If you’ve discovered a mistake on your previously filed taxes—whether you missed a juicy deduction, forgot to report some income, or had your federal return adjusted by the IRS—you are likely scrambling to find the correct Utah Amended Tax Return Mailing Address to set things straight. Filing an amendment can feel like a high-stakes game of paperwork, but for Utah residents, the process is surprisingly streamlined once you know where to aim. The Utah State Tax Commission requires you to use the standard Form TC-40 (the same form used for your original return) but with a special “Amended Return” code marked at the top, and unlike the digital-first approach of original filings, many amended returns still need to be printed, signed, and physically mailed to specific addresses in Salt Lake City. Whether you are expecting a refund check to hit your mailbox or sending in a payment to cover a balance due, sending your documents to the wrong department can lead to processing delays that leave you in limbo. In this guide, we will provide the exact mailing addresses for 2026, explain the crucial “reason codes” you must include, and help you navigate the deadlines so you can fix your errors and get back to enjoying life in the Beehive State.

Where To Mail Your Utah Amended Tax Return

When it comes to mailing your amended Utah return (Form TC-40), the destination depends entirely on one simple question: Are you sending money, or are you asking for money (or neither)? The Utah State Tax Commission has separated their intake processing to speed things up.

1. If You Are Sending A Payment

If your amendment results in you owing more taxes, you must mail your return and check/money order to:

Utah State Tax Commission

210 North 1950 West

Salt Lake City, UT 84134-0266

2. If You Are Expecting A Refund Or No Payment Is Needed

If your amendment results in a refund or there is no change in the tax owed (just an informational update), use this address:

Utah State Tax Commission

210 North 1950 West

Salt Lake City, UT 84134-0260

Tip: Notice the ZIP code extension is the only difference! The “-0266” is for payments, and “-0260” is for refunds/others.

How To Prepare Your Amended Return (Form TC-40)

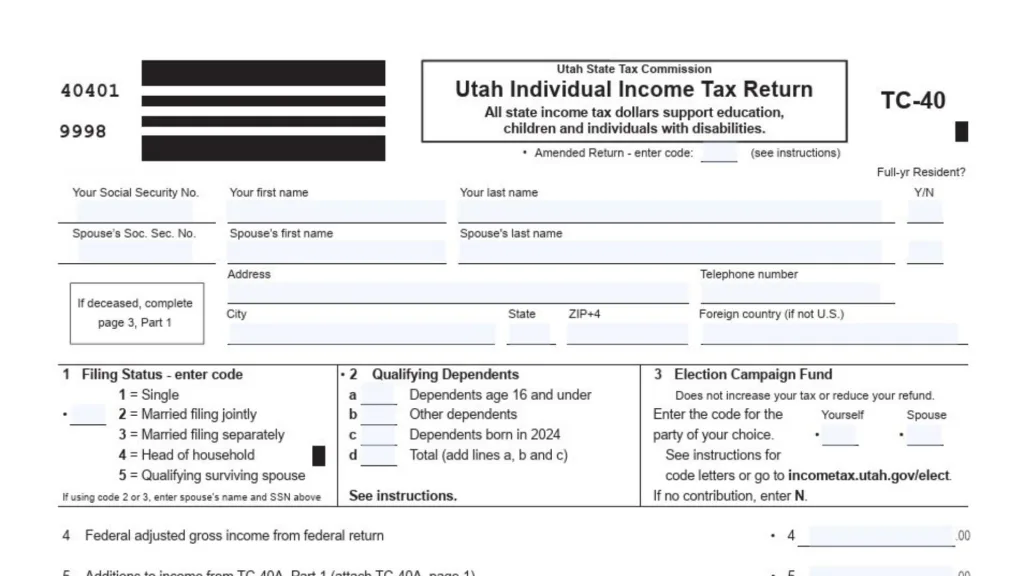

Utah does not have a separate “Form TC-40X” like the federal 1040-X. Instead, you simply use the TC-40 form for the tax year you are amending.

- Get the Right Year’s Form: If you are amending your 2023 return, download the 2023 version of Form TC-40 from

tax.utah.gov. Do not use a 2025 form for a 2023 amendment. - Mark “Amended Return”: On Page 1 of the TC-40, look for the “Amended Return” section at the top. You must enter a “Reason Code” (1-7) that explains why you are changing your return.

- Code 1: Error on federal return (IRS adjustment)

- Code 2: Error on Utah return

- Code 3: Federal NOL carryback

- Code 4: Federal changes (1040-X)

- Attach Schedules: You must attach any schedules that changed and those that didn’t change if they are part of the calculation.

- Do Not Attach Original Return: The Tax Commission explicitly says do not staple a copy of your original return to the back. They already have that in their system.

Deadlines You Cannot Ignore

Time is of the essence when filing an amendment. Generally, you have three years from the original due date of the return (or two years from the date the tax was paid, whichever is later) to claim a refund. However, if the IRS adjusts your federal return, you are on a tighter clock: you must file your Utah amendment within 90 days of the IRS’s final determination to avoid penalties.

Can I E-File An Amended Utah Return?

Yes! Utah is one of the states that supports e-filing for amended returns. If you used software like TurboTax, TaxSlayer, or H&R Block to file your original return, you can often log back in, select “Amend Return,” and submit it electronically. This is faster and safer than mailing paper. However, if your software doesn’t support it, or if you prefer paper, the mailing addresses above are your go-to solution.

Frequently Asked Questions (FAQs)

Q: Which form do I use to amend my Utah state taxes?

A: Use Form TC-40 for the specific tax year you are amending, and mark the “Amended Return” box with the correct reason code.

Q: How long do I have to file an amended Utah return?

A: You typically have three years from the original filing deadline, or 90 days if the amendment is due to an IRS adjustment.

Q: Can I direct deposit my amended return refund in Utah?

A: Generally, amended return refunds are issued as paper checks, even if you request direct deposit, due to fraud prevention measures.