How many allowances can a single person with one job claim? This question often pops up during tax season, especially when completing tax forms like the W-4, which impacts how much federal income tax gets withheld from your paycheck. Understanding the right number of allowances to claim is crucial for single workers who want to balance their tax withholdings without facing a huge bill or forfeiting a refund. Allowances were once used to reduce tax withholding based on personal and dependent credits, but the IRS updated the W-4 form in recent years, changing how withholding is calculated. Nevertheless, knowing the basics about allowances, how they used to work, and how to manage your withholding as a single employee with only one job remains important for keeping your finances on track.

What Are Tax Allowances?

Tax allowances used to be a system to help taxpayers adjust how much tax their employer withheld from paychecks. The more allowances claimed, the less tax withheld, which means more cash in your pocket each pay period but possibly less refund in the end. A single person with one job typically claimed fewer allowances compared to someone with dependents or multiple jobs. However, since 2020, the IRS redesigned the W-4 form, eliminating allowances and moving toward a more straightforward withholding calculation based on income, filing status, dependents, and other income or deductions. Still, the concept of allowances is helpful to understand when reviewing your pay stubs or adjusting withholding.

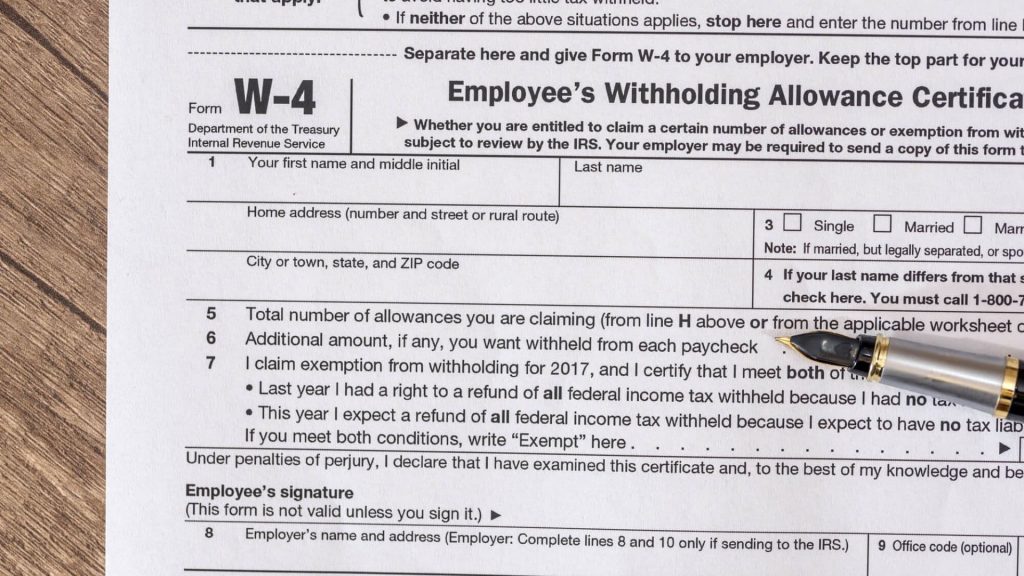

How Does This Affect a Single Person With One Job?

If you are single and have only one job, your withholding will usually be based on the “single” filing status. You no longer need to count allowances as in the past, but rather follow the W-4 form’s steps to provide information about your income and potential deductions. If you want to have more accurate withholding, you can adjust extra amounts withheld or account for deductible expenses on the form. For many single workers, not claiming any extra deductions on the W-4 results in the standard amount of tax being withheld, which usually works out well with the standard deduction taken at tax filing.

How To Adjust Your Withholding

Though allowances are no longer used, you should be aware of the new steps:

- Step 1: Enter your personal information including your single filing status.

- Step 2: If you only have one job, you generally skip the multiple-job adjustment.

- Step 3: Claim dependents if applicable (for single without children, this may be zero).

- Step 4: Use this step to account for other income, deductions beyond the standard deduction, or extra withholding amounts.

If your goal is to avoid owing taxes at the end of the year or to maximize take-home pay, the IRS offers a Tax Withholding Estimator online to help calibrate these inputs.

Why Claiming “Zero” Can Sometimes Be Helpful

Claiming zero allowances (or equivalent on the current W-4 form) means the highest amount of tax is withheld from each paycheck, which may result in a larger refund or less tax owed. Some single workers prefer this conservative approach to avoid surprises at tax time, but it reduces take-home pay.

What If You Want More In Your Paycheck?

If you prefer having more money with each paycheck and are comfortable with possibly owing a small amount of tax at the end of the year, you can adjust your W-4 accordingly by not requesting additional withholding. Just be careful not to under-withhold too much, which can trigger penalties.

Summary

While “allowances” in the traditional sense are no longer part of the official IRS W-4 form, understanding how they worked helps single employees with one job better manage their tax withholding. Using the updated W-4, a single person typically claims no dependents, uses the “single” filing status, and may adjust withholding amounts via the form’s steps. For those who want to be exact, the IRS’s withholding estimator is the best tool to ensure you neither owe a large amount nor lose valuable income through over-withholding.

FAQs

Q1: Can a single person with one job claim multiple allowances?

A: The IRS no longer uses allowances on the W-4 form, but adjustments can be made through the new form steps.

Q2: What happens if I claim zero on my W-4 as a single filer?

A: More tax will be withheld from your paycheck, potentially leading to a larger refund but less take-home pay.

Q3: Does my filing status affect how much tax is withheld?

A: Yes, your filing status (single, married, head of household) affects withholding calculations.

Q4: Where can I check if my withholding is correct?

A: Use the IRS Tax Withholding Estimator online for a personalized calculation.