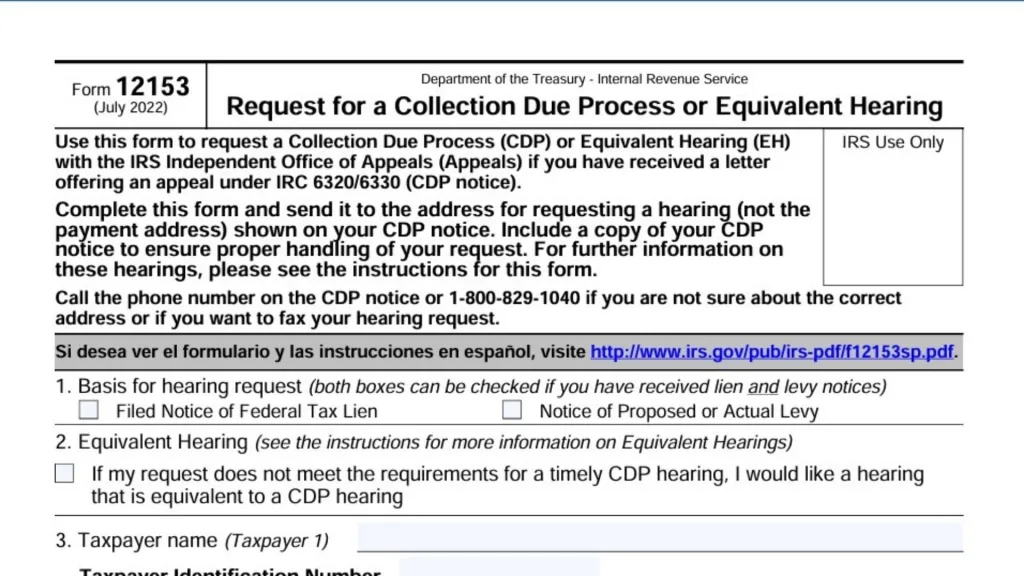

When you are trying to figure out Where to Mail My Form 12153, you might expect to find a single, straightforward address like you would for your annual tax return, but the reality is slightly more specific to your personal situation. The “Request for a Collection Due Process or Equivalent Hearing” is a critical document used to pause IRS collection actions like liens or levies, and sending it to the wrong location can result in disastrous delays or even a rejection of your appeal rights. The most important rule to remember is that you must mail this form to the address listed on the specific IRS notice (such as a Notice of Federal Tax Lien or Notice of Intent to Levy) that alerted you to the collection action in the first place. This is because the form needs to go to the specific compliance office or revenue officer currently handling your file, not a centralized processing center. If you simply Google a generic address, you risk your paperwork getting lost in the bureaucratic shuffle while the 30-day clock on your appeal rights continues to tick. To ensure your request is processed on time, you should always look at the top left or top right corner of the letter you received—often labeled Letter 1058, LT11, or Letter 3172—to find the exact IRS mailing address for your appeal. By sending it to the correct “Collection Due Process hearing location,” you protect your right to be heard before the government seizes your property.

Finding The Correct Address On Your Notice

The “golden rule” for this form is to follow the notice. The IRS issues millions of collection letters annually, and the office handling your specific debt could be in Ogden, Utah; Cincinnati, Ohio; or a local field office in your city. Grab the letter that threatened the levy or lien. On that document, usually near the top or in the body of the text, there will be instructions that say, “Send your request for a hearing to…” followed by a specific street address or P.O. Box. This is the only address that matters for your Form 12153. If you have received multiple notices for different tax years or different types of taxes, ensure you are responding to the most recent “Final Notice” that grants you CDP rights.

What If I Lost The Notice?

Life happens, and sometimes paperwork disappears. If you know you need to file Form 12153 but cannot find the original notice with the address, do not guess. You have two reliable options to retrieve the correct information. First, you can call the phone number listed on any previous correspondence you have from the IRS, or call the general IRS collections line at 1-800-829-1040. When you reach an agent, clearly state that you are filing a Collection Due Process request and need the “address of the office that issued the lien or levy.” Alternatively, if you are working with a tax professional (like a CPA or tax attorney), they can often pull a transcript of your account or call the Practitioner Priority Service to get the correct mailing location for you.

Sending By Certified Mail

Once you have the right address, how you send the form is just as important as where you send it. You should always send your Form 12153 via Certified Mail with Return Receipt Requested (or a designated private delivery service like FedEx or UPS that offers tracking). This provides you with statutory proof of timely filing. If the IRS loses your form—which happens more often than you might think—the green Return Receipt card is your “get out of jail free” card. It proves you mailed the appeal within the strict 30-day deadline, forcing the IRS to accept your request even if they can’t find the paper copy in their building.

Can I Fax My Request?

Yes, in many cases, you can fax Form 12153 instead of mailing it, which can be a lifesaver if you are right up against the deadline. Look at your collection notice again; it will often list a fax number alongside the mailing address. If you choose this route, ensure you keep the fax transmission confirmation report that shows the date, time, and successful delivery status. This confirmation page serves the same legal purpose as the Certified Mail receipt—proof that you acted on time. However, if you have the time, many tax pros recommend doing both: fax the form for speed, and mail the hard copy via Certified Mail for redundancy.

FAQs

Q: Is there one main address for Form 12153?

A: No, you must send it to the specific address listed on the lien or levy notice you received.

Q: What if I send it to the wrong IRS office?

A: It may delay your case or cause you to miss the 30-day deadline, potentially losing your right to a hearing.

Q: Can I file Form 12153 online?

A: Generally, no. It must be mailed or faxed to the office that issued the collection notice.

Q: What is the deadline to mail Form 12153?

A: You must postmark it within 30 days of the date on the Notice of Federal Tax Lien or Notice of Intent to Levy.