanent Residence Address

Provide your permanent address in the country where you claim to be a resident for tax purposes. You must include the street, apartment or suite number, or rural route. It is important to include the city or town, state or province, and the appropriate postal code along with the country. Do not use a P.O. box or an “in-care-of” address for this line.

Line 4: Mailing Address

If you receive mail at a location different from your permanent residence listed in Line 3, enter that address here. Include the street, city, state or province, postal code, and country.

Line 5: U.S. Taxpayer Identification Number

If you have a Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN), enter it in this space. This is often required if you are claiming treaty benefits.

Line 6a: Foreign Tax Identifying Number

Enter the tax identification number (TIN) issued to you by your country of residence.

Line 6b: Check If FTIN Not Legally Required

If your country of residence does not issue tax identification numbers to its residents, you must check this box to explain why Line 6a is blank.

Line 7: Reference Number(s)

This line allows you to enter any reference numbers that might be useful for the withholding agent, such as an account number related to the income.

Line 8: Date Of Birth

Provide your date of birth using the format MM-DD-YYYY (Month-Day-Year).

Part II: Claim Of Tax Treaty Benefits

Line 9: Treaty Residence Certification

If you are claiming a reduced rate of withholding under a tax treaty, you must certify your residency. Enter the name of the country where you are a resident for income tax purposes and which has a tax treaty with the United States.

Line 10: Special Rates And Conditions

Complete this line only if you require specific treaty benefits that are not covered by the general residency claim in Line 9. You must specify the Article and paragraph of the tax treaty you are relying on, the percentage rate of withholding you are claiming, and the type of income involved. There is also a space to explain any additional conditions you meet to qualify for these specific treaty terms.

Part III: Certification

By signing the form, you are certifying under penalty of perjury that the information provided is accurate. This section requires you to confirm several key legal statements:

- You are the beneficial owner (or authorized to sign for them) of the income associated with the form.

- The person named in Line 1 is not a U.S. person.

- The income is not effectively connected with a U.S. trade or business, or if it is, it is exempt under a treaty.

- For partner transactions, the income is effectively connected taxable income or related to a transfer of partnership interest.

- You are a resident of the treaty country listed in Line 9 if you made a claim in Part II.

- For broker or barter transactions, you are an exempt foreign person.

You also authorize the form to be shared with withholding agents and agree to submit a new form within 30 days if any information on the current form becomes incorrect.

Sign Here

Signature

The beneficial owner, or an individual authorized to sign on their behalf, must sign the form in the designated space. You must check the box certifying that you have the capacity to sign for the person identified in Line 1.

Date

Enter the date of signature in the MM-DD-YYYY format.

Print Name

Clearly print the name of the person who signed the form.