If you have ever received government payments like Social Security benefits or unemployment compensation and worried about a surprise tax bill at the end of the year, then IRS Form W-4V Voluntary Withholding Request might just be your best friend. The IRS Form W-4V allows individuals to request that federal income tax be withheld directly from the payments they receive, helping them avoid large lump-sum tax obligations when filing their return. Instead of scrambling to set money aside or risk underpaying, this form gives you more control over your taxes. By filling it out properly, you can choose a withholding percentage that matches your financial needs and stay worry-free throughout the tax season. Making smart use of Form W-4V is like setting up a safety net for your budget—it keeps things stress-free and much easier to manage.

What Is Form W-4V?

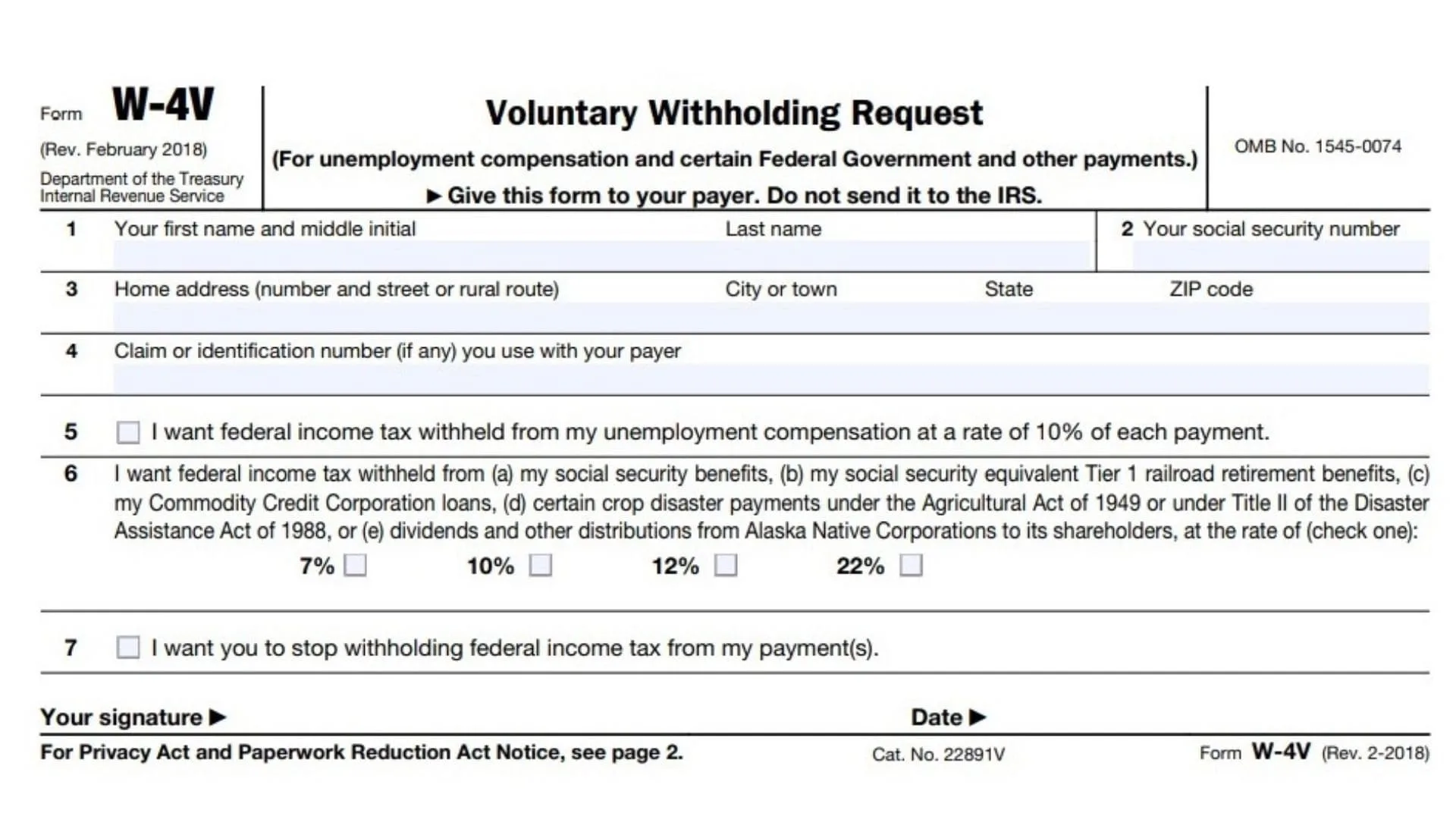

Form W-4V is a voluntary withholding request form created by the IRS. It lets people receiving certain federal payments decide if they want taxes taken out automatically. Instead of dealing with a large tax bill later, you can smooth out the process by paying small amounts upfront through withholding.

Who Should Use Form W-4V?

You may benefit from filing this form if you receive:

- Social Security benefits

- Unemployment compensation

- Railroad Retirement benefits

- Commodity Credit Corporation payments

Using the form helps people who don’t want the hassle of making quarterly tax payments or saving a portion of each check themselves.

How To Complete Form W-4V

Filling out the form is straightforward:

- Download IRS Form W-4V from the official IRS website.

- Provide your personal information, including your name, address, and Social Security number.

- Select the percentage of federal withholding (commonly 7%, 10%, 12%, or 22%).

- Sign and date your request.

- Submit it to the agency paying your benefits, not directly to the IRS.

Why The Form Matters

Form W-4V simplifies tax planning. By making tax withholding automatic, you reduce the chances of owing money to the IRS when tax season arrives. It also eliminates the stress of unexpected bills and supports better financial organization throughout the year.

Tips For Using IRS Form W-4V

- Calculate your expected tax liability before choosing a percentage.

- Review your withholding annually, especially if your income changes.

- Keep a copy of the form for your records.

FAQs

What Is IRS Form W-4V Used For?

It is used to request federal income tax withholding from certain government payments.

Where Do I Send The Form After Filling It Out?

You send it to the agency making your payments, not to the IRS.

Can I Change My Withholding Later?

Yes. You can file a new Form W-4V any time to adjust or stop withholding.