Filling out Form W9 is a common task for many freelancers, contractors, and businesses. However, one question that often arises is, “Where do I send my Form W9?” The Form W9 mailing address is essential to know because sending it to the wrong address can lead to delays in processing, and we all know how important timely paperwork is, especially in financial matters. Whether you’re submitting your W9 to a client for tax purposes or providing it for your own record-keeping, understanding where to send it is key. This article will guide you on how to determine the correct mailing address for your Form W9 and make sure everything gets to the right place with ease.

What Is Form W9?

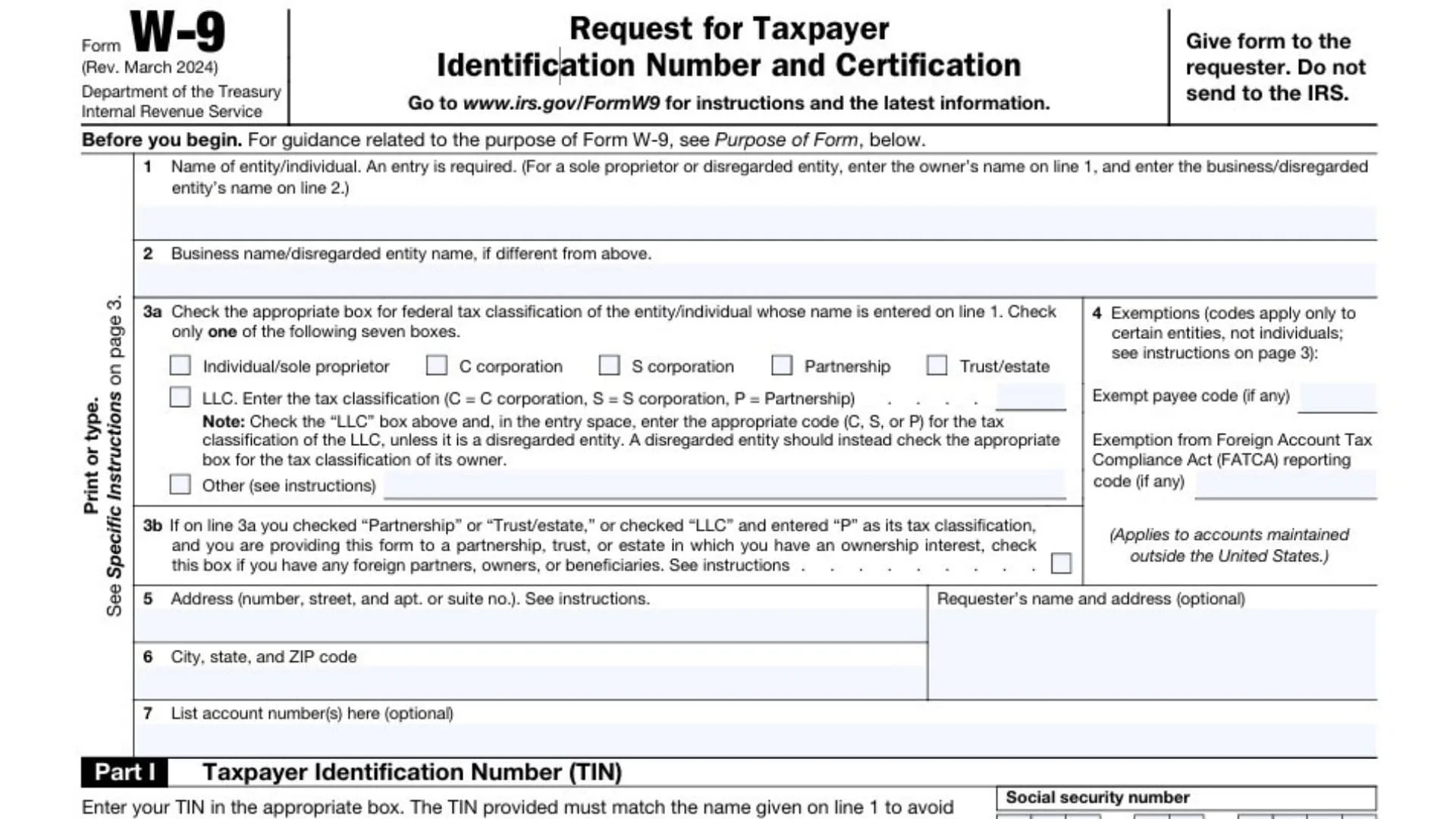

Before diving into the mailing address specifics, let’s first take a quick look at Form W9. This form is typically used in the United States by businesses to collect taxpayer identification information from independent contractors, freelancers, and other non-employee workers. It is primarily used for reporting income paid to contractors or vendors and is submitted to the Internal Revenue Service (IRS) to ensure proper tax reporting.

The Form W9 includes sections to fill out your name, business name (if applicable), address, and Taxpayer Identification Number (TIN), which could be your Social Security Number (SSN) or Employer Identification Number (EIN), depending on your situation. Once you’ve filled out the form, it needs to be sent to the requesting party, typically an employer or client.

Where to Send Form W9?

Knowing the correct Form W9 mailing address is crucial. While the IRS does not require a specific address for individuals to send Form W9 directly to them, it’s important to send it to the right party, such as your client, employer, or financial institution. Typically, the entity requesting your Form W9 will provide a specific mailing address for you to send it.

In cases where you’re submitting the form for vendor setup or tax reporting purposes, your client may ask for a hard copy of the completed W9 form. This mailing address could be a physical address or a designated business office. Sometimes, clients may also request that you submit the W9 electronically, which avoids the need for any physical mailing altogether.

Steps to Ensure Proper Mailing of Form W9

To ensure your Form W9 gets to the right place, follow these easy steps:

- Check for the Correct Address: When filling out the form, ensure you have the correct mailing address. Your client or employer should provide this information, and if you don’t have it, don’t hesitate to ask.

- Use the Right Envelope: Make sure the envelope you use is large enough to accommodate your W9 form without folding it. This is to ensure the form stays in pristine condition and doesn’t get lost or damaged in transit.

- Include a Cover Letter: It’s always a good idea to include a short cover letter along with your W9 that explains what you’re submitting and why. This adds a personal touch and can prevent any confusion from the recipient.

- Send It via Secure Methods: To ensure your W9 reaches its destination safely, consider using secure mail services or certified mail with tracking. This ensures that you have proof that the document was received.

- Consider Electronic Submission: If your client or employer allows electronic submissions, take advantage of this option. It can save time and eliminate the risk of postal delays.

What Happens After You Mail Your Form W9?

Once your Form W9 is received, the party who requested it will use the information you provided to report any payments they made to you on Form 1099 at the end of the tax year. Your information on the W9 form helps them ensure that you’re properly included in their tax reporting and that you receive any necessary forms for filing your tax returns.

It’s important to remember that Form W9 is not submitted to the IRS directly. Instead, it’s used for documentation purposes by the requesting party. That means the Form W9 mailing address you’re looking for is usually not an IRS address but one designated by your employer or client.

Common Mistakes to Avoid When Mailing Form W9

Even though mailing Form W9 is a straightforward process, there are a few common mistakes you should avoid:

- Sending it to the wrong address: As we’ve mentioned earlier, sending your W9 form to the wrong place can cause unnecessary delays. Always double-check the recipient’s address.

- Incomplete forms: Be sure your W9 is filled out completely. Missing details like your TIN or incorrect information can cause the form to be rejected.

- Not keeping a copy: Always keep a copy of your completed Form W9 for your own records. It can be helpful for future reference, especially if any issues arise later.

When Should You Update Your W9?

It’s important to keep your W9 form up to date. You should update your W9 if there are any significant changes to your information, such as:

- A change in your name, business name, or address.

- A change in your tax status or identification number (e.g., switching from an SSN to an EIN).

Your clients or employers may request a new W9 whenever they need to update their records. Keeping it current will ensure that your tax information is accurate and that there are no issues when it comes time for tax reporting.

FAQs

Q: Can I submit Form W9 electronically instead of mailing it?

A: Yes, many businesses now allow electronic submissions of Form W9, which is faster and more secure than mailing a paper copy.

Q: Do I need to send Form W9 directly to the IRS?

A: No, Form W9 is typically submitted to the party who requests it, such as an employer or client, not the IRS.

Q: What should I do if I make a mistake on my Form W9?

A: If you make a mistake on your Form W9, you can correct it by submitting an updated version to the requesting party.