If “Illinois estimated tax payment safe harbor” sounds like a mystical tax loophole, rest assured—it’s actually a practical, IRS-inspired rule designed to protect you from estimated tax underpayment penalties! Whether you’re a freelancer, business owner, investor, or anyone with non-wage income, you might be required to make Illinois estimated tax payments if you expect to owe at least $1,000 in state tax this year after all credits and withholding. By following the Illinois “safe harbor” provisions, you’ll know exactly how much to pay and when, so you can avoid those dreaded penalty notices. In this guide, we’ll cover how safe harbor works in Illinois, who needs to worry about it, the payment options and deadlines, and the specifics for both “100% of prior year tax” and the “110% rule” for high-income filers. Plus, get answers to all of your “What if…?” questions, with expert tips for a stress-free tax year.

What Is the Estimated Tax Safe Harbor in Illinois?

The Illinois safe harbor provision gives you a penalty-free zone for your estimated tax payments, so long as you pay enough by the right dates. The state uses thresholds strikingly similar to federal rules:

- 90% of your current year’s total Illinois tax liability (“pay-as-you-go”)

- 100% of your prior year’s Illinois tax liability, if your previous adjusted gross income (AGI) was $150,000 or less ($75,000 if married filing separately)

- 110% of your prior year’s Illinois tax liability if your prior year’s AGI was over $150,000 ($75,000 if MFS)

If you meet one of these, you’ll avoid penalties—even if you end up owing more than you expected on your next return.

Who Needs to Make Estimated Payments?

Illinois requires estimated income tax payments from individuals who expect to owe more than $1,000 after subtracting withholding and state credits. This includes people with:

- Self-employment or freelance income

- Investment earnings (dividends, capital gains)

- Rental property profits

- Side business or gig income

- Other income not subject to Illinois withholding

Corporations must pay if they expect to owe more than $400 in income and replacement tax.

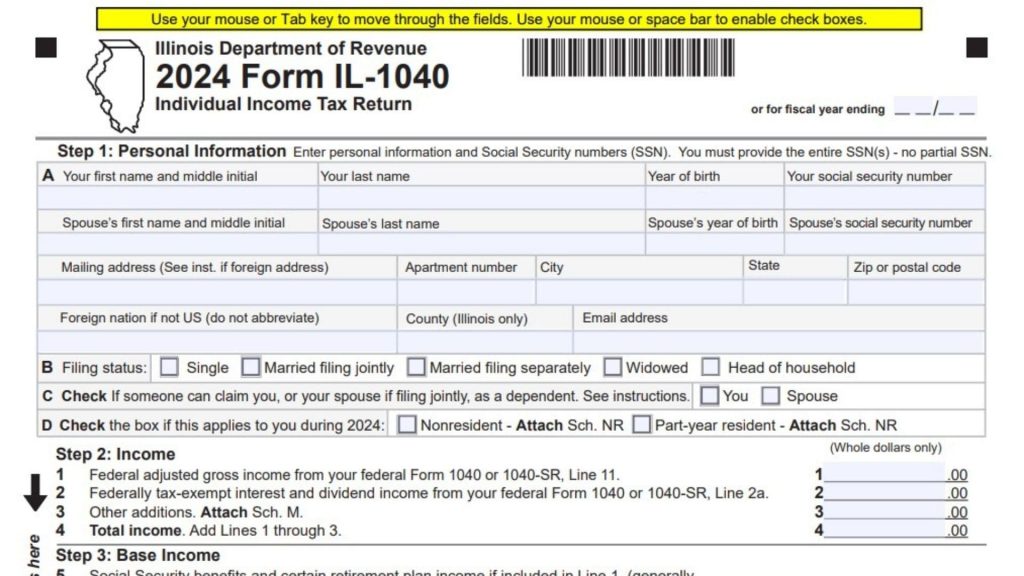

How to Figure Your Payments & Safe Harbor Amount

Here’s how the math breaks down:

- Figure 90% of your expected current-year tax: Multiply your anticipated Illinois net income by the current tax rate (4.95% in 2025), then subtract credits and withholding.

- Check your prior year’s Illinois tax bill: Look at last year’s liability before credits on your IL-1040.

- If your AGI last year was over $150,000, multiply your prior year tax by 110%.

- If not, use 100% of last year’s tax.

Use whichever number (90% of this year or 100/110% of last year) is less for your required “safe harbor”—just make sure you pay that sum via estimates and/or withholding.

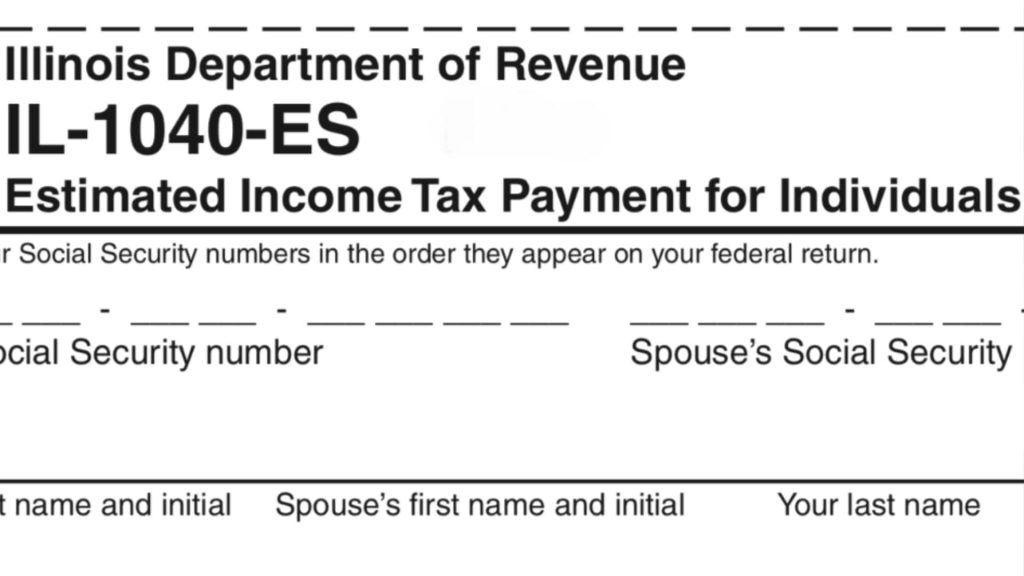

Illinois Estimated Payment Deadlines

Estimated payments are due quarterly:

- April 15

- June 15

- September 15

- January 15 (of the following year)

Pay in four equal installments unless you’re annualizing income (for uneven earnings throughout the year).

Exceptions & Penalty Traps

You don’t have to make estimated payments if:

- You’re 65+ and living in a nursing home

- You qualify as a “farmer” (two-thirds of income from farming)

- You owed less than $1,000 on your prior year’s filing

Failing to pay enough or missing deadlines? You’ll get socked with underpayment penalties, but safe harbor gives you a way out: as long as you pay the safe harbor amount on time, you’re covered—no matter where your final tax bill lands.

Pro Tips for a Smooth Illinois Tax Year

- File early and pay quarterly to avoid surprises

- Track your income and credits throughout the year

- Use IL-1040-ES for worksheets and payment coupons

- High earners: remember the 110% rule!

- If your income spikes midyear, consider “annualizing” to adjust estimates without penalty

Frequently Asked Questions (FAQs)

What is the Illinois safe harbor amount for estimated tax payments?

It’s the lesser of 90% of this year’s total tax or 100% (or 110% if high income) of your previous year’s Illinois tax bill.

Who needs to pay estimated taxes in Illinois?

Anyone who expects to owe more than $1,000 in state tax after withholding and credits, including gig workers, freelancers, and landlords.

Godspeed—here’s to navigating safe harbor and smooth sailing this tax season!