If you’re doing business in Illinois, understanding the Illinois Tax Form RUT-50 is crucial. This form, officially known as the Sales Tax Exemption Certificate, is required for individuals or entities that want to claim sales tax exemptions for certain purchases in the state. The Illinois Tax Form RUT-50 helps businesses reduce their taxable purchases by allowing them to avoid paying sales tax on eligible items. However, completing this form accurately is essential, as errors can delay your exemption or result in penalties. In this article, we’ll walk you through everything you need to know about the RUT-50 form, including how to fill it out, who should file it, and the common mistakes to avoid.

What Is Illinois Tax Form RUT-50?

The Illinois Tax Form RUT-50 is used primarily by individuals or businesses to claim an exemption from paying sales tax on certain purchases made in Illinois. The form is essential for businesses that need to demonstrate to suppliers that they are eligible for sales tax exemptions. This exemption can be related to purchases made for resale or for business use, which are commonly exempt from sales tax in Illinois. If you’re an eligible entity, the RUT-50 form ensures that you’re not overpaying taxes on your purchases.

In simple terms, this form is your ticket to ensuring that your tax obligations are handled correctly and that you aren’t paying more than necessary. If you’re in the business of purchasing products for resale or specific business operations, the Illinois Tax Form RUT-50 should be a part of your routine paperwork. Understanding how to use it correctly can save your business both time and money by ensuring you receive the exemptions to which you’re entitled.

Who Needs to File Illinois Tax Form RUT-50?

Anyone who qualifies for a sales tax exemption in Illinois may need to file the RUT-50 form. Typically, this applies to businesses that are involved in the resale of goods, manufacturers, or other entities that are purchasing items for business operations and not for personal use. If you’re a retailer purchasing inventory for resale or a manufacturer buying raw materials, you can use the RUT-50 to claim your exemption.

The RUT-50 is also necessary for businesses that sell to other businesses and want to show that they’re exempt from paying sales tax on qualifying purchases. In such cases, you’ll provide the completed RUT-50 form to your suppliers to avoid being charged sales tax. If you’re unsure whether you need to file this form, it’s a good idea to consult with a tax professional.

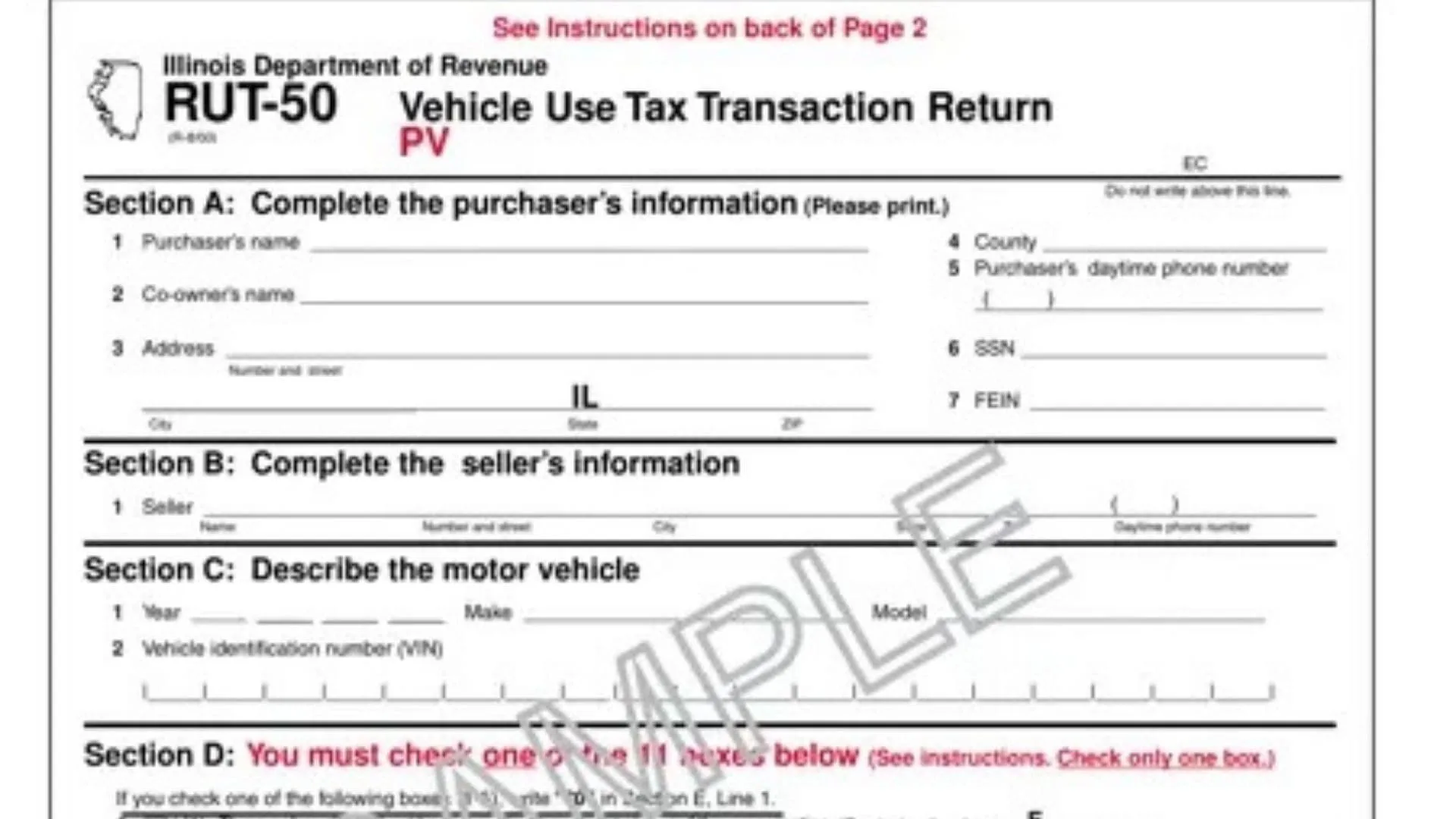

How to Complete Illinois Tax Form RUT-50

Completing the Illinois Tax Form RUT-50 is fairly straightforward, but it’s important to make sure that you include all necessary information. Here’s a step-by-step guide:

- Enter Your Business Information: Start by filling in your business name, address, and account number as issued by the Illinois Department of Revenue. This ensures that your exemption is linked to your correct business account.

- Indicate the Reason for Exemption: On the form, you’ll need to specify why you are claiming a sales tax exemption. Most often, this is due to the fact that you are purchasing goods for resale or use in manufacturing. Choose the appropriate exemption type based on your business needs.

- Include the Purchase Information: You’ll be asked to provide information about the types of purchases you’re making. Be specific about what you’re buying and the nature of the purchase. The more detail you provide, the easier it will be for the Illinois Department of Revenue to process your exemption request.

- Sign and Date the Form: The form requires a signature from the business owner or an authorized representative, along with the date of submission. By signing, you’re confirming that the information provided is correct and that you’re eligible for the exemption.

- Submit the Form: Once completed, submit the form either online through the Illinois Department of Revenue website or by mail. Be sure to keep a copy for your records.

Common Mistakes to Avoid When Filing Illinois Tax Form RUT-50

- Incorrect Business Information: Make sure all your business details (name, address, account number) are accurate. Even a small mistake can delay the processing of your exemption.

- Missing or Incorrect Exemption Reason: If you’re claiming an exemption for resale or manufacturing purposes, ensure that you clearly indicate this on the form. Providing the wrong exemption reason could result in your exemption being denied.

- Failure to Keep Copies: Always keep a copy of the completed form for your own records. This will help you in case you need to reference it in the future or if there’s a discrepancy with your filing.

- Not Filing on Time: While RUT-50 doesn’t have a specific filing deadline, it’s a good practice to submit it as soon as you begin making exempt purchases. Delayed filing could result in you paying unnecessary sales tax in the interim.

Why Is Illinois Tax Form RUT-50 Important?

The Illinois Tax Form RUT-50 is crucial for both businesses and consumers in Illinois. For businesses, it helps minimize tax liabilities by ensuring that you’re not overpaying sales tax on exempt purchases. For the state, it helps verify that only qualified entities are claiming exemptions, preventing misuse and ensuring that tax laws are being properly followed.

By understanding how to fill out and submit the RUT-50 correctly, you can streamline your business’s operations and save valuable time and money. It’s a simple but essential part of doing business in Illinois, particularly for those engaged in retail, wholesale, or manufacturing.

FAQs About Illinois Tax Form RUT-50

Q: Do I need to file Illinois Tax Form RUT-50 if I’m only purchasing goods for personal use?

A: No, the RUT-50 is only required for businesses purchasing goods for resale or business use. Personal purchases do not qualify for tax exemptions.

Q: Can I file Illinois Tax Form RUT-50 online?

A: Yes, you can file the RUT-50 form online through the Illinois Department of Revenue’s website, making the process quicker and easier.

Q: What happens if I make a mistake on my Illinois Tax Form RUT-50?

A: If you make a mistake on the form, it could delay the processing of your exemption request. Be sure to double-check all information before submitting it.

SEO-Friendly Related Keywords

- Illinois Tax Form RUT-50

- Illinois Sales Tax Exemption

- RUT-50 Form Filing

- Illinois Sales Tax Exemption Certificate

- Sales Tax Exemption Illinois

- Tax Exemption Form RUT-50

- Illinois Department of Revenue Form RUT-50

- Filing Sales Tax Exemption Illinois

- How to Complete Illinois Tax Form RUT-50

- Illinois Business Tax Exemption Form