If you’ve recently filed your taxes and checked your status online, you might see a message saying your tax return has been “accepted.” But what does it mean when your tax return is accepted? In the world of tax filing, seeing that “accepted” status can feel like a breath of fresh air. It means the IRS has received your tax return, performed an initial screening, and found that your basic information-like your Social Security number, filing status, and claimed dependents-matches their records. This is a crucial first step in the tax refund process, whether you’re e-filing or mailing in your return. Getting that “accepted” update is a positive sign that your return has passed the initial review and is officially in the IRS system, but it’s not the finish line just yet. Your tax refund journey is just beginning, and knowing what “accepted” means (and what it doesn’t) will help you track your refund, avoid confusion, and stay on top of your tax filing status.

Understanding the “Accepted” Status

When your tax return is marked as “accepted,” it means the IRS has received your submission and it has passed their initial checks for errors or red flags. This includes verifying that your Social Security number is correct, ensuring no one else has filed using your information, and confirming that all necessary forms are attached. Think of it as your return making it through the front door and getting a quick security scan.

What Happens After Your Return Is Accepted?

After acceptance, your return moves into the processing phase. The IRS will now review your income, deductions, credits, and other details to make sure everything is accurate. This step is more thorough and can take anywhere from a few days to three weeks for most electronically filed returns. If you’re due a refund, this is when the IRS decides if you’re getting the amount you expect.

Accepted vs. Approved: What’s the Difference?

It’s easy to confuse “accepted” with “approved,” but they mean different things in the tax world:

| Status | What It Means |

|---|---|

| Accepted | The IRS has received your return and it passed the initial screening. |

| Approved | The IRS has finished processing your return and approved your refund. |

So, “accepted” is the green light to start processing, while “approved” is the final thumbs-up that your refund is on its way.

How Long Does It Take to Get My Refund After Acceptance?

Most refunds are issued within 21 days of the IRS accepting your return, especially if you filed electronically and chose direct deposit. However, some returns require additional review, which can slow things down. Paper returns typically take longer-sometimes up to six to eight weeks.

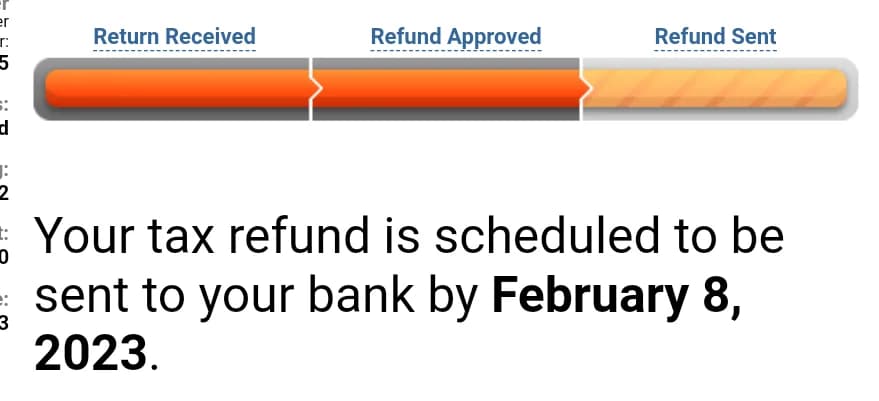

You can track your refund status 24 hours after e-filing (or four weeks after mailing a paper return) using the IRS “Where’s My Refund?” tool or the IRS2Go mobile app35. These tools will update you as your return moves from “accepted” to “approved” and finally to “sent.”

Can the IRS Reject My Return After It’s Been Accepted?

While rare, it’s possible for the IRS to find errors or discrepancies during processing that could delay or even reject your return after it’s been accepted. Common issues include mismatched income, missing forms, or identity verification problems. If this happens, the IRS will contact you with instructions on what to do next.

FAQs

Q: Does “accepted” mean my tax refund is approved?

A: No, “accepted” means the IRS has received your return and it passed initial checks. Approval comes after full processing.

Q: How long after my tax return is accepted will I get my refund?

A: Most refunds are issued within 21 days of acceptance for e-filed returns.