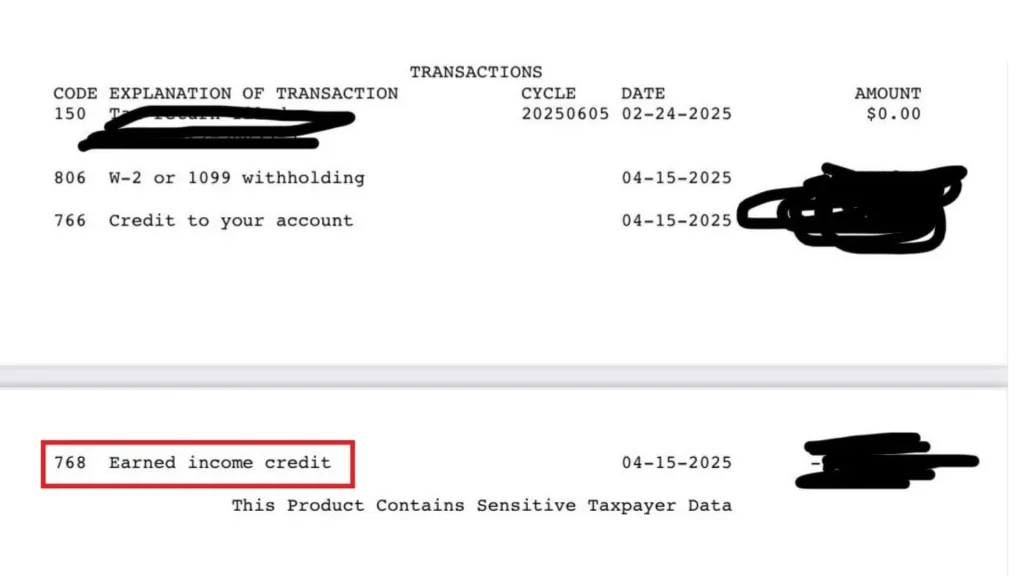

If you pulled your IRS account transcript (or wage and income transcript) and spotted Tax Transcript Code 768, you’re probably wondering whether it signals a refund, a credit, a payment, or a delay—and how it affects your tax refund status, refund timing, and overall IRS transcript cycle. In most cases, IRS transaction code 768 points to a specific refundable credit being applied to your tax account, which often increases your expected refund (or reduces what you owe). That said, seeing Code 768 alongside other transcript codes—like a refund freeze, identity verification note, or processing hold—can change the story fast. Below, you’ll learn what Code 768 typically represents, where it appears on an IRS transcript, how to interpret it with nearby transaction codes and dates, and what practical steps to take if your refund is taking longer than expected.

What IRS Transcript Code 768 Usually Indicates

IRS transcript codes are essentially bookkeeping entries. Code 768 is most commonly associated with the Earned Income Tax Credit (EITC) being added to your account.

Here’s the plain-language meaning:

- Code 768 generally means the IRS has posted the Earned Income Credit (a refundable credit) to your tax account for that tax year

- It often appears with a date and an amount, which reflects the credit the IRS recorded

- It can be a good sign for your refund amount, but it does not automatically mean your refund has been approved or scheduled for deposit

Important nuance: transcripts show “events” on your account; they don’t always show the final outcome in one line. Code 768 can exist even if your return is still under review or waiting for another step.

Where To Find Code 768 On Your Transcript

Most people see Code 768 on an Account Transcript for the relevant tax year. Look for a section listing transaction codes, dates, and amounts. Code 768 will appear as one line item among others.

A quick way to read the line:

- Transaction code: 768

- Description: Earned Income Credit (commonly)

- Date: the posting date (not always the day you filed)

- Amount: the credit amount applied to the account

Does Code 768 Mean I’m Getting A Refund?

Code 768 is often refund-positive, because EITC is refundable (it can produce a refund even if your tax liability is 0). But whether you actually receive money—and when—depends on the rest of your transcript.

You’re more likely headed toward a refund if you also see codes that indicate processing completed and refund issued. If you only see Code 768 but nothing that looks like a finalized refund entry, you may still be in the “processing” phase.

How Code 768 Affects Refund Timing

If you claim EITC, your refund timing can be affected by IRS rules designed to reduce fraud. For many filers, EITC-related refunds can’t be released until the IRS is allowed to issue them under those rules, even if the credit posts on the transcript earlier.

In practical terms:

- Code 768 can appear before your refund is authorized

- Your refund date depends on when the IRS finishes processing and clears any holds

- If your transcript later shows a refund-issued transaction, that’s when the countdown becomes real

How To Interpret Code 768 With Other Common Transcript Codes

The best transcript reading happens in combos. Code 768 tells you a refundable credit was recorded, but the nearby codes often explain the “what next.”

Here are pairings people commonly notice:

- Code 768 + a processing/assessment code: usually indicates your return is moving through normal workflow

- Code 768 + a hold/freeze code: can suggest the IRS posted the credit but temporarily paused refund release

- Code 768 + a refund issued code: typically means the IRS has scheduled or released the money (check the date and method)

If you want a fast self-check, focus on whether you see a clear “refund issued” line after the credits and processing steps.

Why Code 768 Might Appear But Your Refund Still Isn’t Here

Seeing Code 768 and still waiting can feel like ordering food, watching it get plated, then… nothing arrives at your table. Common reasons include:

- Normal processing backlog or timing differences between transcript updates and bank deposits

- Verification needs (identity, income, or withholding mismatches)

- Review for accuracy, especially if credits and income documentation don’t match IRS records

- Offsets for other debts (some refunds get reduced to pay past-due obligations)

What To Do After You See IRS Transcript Code 768

If you’re trying to be efficient (and keep your sanity), follow this order:

- Confirm you’re viewing the correct tax year transcript

- Look for additional transaction codes posted after 768, especially anything indicating refund issuance or holds

- Compare transcript info with your filed return for EITC eligibility and amounts

- Check your refund tracker and payment method (direct deposit details, mailing address)

- If the transcript suggests a hold or you received an IRS notice, follow the notice instructions before calling

If you have a tax professional, share the transcript screenshot (with sensitive info redacted) and ask them to interpret the full sequence of codes and dates.

Common Misunderstandings About Code 768

A few quick clarifications that save time:

- Code 768 does not automatically mean your refund is approved

- The posting date on the transcript is not always the same as the day the IRS will pay you

- Code 768 is generally about a credit entry, not a direct deposit event by itself

- You need the surrounding codes to know whether anything is delaying release

When To Consider Getting Help

Consider contacting the IRS or a qualified tax pro if:

- Your transcript shows a hold/freeze code and it doesn’t resolve after the timeframe in your notice

- Your credit amounts look wrong compared to what you filed

- You suspect identity theft or unauthorized filing

- You’ve waited significantly longer than typical processing time and transcript updates have stopped changing

If you’re calling the IRS, having your transcript in front of you helps you explain exactly what you’re seeing (code, date, amount) and get to the point faster.

FAQs

Does IRS Transcript Code 768 Mean My Refund Is Approved?

Not necessarily. Code 768 usually means the Earned Income Credit posted, but refund approval depends on later processing and any holds.

Can Code 768 Show Up Even If I Owe Taxes?

Yes. The credit can reduce what you owe, and if it’s larger than your balance, it may contribute to a refund.

How Long After Code 768 Will I Get My Refund?

There’s no fixed timeline. Watch for a refund-issued entry on the transcript and allow additional time for direct deposit or mail delivery.