Schedule 3 is the attachment you use when you have certain tax credits and payments that don’t fit directly on the main Form 1040 (or 1040-SR / 1040-NR). It’s essentially a “catch-and-carry” schedule: it collects specific nonrefundable credits (which can reduce your tax to zero but usually won’t create a refund by themselves) and certain payments/refundable credits (which can increase your total payments and may increase your refund). If you qualify for items like the foreign tax credit, child and dependent care credit, education credits, retirement savers credit, clean energy/home improvement credits, or several less common credits (adoption, mortgage interest credit, clean vehicle credits, and more), you typically enter the supporting form’s final number on a specific line of Schedule 3 and then carry the totals to the right line on your Form 1040. Schedule 3 also handles “other payments” items such as net premium tax credit, extension payments, excess Social Security withholding, fuel tax credit, and other specialized refundable credits—again, by pulling totals from other forms and moving the combined total back to your main return. In short: you use Schedule 3 to make sure these credits and payments are counted in the right place on your tax return, with a clean trail back to the supporting forms you completed.

How To File Schedule 3 (Form 1040)

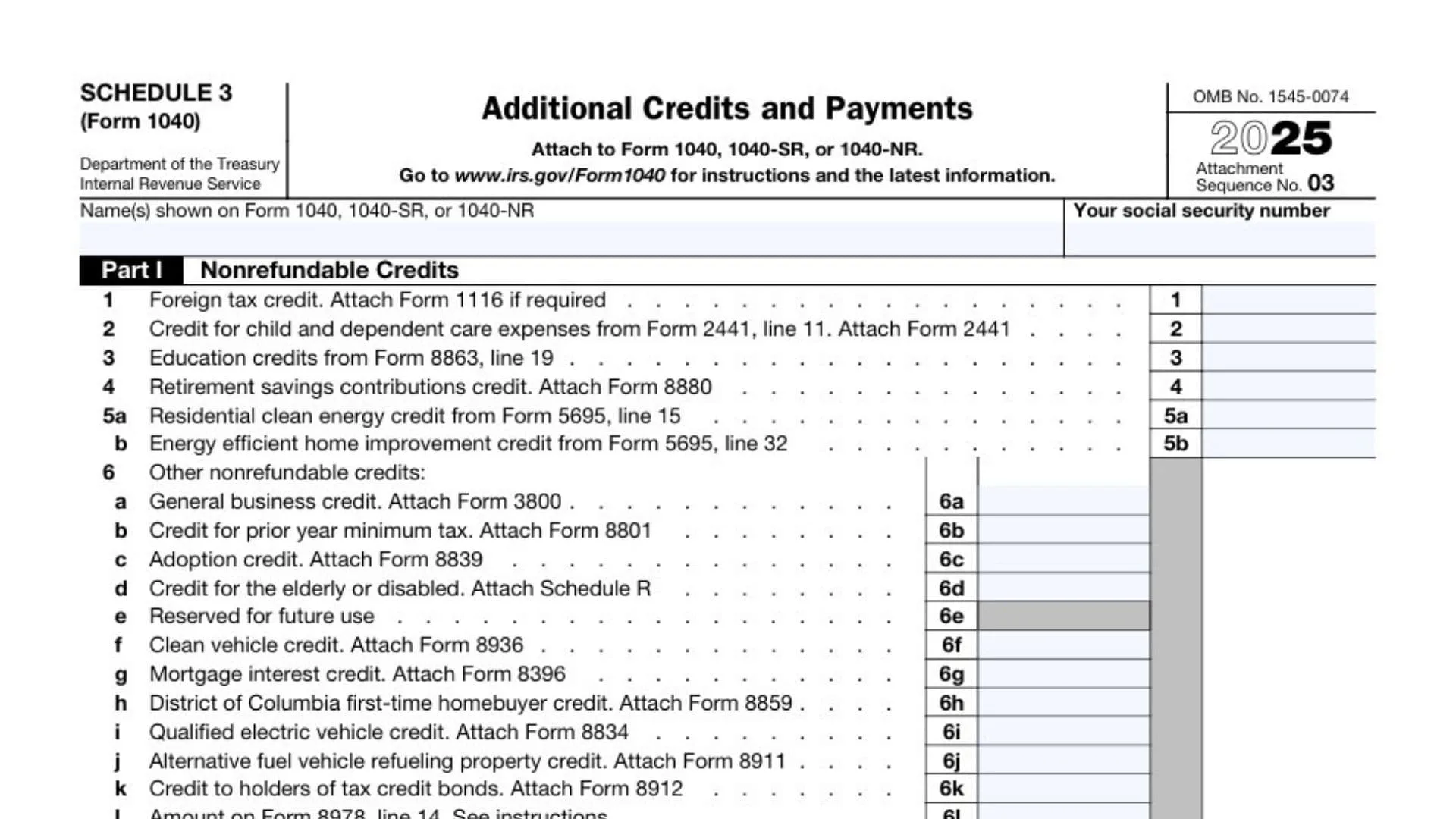

Attach Schedule 3 to Form 1040, Form 1040-SR, or Form 1040-NR when you have any entry on Schedule 3 (even if it’s just one line). Fill in the name(s) exactly as shown on your main return and the Social Security number (SSN) listed for the primary filer on that return. After you complete all applicable lines, you’ll transfer:

- The Part I total (line 8) to Form 1040 / 1040-SR / 1040-NR, line 20.

- The Part II total (line 15) to Form 1040 / 1040-SR / 1040-NR, line 31.

How To Complete Schedule 3 (Form 1040)

Top Of Schedule 3 (Before Part I)

Name(s) Shown On Return

Enter the taxpayer name(s) exactly as they appear on your Form 1040, 1040-SR, or 1040-NR (for joint returns, list both names in the same order).

Your Social Security Number

Enter the primary taxpayer’s SSN (the same SSN used on the main return).

Part I: Nonrefundable Credits

- Line 1: Foreign Tax Credit

Enter the foreign tax credit amount here (generally the final computed credit). Attach Form 1116 if you’re required to file it; if you’re not required to file Form 1116, still enter the allowed credit amount on this line. - Line 2: Child And Dependent Care Credit

Enter the credit amount from Form 2441, line 11. Attach Form 2441. - Line 3: Education Credits

Enter the education credit amount from Form 8863, line 19. - Line 4: Retirement Savings Contributions Credit

Enter the saver’s credit amount and attach Form 8880. - Line 5a: Residential Clean Energy Credit

Enter the credit amount from Form 5695, line 15. - Line 5b: Energy Efficient Home Improvement Credit

Enter the credit amount from Form 5695, line 32. - Line 6: Other Nonrefundable Credits

Use these sub-lines only if they apply, and follow each line’s “attach” instruction so the IRS can match your amount to the right calculation. - Line 6a: General Business Credit

Enter the general business credit amount and attach Form 3800. - Line 6b: Credit For Prior Year Minimum Tax

Enter the credit amount and attach Form 8801. - Line 6c: Adoption Credit

Enter the adoption credit amount and attach Form 8839. - Line 6d: Credit For The Elderly Or Disabled

Enter the credit amount and attach Schedule R. - Line 6e: Reserved For Future Use

Leave this line blank unless future instructions tell you otherwise. - Line 6f: Clean Vehicle Credit

Enter the credit amount and attach Form 8936. - Line 6g: Mortgage Interest Credit

Enter the credit amount and attach Form 8396. - Line 6h: District Of Columbia First-Time Homebuyer Credit

Enter the credit amount and attach Form 8859. - Line 6i: Qualified Electric Vehicle Credit

Enter the credit amount and attach Form 8834. - Line 6j: Alternative Fuel Vehicle Refueling Property Credit

Enter the credit amount and attach Form 8911. - Line 6k: Credit To Holders Of Tax Credit Bonds

Enter the credit amount and attach Form 8912. - Line 6l: Amount On Form 8978

Enter the amount from Form 8978, line 14 (follow the “see instructions” note for how this amount applies to you). - Line 6m: Credit For Previously Owned Clean Vehicles

Enter the credit amount and attach Form 8936 (this is separate from the clean vehicle credit line and specifically for previously owned clean vehicles). - Line 6z: Other Nonrefundable Credits (List Type And Amount)

If you have another nonrefundable credit that belongs here but isn’t listed on 6a–6m, list the credit type and the amount. Use this line only for nonrefundable credits that are directed to Schedule 3 as “other.” - Line 7: Total Other Nonrefundable Credits

Add lines 6a through 6z and enter the total on line 7. - Line 8: Total Nonrefundable Credits Reported On This Schedule

Add lines 1 through 4, line 5a, line 5b, and line 7. Enter the result on line 8 and also on your Form 1040/1040-SR/1040-NR, line 20.

Part II: Other Payments And Refundable Credits

- Line 9: Net Premium Tax Credit

Enter the net premium tax credit amount and attach Form 8962. - Line 10: Amount Paid With Request For Extension To File

Enter any payment you made with an extension request to file your return (this is the payment you submitted for extra filing time). - Line 11: Excess Social Security And Tier 1 RRTA Tax Withheld

Enter any excess Social Security tax and/or Tier 1 Railroad Retirement Tax Act (RRTA) withholding that applies to you. - Line 12: Credit For Federal Tax On Fuels

Enter the credit amount and attach Form 4136. - Line 13: Other Payments Or Refundable Credits

Use these sub-lines for the specific items listed. - Line 13a: Form 2439

Enter the amount reported to you on Form 2439. - Line 13b: Section 1341 Credit

Enter the Section 1341 credit for repayment of amounts that were included in income in an earlier year. - Line 13c: Net Elective Payment Election Amount

Enter the net elective payment election amount from Form 3800, Part III, line 6, column (j). - Line 13d: Deferred Amount Of Net 965 Tax Liability

Enter the deferred amount of net 965 tax liability (this line applies only in specific situations; follow the return instructions for eligibility and computation). - Line 13z: Other Refundable Credits (List Type And Amount)

If you have another refundable credit/payment item that belongs on this schedule but isn’t listed in 13a–13d, list the type and amount here. - Line 14: Total Other Payments Or Refundable Credits

Add lines 13a through 13z and enter the total on line 14. - Line 15: Total Other Payments And Refundable Credits Reported On This Schedule

Add lines 9 through 12 and line 14. Enter the result on line 15 and also on your Form 1040/1040-SR/1040-NR, line 31.