Form 1040-ES, “Estimated Tax for Individuals,” is the tax package used to calculate and pay taxes on income that is not subject to automatic withholding. The United States operates on a “pay-as-you-go” tax system, meaning you are required to pay taxes on your income as you earn or receive it throughout the year, rather than waiting until the end of the year to pay it all at once. This form is essential for individuals who receive income such as earnings from self-employment, gig economy work, interest, dividends, rents, alimony, unemployment compensation, and the taxable portion of social security benefits. Generally, you must file this form and make payments if you expect to owe at least $1,000 in tax for 2026 after subtracting your withholding and refundable credits, and if you expect your withholding to be less than the smaller of 90% of your 2026 tax liability or 100% of your 2025 tax liability (110% for higher-income taxpayers). Failing to make these quarterly payments can result in an underpayment penalty.

How To File IRS Form 1040-ES

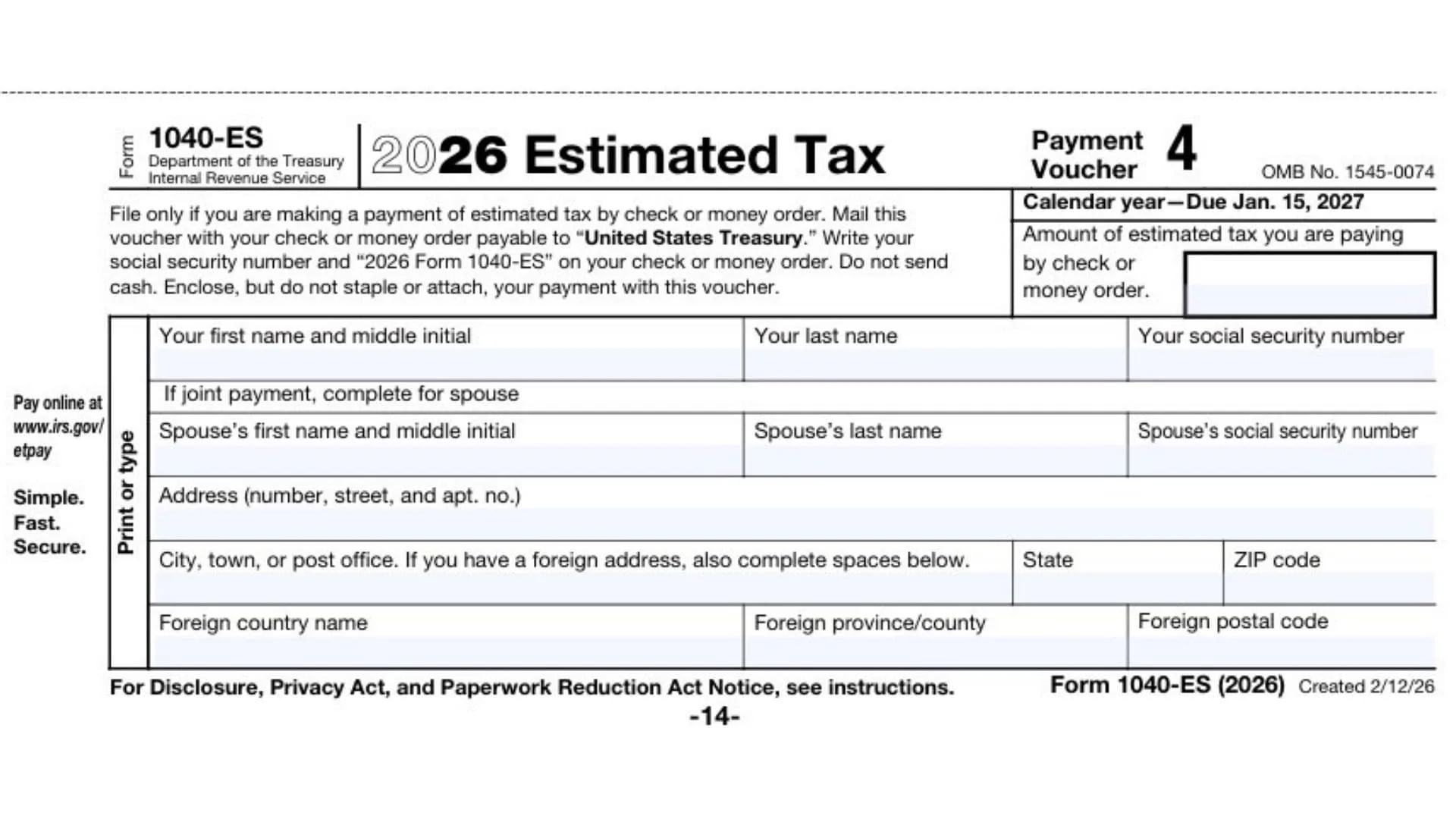

You have several convenient options for filing and paying your estimated tax. The IRS strongly encourages electronic payments, which are secure and provide immediate confirmation. You can pay online using your Online Account or IRS Direct Pay to transfer funds directly from your checking or savings account for free. Alternatively, you can use the Electronic Federal Tax Payment System (EFTPS) or pay by debit or credit card through an approved processor (which may charge a fee). If you choose to mail your payment, you must use the Payment Voucher included in the form package. Mail the voucher along with your check or money order made payable to “United States Treasury” to the address listed in the instructions for your region. Do not send cash.

How To Complete The 2026 Estimated Tax Worksheet

This worksheet is for your records to help you calculate the correct amount to pay. Do not mail this worksheet to the IRS.

Line 1: Adjusted Gross Income

Enter the total adjusted gross income (AGI) you expect to earn in 2026. This includes all wages, salary, self-employment earnings, and other income sources.

Line 2a: Deductions

Enter your expected deduction amount. If you plan to itemize, estimate your total itemized deductions. If you take the standard deduction, enter the standard deduction amount for your filing status plus any allowable charitable contributions if applicable.

Line 2b: Qualified Business Income Deduction

If you are eligible, enter the estimated amount of your qualified business income deduction.

Line 2c: Additional Deductions

Enter any estimated additional deductions you expect to claim on Schedule 1-A (Form 1040), such as specific adjustments to income.

Line 2d: Total Deductions

Add lines 2a, 2b, and 2c to get your total expected deductions.

Line 3: Taxable Income

Subtract your total deductions (Line 2d) from your adjusted gross income (Line 1). This is your estimated taxable income.

Line 4: Tax Calculation

Calculate the tax on the amount from Line 3 using the 2026 Tax Rate Schedules provided in the form package. Be careful to use the schedule that matches your filing status.

Line 5: Alternative Minimum Tax

Enter any expected Alternative Minimum Tax (AMT) calculated using Form 6251.

Line 6: Total Tax Before Credits

Add your calculated tax from Line 4 and any AMT from Line 5. Also, add any other specific taxes you expect to include on your final return.

Line 7: Credits

Enter the total of your expected non-refundable tax credits. Do not include any income tax withholding here.

Line 8: Tax After Credits

Subtract Line 7 from Line 6. If the result is zero or less, enter zero.

Line 9: Self-Employment Tax

If you have self-employment income, calculate your self-employment tax and enter it here. You can use the separate Self-Employment Tax and Deduction Worksheet in the package to figure this amount.

Line 10: Other Taxes

Enter any other taxes you expect to owe, such as additional taxes on retirement plans or investment income.

Line 11a: Total Estimated Tax

Add Lines 8 through 10 to get your total expected tax liability.

Line 11b: Refundable Credits

Enter your expected refundable credits, such as the Earned Income Credit or Additional Child Tax Credit.

Line 11c: Net Estimated Tax

Subtract Line 11b from Line 11a. This is the total estimated tax you owe for 2026.

Line 12a: Percentage Of Current Year Tax

Multiply the amount on Line 11c by 90% (or 66 2/3% if you are a farmer or fisherman).

Line 12b: Prior Year Tax

Enter 100% of the tax shown on your 2025 tax return (or 110% if your income exceeds the high-income threshold).

Line 12c: Required Annual Payment

Enter the smaller of Line 12a or Line 12b. This is the minimum amount you must pay to avoid a penalty.

Line 13: Withholding

Enter the total amount of income tax you expect to be withheld from your paychecks, pensions, or other payments during 2026.

Line 14a: Payment Balance

Subtract your expected withholding (Line 13) from your required annual payment (Line 12c). If the result is zero or less, you do not need to make payments.

Line 15: First Installment

If your first payment is due by April 15, 2026, enter one-quarter of the amount from Line 14a. This is the amount you should pay for the first quarter.

How To Complete The 2026 Estimated Tax Payment Voucher

If you pay by check or money order, you must complete and mail this voucher.

Personal Information

Print or type your first name, middle initial, and last name. If filing jointly, include your spouse’s name. Enter your social security number (and your spouse’s if applicable) in the designated boxes.

Address

Enter your street address, apartment number, city, state, and ZIP code. If you have a foreign address, complete the foreign country and province fields.

Payment Amount

In the box labeled “Amount of estimated tax you are paying by check or money order,” write the specific dollar amount you are paying for this quarter (calculated from Line 15 of the worksheet).

Check Or Money Order Details

Make your check payable to “United States Treasury.” Do not staple your check to the voucher. On the check, write your social security number and “2026 Form 1040-ES” to ensure it is credited to the correct account.