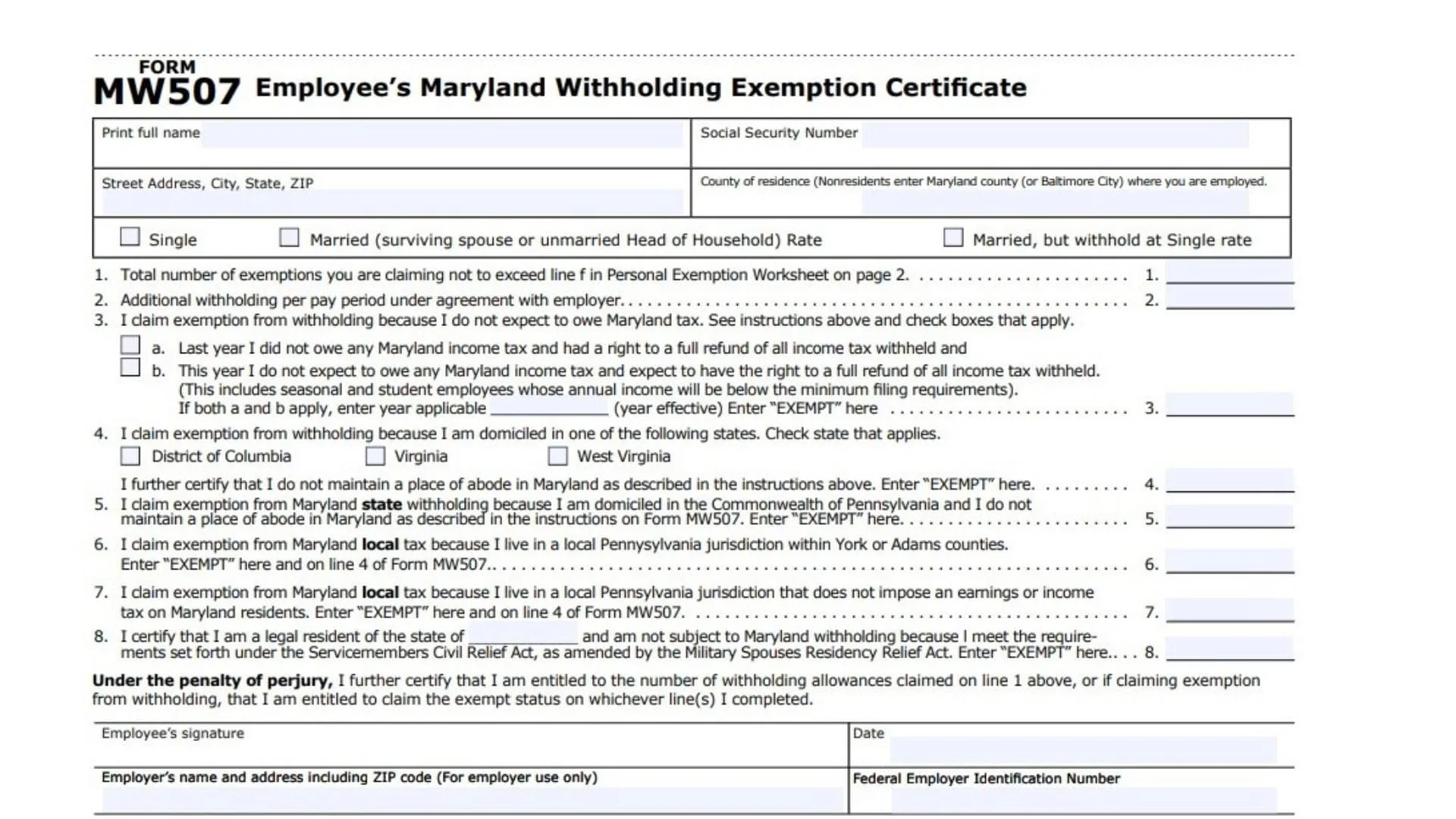

The Maryland Form MW507 (Employee’s Maryland Withholding Exemption Certificate) is the critical document you must complete when you start a new job in Maryland or when your personal tax situation changes. Think of it as the state-level equivalent of the federal W-4 form. By filling out this certificate, you instruct your employer on exactly how much state income tax to withhold from your paycheck. If you do not file this form, your employer is required by law to withhold taxes as if you are single with zero exemptions, which often results in the maximum amount of tax being taken out of your pay. This form is used not only to set your standard withholding allowances based on dependents and deductions but also to claim full exemption from withholding if you meet specific legal criteria—such as being a resident of a reciprocal state like Virginia, D.C., or West Virginia, or if you are a military spouse. Getting this form right ensures you are not overpaying the government throughout the year or facing a surprise tax bill when you file your tax return.

How to Complete Maryland Form MW507

Personal Information Section

Before diving into the calculations, you must provide your basic identification details at the top of the form.

- Full Name: Print your full legal name as it appears on your Social Security card.

- SSN: Enter your Social Security Number. This is mandatory for tax administration.

- Address: Provide your current home address, including City, State, and Zip Code.

- County of Residence: Enter the Maryland county where you live (or Baltimore City). If you live in Pennsylvania, York or Adams county residents must enter that here. Non-Maryland residents should write “Nonresident” or the name of their state.

- Filing Status: Check the box that applies to you (Single, Married filing jointly, Married but withhold at Single rate, or Head of Household).

Section A: Withholding Calculation

Use this section if you are a standard Maryland taxpayer who needs to determine how many exemptions to claim.

Line 1: Enter the total number of exemptions you are claiming. This number must not exceed the calculated amount from Line ‘f’ of the Personal Exemption Worksheet on page 2. If you claim more exemptions than you are entitled to, you may owe taxes at the end of the year.

Line 2: Enter any additional withholding amount you want deducted from each pay period. You might use this if you have other income (like freelance work) that isn’t taxed and you want to cover that liability through your main job’s paycheck. If you don’t need extra tax taken out, leave this blank.

Section B: Exemption From Withholding

Only complete the lines in this section if you are claiming to be exempt from Maryland income tax withholding. Do not complete Line 1 or 2 if you are filling out this section.

Line 3: Use this line if you owe no Maryland income tax. You must check boxes ‘a’ and ‘b’ to certify that (a) you owed no Maryland tax last year and received a full refund, and (b) you expect to owe no Maryland tax this year and expect a full refund. If both apply, enter the current year in the space provided and write “EXEMPT” on the line.

Line 4: Use this if you live in a reciprocal state. Check the box for your state of domicile (District of Columbia, Virginia, or West Virginia). By checking this, you certify that you do not maintain a place of abode in Maryland for more than 183 days. Write “EXEMPT” on the line.

Line 5: Use this line if you are a resident of the Commonwealth of Pennsylvania and do not maintain a home in Maryland for more than 183 days. Write “EXEMPT” on the line.

Line 6: Use this line if you live in a Pennsylvania jurisdiction within York or Adams counties (which have a reciprocal local tax agreement). Write “EXEMPT” here and also on Line 4.

Line 7: Use this line if you live in a Pennsylvania jurisdiction that does not impose an earnings or income tax on Maryland residents. Write “EXEMPT” here and also on Line 4.

Line 8: Use this line if you are the spouse of a U.S. Armed Forces member. You generally qualify for exemption if your spouse is present in Maryland solely for military orders, you are here solely to be with them, and your permanent residence is in another state. If eligible, write “EXEMPT” on the line.

Personal Exemptions Worksheet (Page 2)

To accurately fill out Line 1 on the front, complete this worksheet first.

Line a: Multiply the number of your personal exemptions by the value of each exemption (usually $3,200). Note: If your salary is over $100,000, this value may be reduced (see the table on the form).

Line b: Multiply the number of additional exemptions for dependents age 65 or over by the value of each exemption.

Line c: Enter your estimated itemized deductions (excluding state/local income taxes) that exceed your standard deduction. The standard deduction is generally 15% of your income (min $1,850, max $2,800).

Line d: Enter $1,000 for each additional exemption for you or your spouse if you are age 65 or over and/or blind.

Line e: Add lines a through d together.

Line f: Divide the total on Line ‘e’ by $3,200. Drop any fraction (do not round up). This result is the maximum number of exemptions you can claim on Line 1 of the main form.