No one loves a tax bill—but if you owe Illinois state taxes you can’t pay in full, a payment plan with the Illinois Department of Revenue (IDOR) is your ticket back to financial peace of mind. In this long-form guide, we break down the step-by-step process for setting up an Illinois payment plan—digging into keywords like Illinois Department of Revenue payment plan, installment agreement, MyTax Illinois, Form CPP-1, tax debt relief, and financial hardship plan. You’ll learn eligibility requirements, how to apply, which forms to use, and what happens after you set up your plan—so you can handle your tax debt with less worry, fewer penalties, and a friendly dose of help for your wallet.

What is an Illinois Department of Revenue Payment Plan?

A payment plan (also called an installment agreement) is an arrangement between you and IDOR that lets you pay what you owe in smaller, regular payments instead of one lump sum. It’s ideal if you’re facing unexpected tax debt and need a practical way to settle your balance without draining your bank account.

Payment plans are based on your financial situation, and your monthly payment amount and length are tailored to what you can reasonably afford. As long as you keep up with agreed payments and have filed all required returns, you’ll be protected from more serious collection actions such as bank levies or wage garnishments.

Who Can Set Up a Payment Plan?

You may qualify if you:

- Have tax delinquencies you cannot pay in full due to hardship.

- Have filed all required Illinois tax returns up to date—the state won’t set up a plan if you haven’t filed.

- Owe individual, business, or other state taxes to Illinois.

If your total balance (including penalties and interest) is above $10,000, you’ll need to provide extra financial details with your application.

How to Apply: Step-by-Step

You have two basic ways to set up a payment plan:

1. Apply Online via MyTax Illinois (Recommended for Speed & Simplicity)

- Go to the MyTax Illinois website and either log in or use the pre-approved payment plan link for quick setup.

- Select “Set up a Payment Installment Plan with IDOR”.

- Enter your details, including the amount you can pay each month, and any financial information required.

- If you agree to standard terms, you may get automatic approval right away.

- If you propose custom terms, IDOR staff will review your info and contact you with approval, changes, or requests for more details.

- Receive your plan confirmation and follow payment instructions.

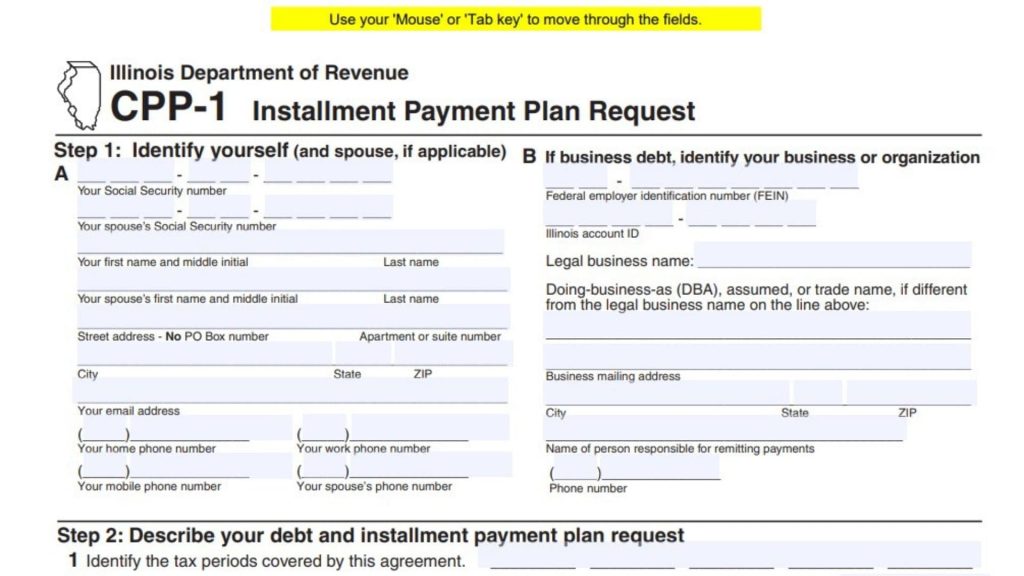

2. Apply by Mail Using Form CPP-1

- Download Form CPP-1 (Installment Payment Plan Request) from the IDOR website.

- Fill in your personal (or business) info, tax periods, total debt, and proposed payment schedule.

- Include a “good faith” down payment if possible—larger up-front payments show commitment and can reduce future interest.

- If you owe more than $10,000, also complete and attach Form EG-13-I (individual) or EG-13-B (business) financial statement.

- Mail or fax completed forms and attachments to:

- text

Installment Contract Unit Illinois Department of Revenue PO Box 19035 Springfield, IL 62794-9035 Fax: 217-785-2635

- text

- Wait for IDOR’s response (approval or additional info request).

What Happens Next?

- Approval: If approved, you’ll receive a confirmation with the amounts, payment dates, and instructions for making payments (ACH debit, online, phone, or mail).

- Payments: Follow your schedule, pay at least the minimum due, and keep your account in good standing to avoid default or new penalties.

- Interest/penalties: These continue to accrue until your full debt is paid, so pay off your plan as soon as you’re able.

Pro Tips for a Smoother Illinois Payment Plan

- File all returns first! Unfiled returns may cause delays.

- Offer the largest good faith/down payment you can to show commitment and cut back future interest.

- Set up automatic debit payments (ACH) for on-time ease—use Form CPP-1-A for this.

- Check your plan status and messages via your MyTax Illinois account.

- Notify IDOR right away if your financial situation changes.

Frequently Asked Questions (FAQs)

How long does it take for my Illinois payment plan to be approved?

Most online requests are confirmed immediately if you agree to preset terms; custom requests or paper forms are usually reviewed within several weeks.

Will penalties and interest stop with my payment plan?

No, penalties and interest still accrue until the balance is paid in full—but you’ll avoid more serious enforcement and can pay at a manageable pace.

Do I have to pay by bank draft?

No, but automatic (ACH) payments help you stay on track. Checks, online card payments, and “Pay by Phone” are also available.

What if I miss a payment?

Contact IDOR right away! Missed payments can default your plan and lead to collection action.