The qualified dividends and capital gain tax worksheet is a vital tool used by taxpayers to determine the correct tax owed on income generated from qualified dividends and long-term capital gains. These two types of income enjoy favorable tax rates compared to ordinary income, making it crucial to understand how they are reported and calculated on your tax return. Whether you’re an experienced investor or a first-time taxpayer, grasping how qualified dividends—dividends meeting specific holding period and source criteria—and capital gains—profits from the sale of investments held over one year—are taxed can lead to significant savings and smoother filing. This worksheet works hand-in-hand with IRS Form 1040, especially lines 3a (for qualified dividends) and 7 (for capital gains), and ensures your tax liability reflects these unique income streams accurately.

Modern tax filings require discerning between income types because qualified dividends and long-term capital gains are taxed at distinct rates of 0%, 15%, or 20%, unlike ordinary dividends or short-term gains that are taxed as regular income. Using the worksheet, taxpayers compute the tax implications based on their total taxable income, adjusted gross income, and applicable filing status. For many, the worksheet is essential to avoid overpayment and to align with IRS regulations, especially when filing Schedule D (Capital Gains and Losses) or handling Form 8949 documentation.

What Are Qualified Dividends and Capital Gains?

Qualified dividends are distributions from corporations that the IRS considers to have met holding period requirements—generally you must hold the stock for more than 60 days within a specific 121-day timeframe surrounding the dividend payment date. Capital gains occur when you sell assets such as stocks, bonds, or property for more than the purchase price. Long-term capital gains apply to assets held longer than one year; short-term gains apply to assets held one year or less.

How the Worksheet Works

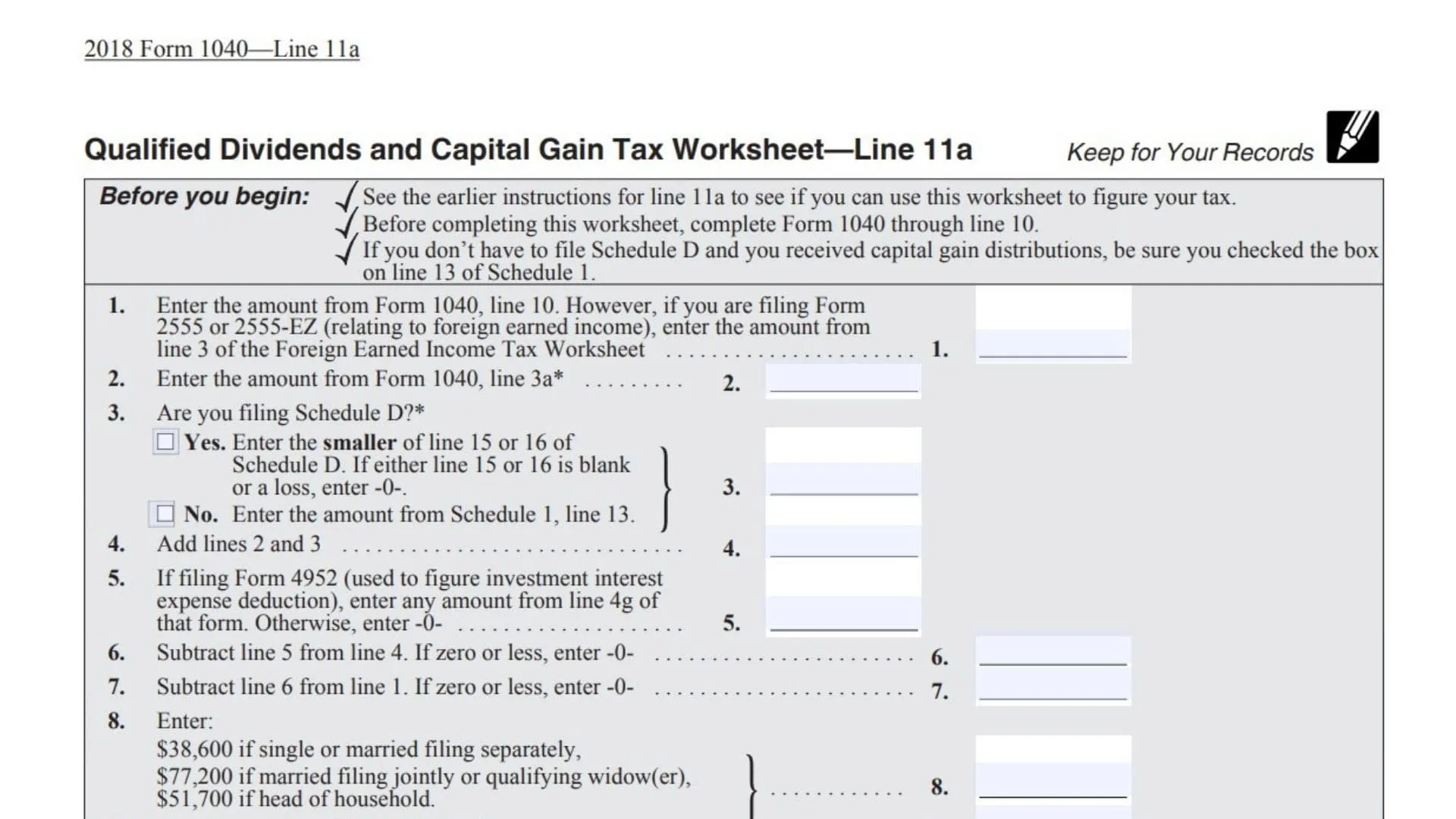

The worksheet starts with your total taxable income, subtracts the qualified dividends and capital gains to isolate ordinary income, then applies the relevant tax rates across different income brackets. It integrates information from several tax forms, especially Form 1040 and Schedule D, to determine if your income qualifies for lower tax brackets applicable to dividends and gains. The worksheet itself isn’t filed with your return but serves as a calculation guide. Here’s how you fill out the Qualified Dividends and Capital Gain Tax Worksheet:

- Enter the amount from Form 1040, line 10. If you are filing Form 2555 or 2555-EZ (relating to foreign earned income), enter the amount from line 3 of the Foreign Earned Income Tax Worksheet.

- Enter the amount from Form 1040, line 3a (qualified dividends).

- Determine if you are filing Schedule D:

- If Yes, enter the smaller of line 15 or 16 of Schedule D. If either line 15 or 16 is blank or a loss, enter zero.

- If No, enter the amount from Schedule 1, line 13.

- Add lines 2 and 3.

- If filing Form 4952 (investment interest expense deduction), enter any amount from line 4g of that form. Otherwise, enter zero.

- Subtract line 5 from line 4. If zero or less, enter zero.

- Subtract line 6 from line 1. If zero or less, enter zero.

- Enter the applicable amount based on filing status:

- $38,600 if single or married filing separately

- $77,200 if married filing jointly or qualifying widow(er)

- $51,700 if head of household

- Enter the smaller of line 1 or line 8.

- Enter the smaller of line 7 or line 9.

- Subtract line 10 from line 9. This amount is taxed at 0%.

- Enter the smaller of line 1 or line 6.

- Enter the amount from line 11.

- Subtract line 13 from line 12.

- Enter the applicable amount based on filing status:

- $425,800 if single

- $239,500 if married filing separately

- $479,000 if married filing jointly or qualifying widow(er)

- $452,400 if head of household

- Enter the smaller of line 1 or line 15.

- Add lines 7 and 11.

- Subtract line 17 from line 16. If zero or less, enter zero.

- Enter the smaller of line 14 or line 18.

- Multiply line 19 by 15% (0.15).

- Add lines 11 and 19.

- Subtract line 21 from line 12.

- Multiply line 22 by 20% (0.20).

- Figure the tax on the amount on line 7:

- If the amount on line 7 is less than $100,000, use the Tax Table.

- If $100,000 or more, use the Tax Computation Worksheet.

- Add lines 20, 23, and 24.

- Figure the tax on the amount on line 1:

- If less than $100,000, use the Tax Table.

- If $100,000 or more, use the Tax Computation Worksheet.

- Tax on all taxable income. Enter the smaller of line 25 or 26 here and on Form 1040, line 11a.

- If filing Form 2555 or 2555-EZ, do not enter on 1040 line 11a; instead, enter on line 4 of the Foreign Earned Income Tax Worksheet.

Why You Should Care

Understanding and using the qualified dividends and capital gain tax worksheet can save you money by correctly applying lower tax rates and avoiding mistakes that lead to penalties or missed deductions. It’s particularly important if your income is near tax bracket thresholds or if you have significant investment earnings.

Frequently Asked Questions (FAQs)

Q1: Do I always have to use the qualified dividends and capital gain tax worksheet?

A1: Not always. It depends on your income level and whether you have qualified dividends or long-term capital gains, but it’s required if you report these on your Form 1040.

Q2: What is the difference between qualified dividends and ordinary dividends for tax purposes?

A2: Qualified dividends meet holding period rules and are taxed at lower capital gains rates, while ordinary dividends are taxed as ordinary income.

Q3: Can I ignore Schedule D if I only have capital gain distributions reported on my 1040?

A3: If your capital gains are reported directly on Form 1040 and you have no other capital asset sales, you might not need to file Schedule D.

Q4: Where can I find the official IRS worksheet?

A4: The qualified dividends and capital gain tax worksheet is included in the Form 1040 instructions booklet, typically toward the back.