Navigating U.S. tax rules as an H1B visa holder can feel like trying to solve a Rubik’s cube blindfolded. The big question—is H1B a non resident alien?—is one that pops up for thousands of professionals every year. In this comprehensive guide, we’ll explore the ins and outs of H1B visa tax status, explain the difference between resident and nonresident aliens, and show you how the IRS decides which bucket you fall into. From the “substantial presence test” to what income you need to report, we’ll break down the jargon and help you understand what it all means for your paycheck and your peace of mind. Get ready to master the essentials of H1B nonresident alien rules, tax filing tips, and more—without repeating yourself into a tax-time trance.

What Is a Nonresident Alien? What About a Resident Alien?

- Nonresident alien: Someone who is not a U.S. citizen and does not meet either the green card test or the substantial presence test. Nonresident aliens only pay U.S. taxes on income earned within the United States.

- Resident alien: Someone who is not a U.S. citizen but meets the green card test or the substantial presence test. Resident aliens are taxed like U.S. citizens on their worldwide income.

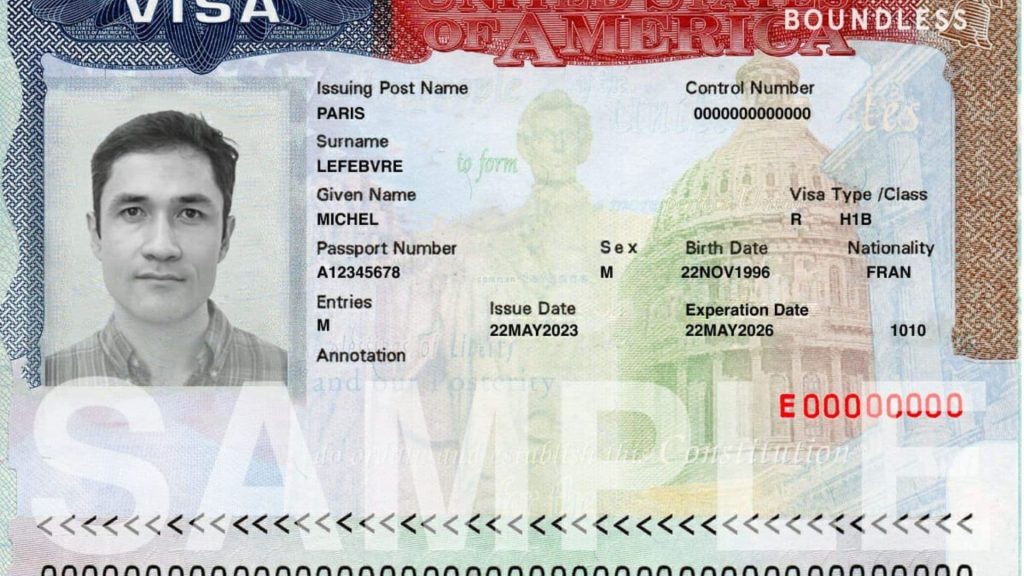

The H1B Visa: Nonresident or Resident Alien?

If you’re in the U.S. on an H1B visa, your tax status isn’t automatically “nonresident alien.” Instead, it depends on how long you’ve been in the U.S. and whether you meet the substantial presence test.

Substantial Presence Test (SPT): The Decider

- You’re a nonresident alien if you don’t pass the SPT.

- You’re a resident alien if you do pass the SPT.

How does the SPT work?

- You must be physically present in the U.S. for at least 31 days during the current year, and

- 183 days during the current year and the two preceding years, counting:

- All days present in the current year,

- 1/3 of the days present in the first preceding year,

- 1/6 of the days present in the second preceding year.

If you’re new to the U.S. on an H1B, you’ll likely be a nonresident alien for your first year, but after you’ve spent enough time in the country, you’ll usually become a resident alien for tax purposes.

Why Does Tax Status Matter for H1B Holders?

- Nonresident aliens: Only taxed on U.S.-sourced income. File Form 1040NR. Fewer deductions and credits available.

- Resident aliens: Taxed on worldwide income, just like U.S. citizens. File Form 1040. Eligible for more deductions and credits.

How to Determine Your Status (Quick Checklist)

- New to the U.S. on H1B?

- Likely a nonresident alien for your first year.

- Been here a while?

- Use the substantial presence test to check if you’re now a resident alien.

- Still confused?

- The IRS has a handy tool and worksheet in Publication 519 to help you calculate your days.

Can H1B Holders Be Both in the Same Year?

Yes! If you arrive in the middle of the year, you might be a nonresident alien for part of the year and a resident alien for the rest. This is called “dual-status alien.” Special rules apply for tax filing in this case.

What If I Don’t Meet the SPT?

You remain a nonresident alien until you do. But, you might be able to make an election (like the “First-Year Choice”) to be treated as a resident for tax purposes if you meet certain conditions.

Key Takeaways

- H1B visa holders can be nonresident or resident aliens for tax purposes—it all depends on time spent in the U.S.

- Nonresident aliens pay tax only on U.S. income; resident aliens pay tax on worldwide income.

- Your status can change, so check every year!

FAQs

Q: Is an H1B visa holder always a nonresident alien?

A: No. H1B holders are nonresident aliens until they meet the substantial presence test, after which they become resident aliens for tax purposes.

Q: How do I know if I’m a resident or nonresident alien on H1B?

A: Use the substantial presence test to determine your status. If you meet the required number of days in the U.S., you’re a resident alien; if not, you’re a nonresident alien.

Q: What tax form do H1B nonresident aliens file?

A: Nonresident aliens file Form 1040NR. Resident aliens file the standard Form 1040.

Q: Does my immigration status affect my tax status?

A: Not directly. The IRS uses its own criteria (SPT and green card test) to determine tax residency, which may differ from your immigration status.