If you’re a freelancer, contractor, small business owner, or anyone who deals with non-employee payments, understanding the difference between 1099-MISC and 1099-NEC is more important than ever. Since 2020, the IRS has split the reporting of non-employee compensation and miscellaneous income into two distinct forms, and using the wrong one can lead to confusion—or even penalties. The 1099-NEC is now the go-to form for reporting payments to independent contractors, freelancers, and anyone who isn’t on your payroll, while the 1099-MISC is reserved for a variety of other payments like rent, prizes, awards, and royalties. Knowing which form to use not only keeps you compliant but also streamlines your tax reporting, especially in the ever-growing gig economy where creative work and contract gigs are the norm.

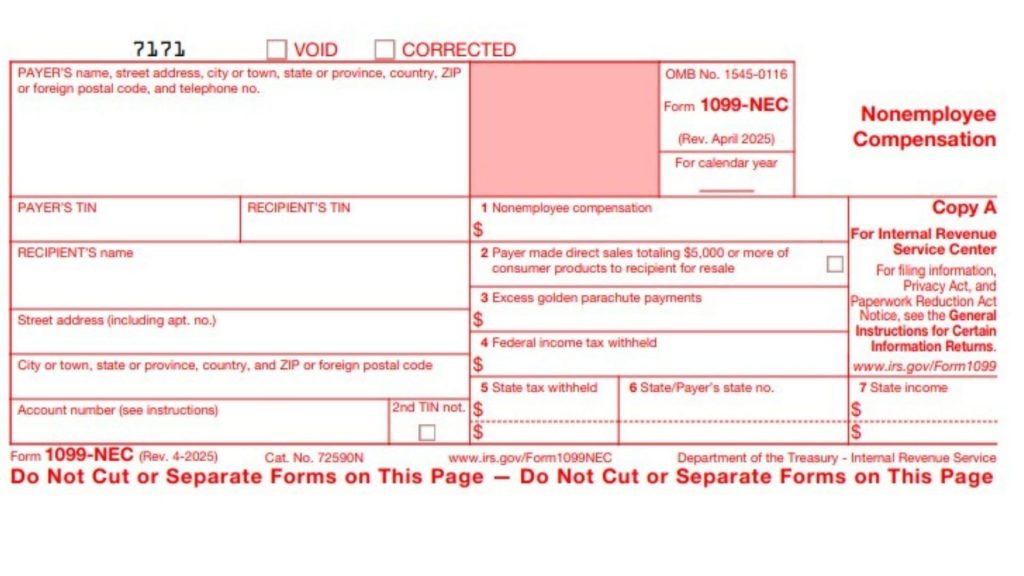

What Is Form 1099-NEC?

Form 1099-NEC (Non-Employee Compensation) is used to report payments of $600 or more made to non-employees for services rendered. This includes freelancers, independent contractors, consultants, and anyone who’s not on your regular payroll. If you’ve paid a graphic designer, writer, or IT consultant for a project, you’ll report it here. The 1099-NEC is all about service-based payments and is likely subject to self-employment tax for the recipient.

Key points:

- For non-employee compensation (services, gig work, freelance projects)

- Applies to individuals, partnerships, estates, and sometimes corporations

- $600 threshold per year

- Deadline: January 31st for both filing and furnishing to recipients

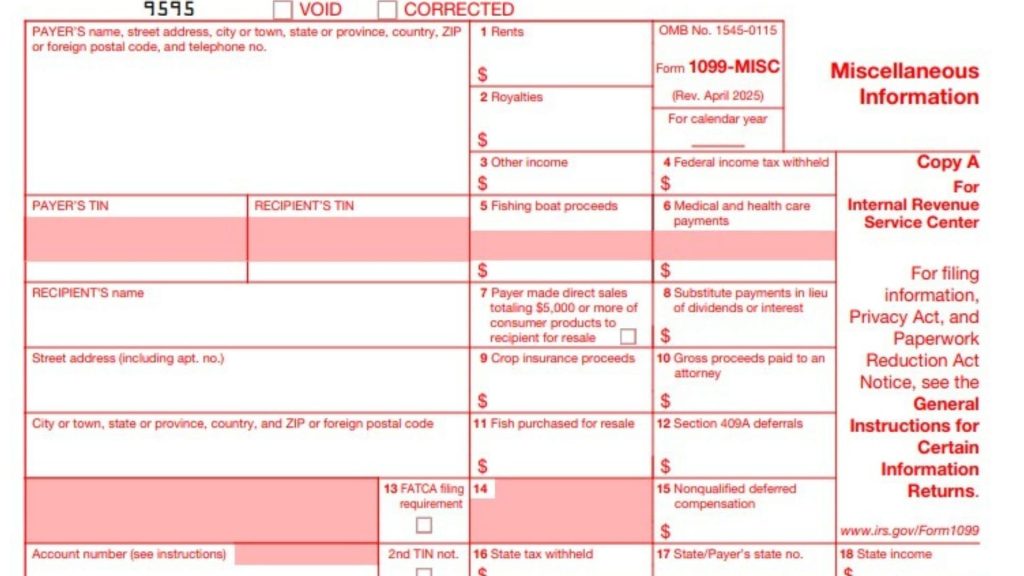

What Is Form 1099-MISC?

Form 1099-MISC (Miscellaneous Information) is used for a broad range of payments that don’t fit the non-employee compensation category. This includes rent, royalties, prizes, awards, medical and healthcare payments, legal settlements, and more. If you pay a landlord for office space, send out prize money for a contest, or pay royalties to a songwriter, these go on the 1099-MISC.

Key points:

- For miscellaneous income (rent, prizes, royalties, legal settlements, etc.)

- $10 threshold for royalties, $600 for most other payments

- Deadline: February 28th (paper) or March 31st (electronic)

Why Did the IRS Split the Forms?

Before 2020, all these payments—including non-employee compensation—were reported on the 1099-MISC (Box 7). To reduce confusion and speed up IRS processing, the 1099-NEC was reintroduced specifically for contractor and freelancer payments. This separation helps both businesses and the IRS keep better track of different income types and avoid reporting mistakes.

When to Use Each Form

| Situation | Use 1099-NEC | Use 1099-MISC |

|---|---|---|

| Paying a freelancer or independent contractor for services | ✔ | |

| Paying rent for office/warehouse space | ✔ | |

| Awarding a cash prize | ✔ | |

| Paying royalties to a songwriter | ✔ | |

| Medical or healthcare payments | ✔ | |

| Legal settlements (non-service) | ✔ | |

| Direct sales of $5,000+ for resale | ✔ (or MISC, see IRS notes) | ✔ (Box 7, see IRS notes) |

Common Mistakes to Avoid

- Reporting contractor payments on 1099-MISC: Use 1099-NEC for all non-employee services.

- Missing deadlines: 1099-NEC is due earlier than 1099-MISC.

- Mixing up payment types: Rent, prizes, and royalties never go on the 1099-NEC.

FAQs

Q: When should I use a 1099-NEC instead of a 1099-MISC?

A: Use 1099-NEC for payments to non-employees (like freelancers or contractors) for services totaling $600 or more in a year.

Q: What types of payments go on a 1099-MISC?

A: Use 1099-MISC for rent, royalties, prizes, awards, medical payments, and other miscellaneous income not related to services by non-employees.

Q: What happens if I use the wrong form?

A: Using the wrong form can result in IRS penalties and reporting errors, so always double-check which form fits your payment type.