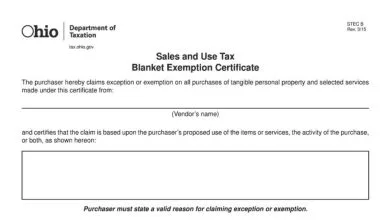

Tax Exemption

Tax exemption is the official status that allows an individual or organization to be free from paying certain taxes. Tax-exempt entities, like charities, are typically not required to pay federal income tax on income related to their exempt activities.