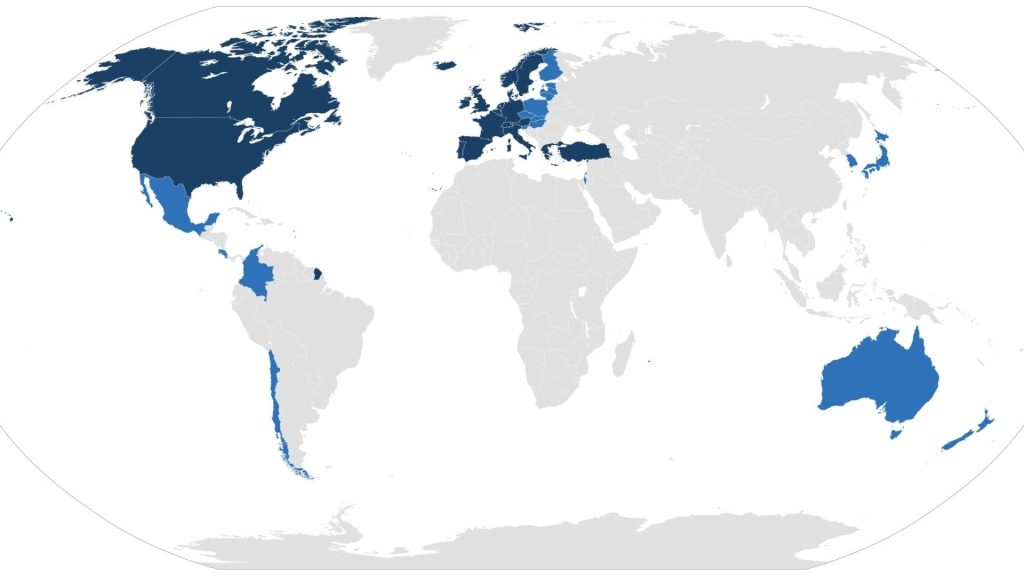

The International Tax Competitiveness Index is an essential tool for measuring how well countries design their tax codes to be competitive and neutral, making the business environment attractive for startups, investors, and economic growth worldwide. This index rates 38 OECD member countries by analyzing over 40 variables in five major categories including corporate taxes, individual income taxes, consumption taxes, property taxes, and cross-border tax rules. Instead of solely focusing on tax rates, the index looks at how tax systems encourage sustainable economic development by promoting neutrality—meaning decisions are based on merits rather than tax advantages—and competitiveness through reasonable tax burdens. Countries with high scores in the International Tax Competitiveness Index tend to offer lower combined corporate and individual tax rates, fair treatment for international profits, and efficient consumption and property tax structures. The index assesses these complex factors in relative terms, assigning scores that reflect each country’s distance from the best performer, shining a light on which places provide optimal tax environments to start, grow, and invest in businesses.

International Tax Competitiveness Index Table

| Country | Overall Rank | Overall Score | Corporate Tax Rank | Individual Taxes Rank | Consumption Taxes Rank | Property Taxes Rank | Cross-Border Tax Rules Rank |

|---|---|---|---|---|---|---|---|

| Australia | 13 | 72.5 | 32 | 15 | 9 | 4 | 33 |

| Austria | 15 | 67.9 | 19 | 25 | 14 | 16 | 15 |

| Belgium | 26 | 61.0 | 18 | 13 | 26 | 29 | 24 |

| Canada | 17 | 66.7 | 26 | 31 | 8 | 25 | 19 |

| Chile | 29 | 58.4 | 36 | 24 | 11 | 13 | 38 |

| Colombia | 38 | 45.7 | 38 | 14 | 15 | 35 | 37 |

| Costa Rica | 21 | 65.2 | 35 | 32 | 7 | 11 | 28 |

| Czech Republic | 8 | 77.3 | 8 | 4 | 32 | 6 | 11 |

| Denmark | 28 | 60.2 | 14 | 36 | 20 | 17 | 32 |

| Estonia | 1 | 100.0 | 2 | 2 | 18 | 1 | 9 |

| Finland | 20 | 65.2 | 7 | 27 | 24 | 19 | 22 |

| France | 36 | 50.2 | 33 | 33 | 31 | 31 | 13 |

| Germany | 16 | 66.8 | 31 | 35 | 13 | 12 | 8 |

| Greece | 27 | 60.9 | 17 | 9 | 34 | 27 | 21 |

| Hungary | 7 | 77.5 | 4 | 5 | 36 | 23 | 3 |

| Iceland | 34 | 55.9 | 16 | 20 | 29 | 33 | 27 |

| Ireland | 32 | 57.4 | 5 | 37 | 35 | 18 | 34 |

| Israel | 10 | 76.4 | 11 | 29 | 10 | 10 | 10 |

| Italy | 37 | 47.2 | 24 | 16 | 38 | 38 | 25 |

| Japan | 25 | 61.1 | 34 | 34 | 5 | 26 | 29 |

| Korea | 24 | 63.0 | 25 | 38 | 1 | 32 | 30 |

| Latvia | 2 | 92.2 | 1 | 3 | 21 | 5 | 7 |

| Lithuania | 5 | 79.5 | 3 | 10 | 27 | 7 | 16 |

| Luxembourg | 6 | 78.8 | 22 | 23 | 6 | 14 | 5 |

| Mexico | 23 | 64.9 | 27 | 19 | 12 | 3 | 36 |

| Netherlands | 14 | 68.3 | 23 | 30 | 17 | 21 | 4 |

| New Zealand | 3 | 84.2 | 30 | 6 | 2 | 8 | 17 |

| Norway | 19 | 66.2 | 13 | 28 | 25 | 15 | 14 |

| Poland | 31 | 57.5 | 12 | 11 | 37 | 30 | 23 |

| Portugal | 35 | 53.7 | 37 | 26 | 22 | 20 | 31 |

| Slovak Republic | 9 | 76.5 | 15 | 1 | 28 | 2 | 26 |

| Slovenia | 22 | 64.9 | 9 | 12 | 30 | 24 | 20 |

| Spain | 33 | 56.3 | 29 | 22 | 19 | 37 | 18 |

| Sweden | 12 | 73.2 | 6 | 18 | 23 | 9 | 12 |

| Switzerland | 4 | 83.6 | 10 | 8 | 3 | 36 | 1 |

| Turkey | 11 | 74.8 | 21 | 7 | 16 | 22 | 6 |

| United Kingdom | 30 | 58.1 | 28 | 21 | 33 | 34 | 2 |

| United States | 18 | 66.5 | 20 | 17 | 4 | 28 | 35 |

What The International Tax Competitiveness Index Reveals

This internationally recognized index doesn’t just rank countries; it provides deep insights into the principles of good tax policy. By weighing criteria such as corporate tax costs, consumption tax base and rates, property taxation, and rules about taxing international earnings, the index reveals the balance countries strike between collecting revenue and fostering a competitive business climate. Countries that score high, like often Ireland or Switzerland, demonstrate tax codes that attract investment without unfair distortion of economic decisions. Conversely, nations with less competitive tax systems may face economic challenges as businesses seek friendlier environments.

Categories And Variables In The International Tax Competitiveness Index

- Corporate Taxes: Includes statutory rates, cost recovery policies like depreciation, and treatment of capital gains and dividends.

- Individual Taxes: Examines income tax rates, social security contributions, and tax brackets.

- Consumption Taxes: Looks at value-added taxes (VAT) or sales taxes, thresholds, and tax bases as a percent of consumption.

- Property Taxes: Evaluates taxes on real estate holdings and recurrent property tax structures.

- International Tax Rules: Assesses rules around profit shifting and taxation of foreign income (controlled foreign corporation rules).

These broad categories break down into more than 40 detailed variables which are standardized and weighted to calculate a final country score for competitiveness and neutrality.

Methodology: How Are Scores Calculated?

The index uses a statistical method standardizing each tax variable’s value across countries using measures like averages and standard deviations to create normalized scores. Each variable contributes evenly to its subcategory, and subcategories roll up into major category scores. The final rankings are relative, meaning the highest score represents the best tax system among OECD countries, not an absolute perfect system. Scores thus express how far a country’s tax environment deviates from the ideal of competitiveness and neutrality.

Why The International Tax Competitiveness Index Matters

Understanding the tax competitiveness of countries helps policymakers design reforms that attract investment and promote economic growth. For businesses and investors, the index acts as a compass to navigate the complex global tax landscape, identifying jurisdictions that offer favorable conditions for expansion or migration. Moreover, an efficient tax system supports job creation, boosts wages, and improves government revenues—fundamental to a society’s overall well-being.

Top Performers And Global Trends

Historically, countries with low corporate tax rates, efficient consumption taxes, and favorable international tax policies rank highest. Ireland, Switzerland, and Estonia frequently top the list, showcasing streamlined tax codes conducive to investment. In contrast, higher tax rates on corporations and individuals and complex tax rules often weigh down countries lower in the ranking. Tracking these trends year-over-year provides insights into global tax policy shifts and their economic impacts.

SEO-Friendly Related Keywords

- OECD tax competitiveness ranking

- Corporate tax competitiveness index

- International tax policy comparison

- Tax neutrality and economic growth

- Global tax competitiveness scores

- Tax system rankings for investment

- Business tax environment index

- International tax code efficiency

Frequently Asked Questions (FAQs)

Q: What does the International Tax Competitiveness Index measure?

A: It measures how well countries balance competitive tax rates with neutral tax policies that promote economic growth.

Q: Why is neutrality important in tax policy?

A: Neutrality ensures tax systems do not distort business decisions, encouraging investment based on economic merit.

Q: How many countries are ranked in the index?

A: 38 OECD member countries are assessed annually.

Q: Does a higher tax rate mean a better ranking?

A: No, higher tax rates generally reduce competitiveness; the index considers rates and tax structures for fairness and growth.

Q: Who publishes the International Tax Competitiveness Index?

A: The Tax Foundation, a respected nonprofit organization focused on tax policy research, publishes the index.

This article helps break down the complex world of tax competitiveness into understandable insights, supporting smarter economic decisions worldwide. Godspeed in unraveling the art of the international tax game!

- https://github.com/TaxFoundation/international-tax-competitiveness-index

- https://sk.sagepub.com/ency/edvol/embed/sage-encyclopedia-of-business-ethics-and-society-2e/chpt/international-tax-competitiveness-index

- https://statbase.org/datasets/indexes-and-ratings/international-tax-competitiveness-index/

- https://aak.slu.cz/pdfs/aak/2018/02/05.pdf

- https://www3.weforum.org/docs/GCR2018/04Backmatter/3.%20Appendix%20C.pdf

- https://dergipark.org.tr/tr/download/article-file/3971359

- https://cps.org.uk/wp-content/uploads/2023/10/ITCI-2023.pdf

- https://4liberty.eu/lessons-from-the-tax-competitiveness-index-how-to-get-on-the-pedestal/