If you’ve ever filed your taxes and wondered, “Who changed the student loan tax deduction to $2,500?”—you’re not alone. The student loan interest deduction is a lifeline for millions of borrowers, allowing them to deduct up to $2,500 in interest paid on qualified student loans each year. This deduction helps reduce taxable income, making higher education a bit more affordable for graduates and their families. But how did we get to the $2,500 figure, and who was responsible for this change? Let’s explore the legislative history, the key players, and what this tax deduction means for you today.

The Legislative Journey: How the $2,500 Student Loan Interest Deduction Was Born

The story of the student loan interest deduction is a tale of shifting tax priorities and political compromise. Before 1986, student loan interest—like mortgage or credit card interest—was deductible. However, the Tax Reform Act of 1986, signed by President Ronald Reagan, eliminated the deduction for personal interest, including student loan interest, as part of sweeping tax code changes.

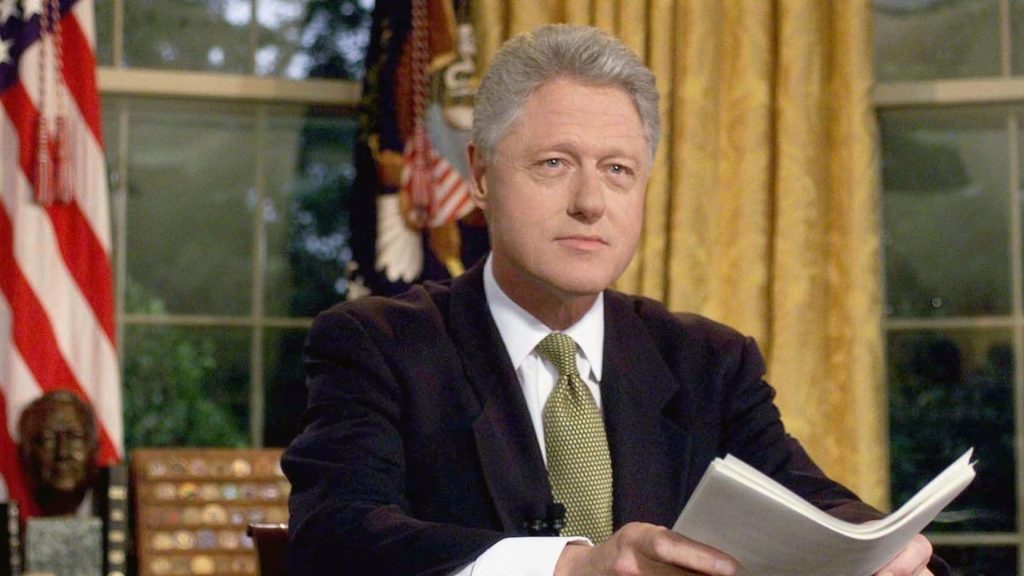

For the next decade, borrowers couldn’t deduct student loan interest at all. That changed in 1997, when President Bill Clinton signed the Taxpayer Relief Act of 1997. This act reintroduced the student loan interest deduction, allowing taxpayers to deduct interest paid on qualified student loans as an “above-the-line” deduction—meaning you didn’t need to itemize to claim it.

Initially, the deduction was capped at $1,000 in 1998, then increased to $1,500 in 1999, $2,000 in 2000, and finally reached $2,500 in 2001 and subsequent years. The Taxpayer Relief Act of 1997 set this gradual increase, and by 2001, the maximum deduction was locked in at $2,500, where it remains today. This change was designed to provide greater relief to borrowers as education costs soared.

Who Made the Change?

The increase to a $2,500 maximum deduction was the result of bipartisan legislative action, but the specific law that set the limit at $2,500 was the Taxpayer Relief Act of 1997, signed by President Clinton. The law’s provisions were phased in over several years, with the $2,500 maximum taking effect for tax year 2001 and beyond. Congress has since debated further increases, but the $2,500 cap has remained unchanged for over two decades.

Why Was the Deduction Increased?

The late 1990s saw a surge in college costs and student debt, prompting lawmakers to provide more meaningful tax relief to borrowers. By increasing the deduction to $2,500, Congress aimed to help middle-class families manage the growing burden of student loans. The deduction is available to those who meet certain income requirements, and it applies to both federal and private student loans used for qualified higher education expenses.

The Deduction Today: Who Benefits and How?

Today, the student loan interest deduction remains a valuable tax break for eligible borrowers. You can deduct up to $2,500 in interest paid on qualified student loans each year, subject to income phaseouts. The deduction is available even if you don’t itemize your deductions, and it can be claimed by anyone legally obligated to pay interest on a qualified student loan, provided they meet income and dependency requirements.

Will the $2,500 Deduction Change Again?

While there have been proposals in Congress to increase the deduction or eliminate income limits, no major changes have passed since the early 2000s. The $2,500 cap has held steady, even as student debt levels have soared. Lawmakers continue to debate the future of the deduction, especially as student loan policy remains a hot topic in Washington.

FAQs

Q: When did the student loan tax deduction become $2,500?

A: The maximum deduction was set at $2,500 starting in tax year 2001, as part of the Taxpayer Relief Act of 1997.

Q: Who was responsible for raising the student loan interest deduction to $2,500?

A: Congress increased the deduction through the Taxpayer Relief Act of 1997, which was signed into law by President Bill Clinton.

Q: Is the $2,500 student loan tax deduction still available?

A: Yes, as of 2025, eligible taxpayers can still deduct up to $2,500 in student loan interest, subject to income limits.

Q: Can the deduction amount change in the future?

A: Yes, Congress can change the deduction amount, but it has remained at $2,500 since 2001.