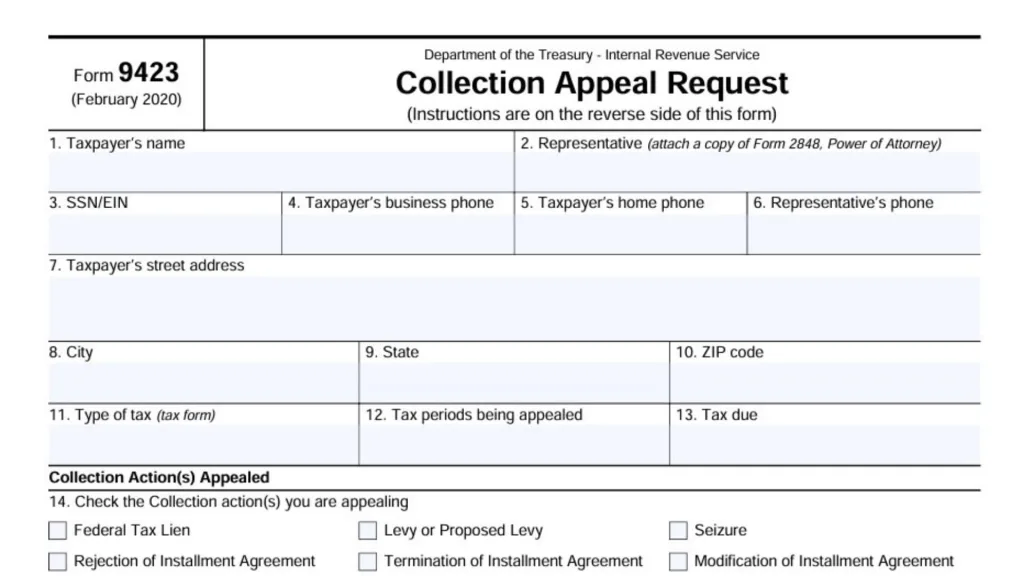

Navigating the maze of tax bureaucracy can feel like trying to solve a puzzle with missing pieces, especially when you are holding a document as urgent as Where to Mail Form 9423. Unlike your standard annual tax return which goes to a massive regional processing center, this specific form—officially known as the Collection Appeal Request—does not have a single, universal mailing address printed on the back of the instruction sheet. Instead, the destination of your Form 9423 depends entirely on who is knocking on your door (metaphorically or literally). This form is your emergency brake against aggressive collection actions like liens, levies, or the seizure of property, and it is part of the Collection Appeals Program (CAP). Because it is designed to stop a specific action taken by a specific IRS employee or office, you must direct your appeal to that exact source. Sending it to the wrong place—like the general address for 1040 returns in Austin or Kansas City—could result in your appeal getting lost in the shuffle while the collection action against your bank account continues unchecked. Understanding exactly how to locate the correct address on your notice letter and knowing the tight deadlines for submission are the keys to successfully asserting your rights and getting a fair hearing.

The Golden Rule: Check Your Notice

The most important piece of advice for mailing Form 9423 is to look at the letter you just received. Whether it is a Notice of Federal Tax Lien or a Final Notice of Intent to Levy, the document will almost always contain the specific name, address, and fax number of the Revenue Officer or Settlement Officer assigned to your case. This is your target destination. You are essentially telling that specific officer, “Stop what you are doing, I want to appeal this decision.”

Mailing to a Revenue Officer

If you have been working directly with a Revenue Officer (a specific human being rather than a faceless automated system), you should mail or hand-deliver Form 9423 directly to them. In many cases, you are required to have a “conference” (a phone call or meeting) with their manager before you can even file this form. If you cannot resolve the issue during that conference, you typically have two business days to mail this form to that office. Always use Certified Mail with Return Receipt so you have undeniable proof that you met the deadline.

Mailing to the Automated Collection System (ACS)

If your notice came from a generic IRS campus—often referred to as the Automated Collection System (ACS)—and you do not have a specific officer’s name, you must send the form to the address listed on the top left or top right of that correspondence. If you have lost the notice, you can call the general IRS collections phone number (1-800-829-1040) to ask for the correct “Collection Appeal Rights” address for your specific case, but be prepared for long hold times.

Can You Fax Form 9423?

Yes, and in many cases, it is preferred because of the time-sensitive nature of the appeal. Since the Collection Appeals Program often operates on a 2-day or 3-day window, snail mail can be risky. If the notice includes a fax number for the office or officer, faxing the form is a valid way to file. Just like with mailing, be sure to keep the “Transmission Successful” confirmation page as your proof of timely filing.

The “Do Not Mail Here” Warning

Do not mail Form 9423 to the centralized “IRS Appeals Office” unless specifically instructed to do so. The CAP process is unique because it starts with the collection manager, not the appeals office. If you skip the line and send it straight to the Chief of Appeals, it may be rejected or returned to the collection office, wasting valuable time during which your assets remain at risk.

Frequently Asked Questions

Q: Is there a specific deadline to mail Form 9423?

A: Yes, typically you must mail it within 2 business days after your conference with the Collection Manager.

Q: Can I file Form 9423 online?

A: No, this specific form must be mailed, faxed, or hand-delivered to the collection office handling your case.

Q: Does mailing this form stop the collection action immediately?

A: Generally, yes; the IRS will usually suspend collection actions (like seizing your bank account) while the appeal is being decided.