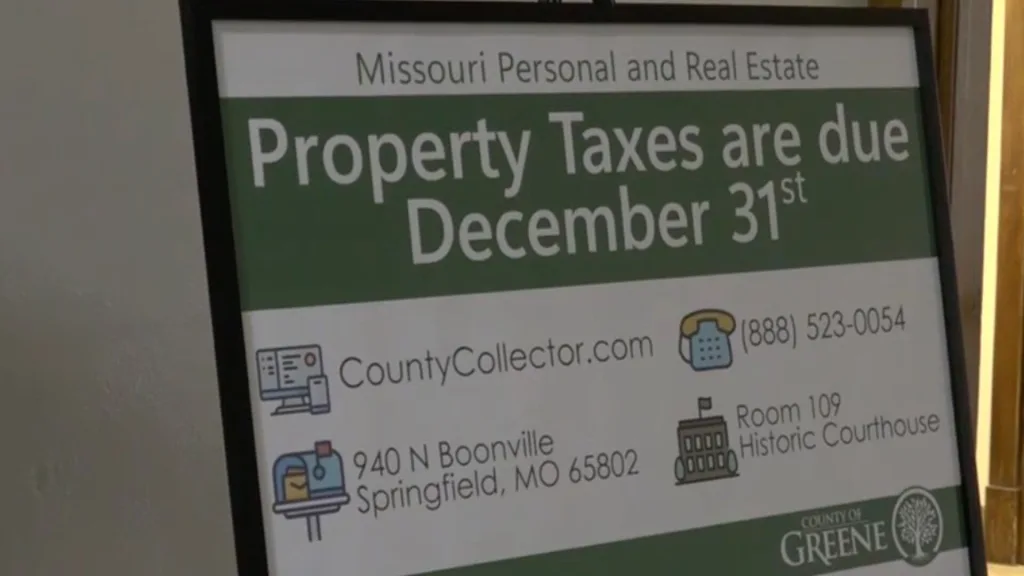

Navigating the intricacies of state tax obligations can often feel overwhelming, but learning How to Pay Missouri Personal Property Tax Online? is the ultimate way to simplify your financial responsibilities and avoid the frantic year-end rush at the county courthouse. As a resident of the Show-Me State, managing your MO personal property tax payment digitally not only saves valuable time but also provides an immediate digital receipt for your records, which is crucial when you need to renew your vehicle registration tags at the Department of Revenue. Whether you live in St. Louis County, Jackson County, Greene County, or anywhere in between, most local jurisdictions have modernized their systems to accept online tax payments Missouri residents can access 24/7. By utilizing the Missouri county collector website specific to your region, you can view your tax assessment, verify the amount owed on your cars, boats, or trailers, and process transactions securely using a credit card or e-check. Understanding the Missouri property tax deadline, which generally falls on December 31st, is vital to avoiding late fees and penalties, and the convenience of an online tax portal ensures you can meet this date even if you remember at the last minute. This guide will serve as your comprehensive resource for navigating the Missouri tax payment procedures, finding your specific county’s payment gateway, and ensuring your personal property tax receipt is generated instantly for your vehicle licensing needs.

Identify Your County Collector

The State of Missouri does not have a single, centralized website for collecting personal property taxes for every resident. Instead, taxes are collected at the county level. Therefore, the first step is to identify the specific county where your property is assessed.

Most residents already know their county, but if you have moved recently, you must pay taxes in the county where you resided on January 1st of the tax year. You will need to visit the official website of your County Collector or Department of Revenue. For example, if you live in St. Louis, you will visit the St. Louis County Collector of Revenue site; if you are in Kansas City, you will likely need the Jackson County or Clay County portals. A quick search for “[Your County Name] Missouri Collector of Revenue” will direct you to the right place.

Retrieve Your Tax Account

Once you are on the correct county website, you will need to locate your tax bill. Most portals allow you to search for your account without needing a login and password. You can typically search using one of the following methods:

- Account Number: Found on your paper tax bill.

- Name: Search by the owner’s last name and first name.

- Address: Search by the physical address of the residence.

After entering your information, the system should display your current tax statement. Ensure that the personal property listed (vehicles, boats, trailers, livestock) is accurate. If there are discrepancies, you may need to contact the assessor’s office before proceeding with payment.

Select Your Payment Method

After verifying your bill amount, you can proceed to the checkout phase. Missouri counties generally offer a few different payment options for online transactions. It is important to note that most third-party payment processors charge a convenience fee for online services.

- E-Check / ACH: This method pulls funds directly from your checking account. It usually carries the lowest fee (often a flat rate around $1.00 to $2.00) or is sometimes free, depending on the county.

- Credit or Debit Card: You can use Visa, MasterCard, Discover, or American Express. This method typically incurs a percentage-based fee (often around 2.3% to 2.5% of the total tax bill).

Confirm Payment and Save Your Receipt

Once you submit your payment, do not close the browser window immediately. Wait for the confirmation screen. The most critical part of this process is obtaining your paid tax receipt.

In Missouri, you cannot register your vehicle or renew your license plates without proof that you have paid your personal property taxes. When you pay online, most counties allow you to print an official receipt immediately or will email you a PDF copy. Save this digital file. If you pay very close to the end of the month, verify with your county if there is a delay between online payment and when the system updates for the DMV/license office.

Troubleshooting Common Issues

Sometimes the online system may not recognize your information. This frequently happens if your name is misspelled in the system or if you are a new resident who hasn’t declared property yet.

If you cannot find your account online, you must call your County Collector’s office directly. Do not assume that because you can’t find the bill, you don’t owe taxes. Failure to receive a bill does not relieve you of the obligation to pay, and interest will accrue starting January 1st if the payment is missed.

Understanding Deadlines and Penalties

Missouri personal property taxes are due by December 31st of each year. Online payments are generally considered timely if they are completed before midnight on that date. However, technical glitches can happen, so it is highly advisable not to wait until 11:55 PM on New Year’s Eve.

If you miss the deadline, the online system will automatically update the amount owed to include interest and penalties. You will not be able to pay the original amount; you must pay the total with the accrued late fees to clear the account.

Follow-Up Question

Would you like the FAQs to include information about what to do if the user didn’t receive a paper bill, or should we focus strictly on payment methods?

Related Keywords

- Missouri personal property tax lookup

- Jackson County MO tax payment

- St. Louis County real estate tax search

- MO vehicle registration tax receipt

- Pay taxes online Missouri

- Missouri Department of Revenue property tax

- Clay County MO collector

- Greene County personal property tax

Frequently Asked Questions

Q: Can I pay my Missouri personal property tax with a credit card?

A: Yes, most counties accept major credit cards, though a convenience fee (usually a percentage of the total) applies.

Q: When is the deadline for paying Missouri personal property taxes online?

A: Payments must be completed by December 31st to avoid interest and late penalties.

Q: How do I get a receipt for license plate renewal after paying online?

A: Most portals provide an instant printable receipt or email a PDF confirmation that is accepted by the license office.

Q: What if I don’t see my tax bill online?

A: If your bill is missing, contact your specific County Collector’s office immediately to update your account and avoid late fees.