If you’re a business owner, freelancer, or partner in a pass-through entity, understanding the QBI Pass Through Entity Reporting Form (Form 8995) is essential for maximizing your tax deductions and keeping your filings compliant. The term QBI, or Qualified Business Income, refers to the net income from your trade or business that’s eligible for a potential 20% QBI deduction under Section 199A of the Internal Revenue Code. This deduction can significantly reduce your taxable income, but only if your pass-through entity—like an S corporation, partnership, or sole proprietorship—properly reports its income on the right forms. The QBI Pass Through Entity Reporting Form ensures that owners, members, and partners receive the information they need to claim their share of the deduction accurately. This form isn’t just a piece of paper—it’s your gateway to one of the most valuable tax breaks available to small businesses and entrepreneurs today.

What Is The QBI Pass Through Entity Reporting Form?

The QBI Pass Through Entity Reporting Form is an informational statement provided by pass-through entities (such as partnerships and S corporations) to their owners or shareholders. It reports the Qualified Business Income, W-2 wages, and unadjusted basis of qualified property (UBIA) that each owner’s QBI deduction is based on. Essentially, it tells each owner:

- How much QBI they earned,

- How much W-2 wages or qualified property are attributable to them, and

- Whether their income qualifies for the Section 199A deduction.

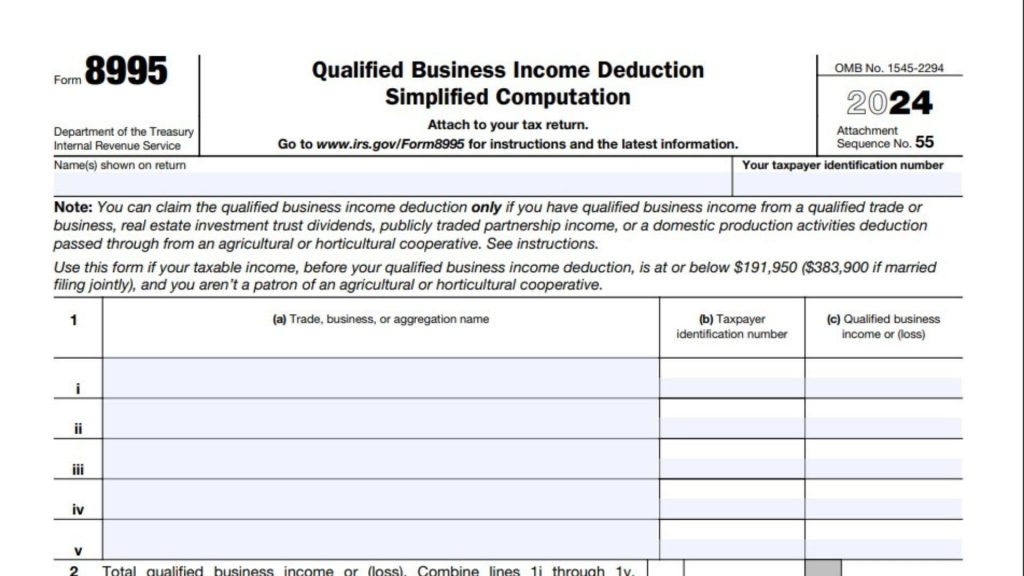

This data is typically summarized in Form 8995 or Form 8995-A, which individuals use to calculate their personal QBI deduction on their tax return.

Who Needs To File A QBI Pass Through Entity Reporting Form?

If your business is structured as a pass-through entity, you’ll need to provide QBI information to your members, partners, or shareholders. These entities include:

- S Corporations

- Partnerships

- Limited Liability Companies (LLCs) taxed as either

- Sole Proprietorships (reported directly on Schedule C)

Each entity must provide its owners with their share of QBI-related details—usually through Schedule K-1 with additional Section 199A statements attached. Without this reporting, owners cannot claim their QBI deduction on their personal returns.

How To Complete The QBI Pass Through Entity Reporting Form

Here’s a simplified process to ensure accuracy when preparing the form:

- Determine QBI for Each Activity:

Separate income, deductions, and losses for each qualified business activity. - Allocate QBI Among Owners:

Divide the total QBI among owners based on their ownership percentage or profit share. - Report W-2 Wages and Qualified Property:

These factors affect the deduction limitation for higher-income taxpayers. - Attach Supporting Statements:

Provide each owner with their QBI details—this is often referred to as the “QBI Section 199A Statement.” - File and Distribute:

Submit your business’s K-1 forms and QBI statements to the IRS and each owner before the filing deadline.

Why The QBI Deduction Matters

The QBI deduction can reduce your taxable income by up to 20% of your qualified business income, which is substantial for small business owners. It’s one of the biggest tax incentives for pass-through entities under the Tax Cuts and Jobs Act (TCJA). However, to qualify, your business must meet specific income thresholds and activity requirements.

Properly completing your QBI Pass Through Entity Reporting Form ensures that every owner receives accurate data to maximize their deduction—and avoid unnecessary IRS scrutiny.

Common Mistakes To Avoid

Even small errors can lead to missed deductions or red flags for audits. Here are common pitfalls to watch for:

- ❌ Mixing multiple businesses under one QBI calculation.

- ❌ Forgetting to report W-2 wages or UBIA (especially for S corps).

- ❌ Incorrectly classifying non-QBI income (like investment income).

- ❌ Failing to issue a Section 199A statement to partners or members.

- ❌ Overlooking phaseout limits for high earners.

Always double-check your numbers and, when in doubt, work with a tax professional familiar with pass-through entity reporting.

How QBI Reporting Affects Different Business Structures

| Entity Type | QBI Reporting Method | Owner Receives |

|---|---|---|

| Sole Proprietorship | Schedule C on Form 1040 | N/A (direct reporting) |

| Partnership | Schedule K-1 (Form 1065) + Section 199A statement | QBI, W-2 wages, UBIA |

| S Corporation | Schedule K-1 (Form 1120-S) + Section 199A statement | QBI and wage info |

| LLC (Taxed as Partnership or S Corp) | Depends on classification | Same as above |

Each structure has unique nuances in how QBI is calculated and distributed, so be sure to report in line with your entity’s tax status.

When And Where To File

Typically, QBI reporting is done alongside annual business tax filings—your Schedule K-1 or Form 1065 (for partnerships) and Form 1120-S (for S corps) must include QBI information. Owners then use this data when completing their personal returns by the April 15th tax deadline, or later if extended.

FAQs

Q1: What Is The Purpose Of The QBI Pass Through Entity Reporting Form?

It communicates QBI, W-2 wages, and qualified property data from a pass-through entity to its owners for the Section 199A deduction.

Q2: Can A Sole Proprietor Claim The QBI Deduction?

Yes! Sole proprietors report QBI directly on Schedule C and use Form 8995 or 8995-A for the deduction.

Q3: Is The QBI Deduction Available Every Year?

Yes, but it’s set to expire after 2025 unless Congress extends it.

Q4: Do I Need To Attach The QBI Statement To My K-1?

Yes, pass-through entities must include a Section 199A statement for each owner to claim the deduction.