Navigating the world of taxes can be a rollercoaster, and that’s especially true with the IRS Form 944—not to mention the dreaded penalty amounts related to not filing it. If you’re asking yourself, “What is the tax form 944 not filing penalty amount if there is no income at all?”, you’re not alone. Many small businesses and employers are relieved to learn that Form 944 is designed specifically for smaller employers to report annual payroll taxes, rather than filing quarterly as with Form 941. But what happens if your business had absolutely no income or wages to report? Does the IRS still expect you to file, and what penalties could you face if you don’t? This article breaks down the rules, penalties, and exceptions surrounding failure to file Form 944 when there is no income and helps clarify how to stay compliant without getting penalized.

Understanding IRS Form 944 and Who Should File It

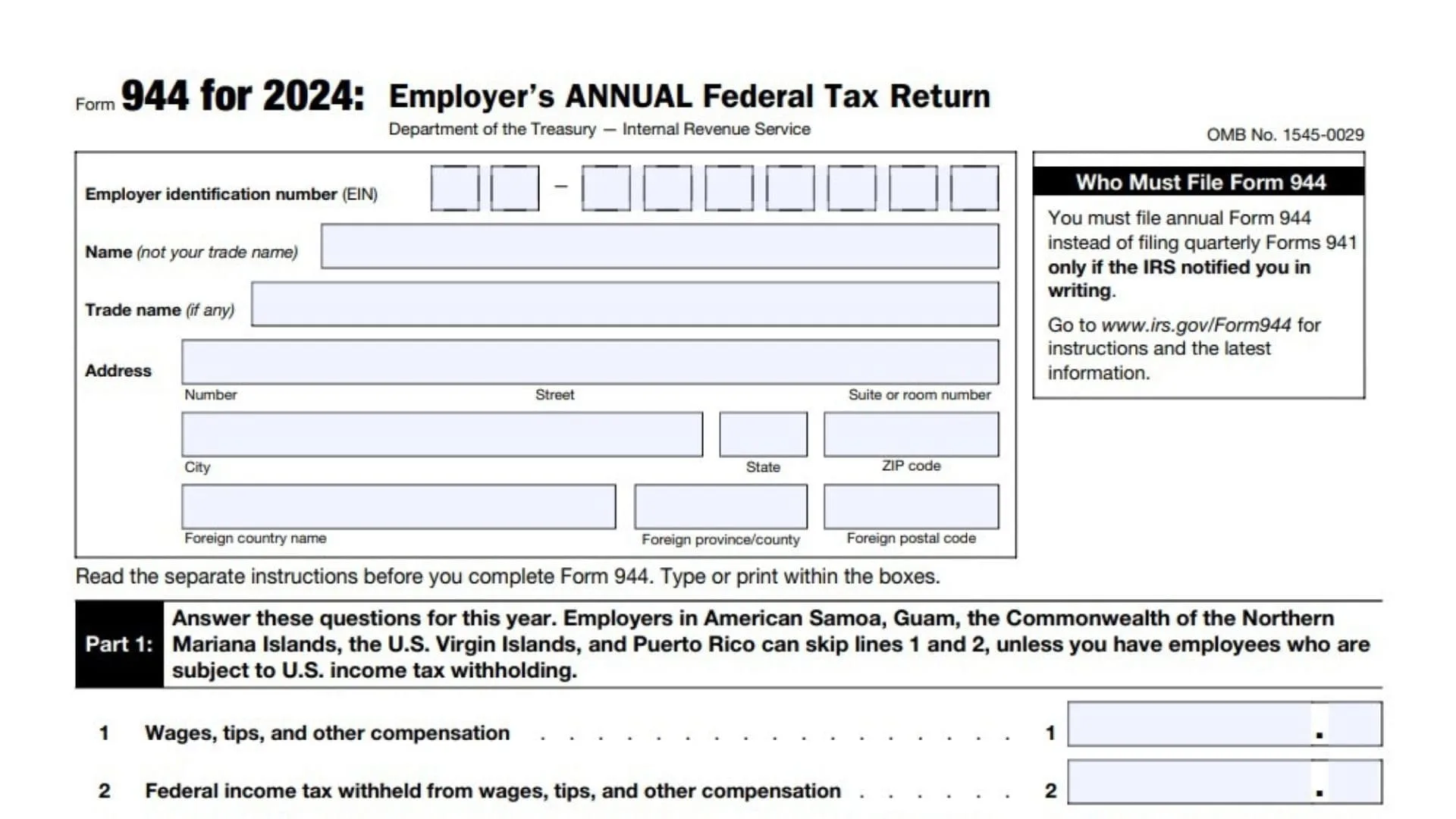

Form 944 is tailored for businesses with smaller payroll tax liability—typically those expecting $1,000 or less in employment taxes for the year. This allows eligible employers to file just once per year instead of quarterly, easing their filing burden. However, even if your business had no employees or income at all during the tax year, the IRS generally expects you to submit Form 944 to report that zero liability. Failure to file can trigger penalties, so timely filing—even a zero return—is important.

When Is A Penalty Applied For Not Filing Form 944?

If you completely neglect to file Form 944 by the due date and you owe taxes (even if this amount is zero), the IRS reserves the right to assess a failure-to-file penalty. This penalty is usually a percentage of the tax due. But when no wages or income exist and no taxes are owed, the enforcement of penalties can be a little more lenient. Still, the IRS asks for the form to confirm your status and protect their records. Filing on time helps avoid any assumptions of tax bill avoidance.

What Is The Penalty Amount For Not Filing Form 944?

The failure-to-file penalty for Form 944 is generally calculated as 5% of the unpaid taxes for each month the form is late, up to 25% of the total unpaid tax. However, if you truly had zero income and zero taxes owed, technically no penalties apply because there’s no unpaid tax. But be mindful: if you don’t file the Form 944 at all, even reporting zero liability, the IRS might send notices or set penalties based on assumption. So submitting the form, even if it reports no income, is the safest route.

How To Avoid Penalties If You Have No Income Or Payroll Taxes

If you expect no wages or income this tax year but you’ve received a notice from the IRS that you must file Form 944, be sure to submit a timely return—even if it’s a “zero” return showing no tax due. This action helps you avoid unnecessary penalties or follow-up letters. If your situation changes during the year and you expect your payroll taxes to exceed the $1,000 threshold, you should notify the IRS and switch back to the quarterly Form 941 filing schedule.

What To Do If You Missed The Deadline For Form 944

Missed the deadline? Don’t panic. File your Form 944 as soon as possible to minimize penalties and interest. If you had no income or wages, explaining this when you file may help reduce or eliminate penalties. The IRS sometimes offers penalty relief, especially for first-time mistakes or reasonable cause, so it’s worth communicating any special circumstances.

Final Thoughts

Understanding the tax form 944 not filing penalty amount if there is no income at all boils down to one key takeaway: file your Form 944 on time, even if you have nothing to report. This small step keeps you aligned with IRS expectations and avoids unnecessary penalty headaches. When in doubt, filing a zero return is always the best policy.

FAQs

Q: Do I have to file Form 944 if I had no employees or wages?

A: Yes, the IRS generally requires you to file even a zero return to avoid penalties.

Q: Will I get a penalty if I don’t file Form 944 and have no income?

A: Usually not, because penalties are based on taxes owed, but failing to file can trigger IRS notices.

Q: Can I switch from Form 944 to quarterly filings?

A: Yes, if your payroll taxes exceed $1,000, you should switch to Form 941 quarterly filings.

Q: What should I do if I missed the Form 944 deadline?

A: File as soon as possible and explain your no-income situation to minimize penalties.